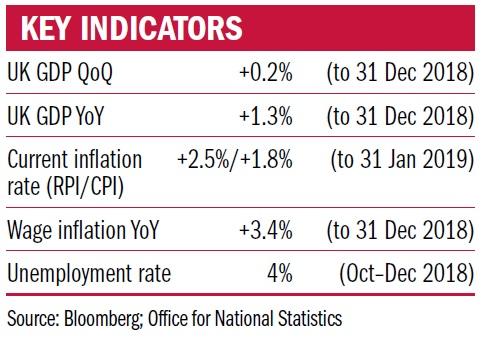

Inflation in the UK has fallen below the Bank of England’s target rate for the first time in two years, with lots of commentary pointing to the fall in energy prices and continued political uncertainty.

But that was not the only reason inflation data made it into the headlines in recent weeks. A report published by the House of Lords stirred up an ongoing debate about the most appropriate measure of inflation by scolding the UK Statistics Authority for failing to amend the way it calculates the retail price index (RPI).

There are two main measures of inflation referenced in the UK; the consumer price index (CPI) and the aforementioned RPI. The inputs and calculation methodology are slightly different for each, meaning they do not produce a consistent annual rate of change.

RPI has historically risen by half a percentage point more than CPI each year, but since 2010 this gap has widened to 0.8 of a percentage point due to a change in the way that clothing prices are collected.

'Interesting time for debate'

The debate is not solely a technical one. The potential allegation is that the government is “data-point” shopping, with its receipts linked to the higher RPI measure (student loans and rail fares), and pay-outs (benefits including public sector and state pensions) linked to the lower CPI.

The main exceptions to this are UK index-linked bonds, where both the interest payments and the principal amount a holder receives at maturity have been linked to RPI.

This type of bond was first issued by the Thatcher government in 1981 as a symbolic gesture that inflation would not be allowed to get out of control again as it did in the 1970s.

It is interesting timing for a debate about measures of inflation. Looking past shorter-term pressures, the UK’s low unemployment and rising wage growth points to an inflationary environment ahead.

With political uncertainty also in the mix, we believe the likelihood of significant fiscal stimulus in the UK is high, with central banks unable to justify meaningfully raising interest rates.

As the gap widens between higher inflation and low interest rates, the debate around the most appropriate measure of inflation may become an increasingly important issue for charities planning their spending whilst maintaining a capital preservation objective.

Jenny Renton is investment director at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles