Anyone paying attention to the recent profusion of populist politicians across developed democracies cannot fail to notice one overarching theme.

The fiscal prudence so revered across the West since the Great Financial Crisis has been usurped by a new consensus of borrow and spend – sanitised by the moniker of Modern Monetary Theory.

In America, this political shift has the glossy feel of a new form of politics, with some Democrats proposing a Green New Deal to rejuvenate American infrastructure along renewable lines.

In Britain, Jeremy Corbyn favours a more familiar brand of nationalisation and public spending. Meanwhile, in France, President Macron considers loosening the purse strings to placate the militant Gilets Jaunes movement.

At their core, these all mark a shift back to Keynesian government spending of the sort familiar to the postwar generation.

Intellectual shift

What is most striking, however, is the intellectual shift taking place to accommodate this political headwind.

Economic orthodoxy has a habit of evolving to fit the prevailing political zeitgeist, and this is most notable among central bankers, in particular those in the US.

The recent Federal Reserve volte face, from a policy of raising rates in line with strong employment and wage figures to a “patient” policy of no further rate hikes and scope for rate cuts, was triggered by turbulent markets.

However, it is not far fetched to suggest that the more recent communication on the Fed’s tolerance for allowing inflation to overshoot its 2 per cent mandated target is, in part, the act of an embattled institution bowing to intense political pressure to keep monetary policy loose, from both sides of the political divide.

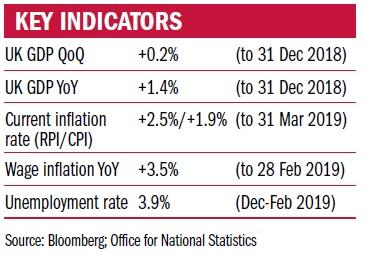

This subjugation of monetary policy to fiscal objectives could well lead to a policy mistake that lets the inflationary cat out of the bag. After all, this is occurring at a time when unemployment across the developed world is at record low levels.

The last incidence of such a potent cocktail of low unemployment, fiscal stimulus and a compromised central bank committed to staying behind the curve was in the late 1960s.

Readers might recall that the resulting inflation of the 1970s took no prisoners.

Investment portfolios took decades to recover in real terms. Charity investors accustomed to the v-shaped recoveries of recent years may find the next cycle a more challenging proposition.

Ben Crawfurd-Porter is an investment associate at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles