At the Conservative Party Conference, the Prime Minister hammered home the message that the UK could enjoy a bounce in the economy if a “hard Brexit” is avoided.

Whether or not that ends up being the case, the domestic recovery has come a long way since the doldrums of the recession induced by the global financial crisis.

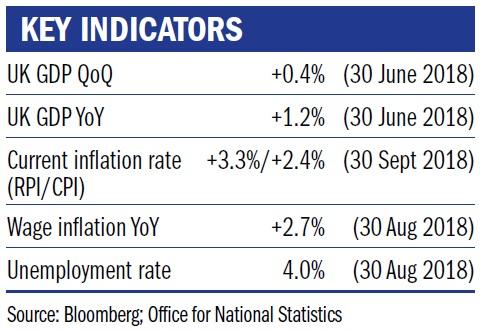

Indeed, in the three months leading up to the end of August, the British economy grew at its fastest rate in almost two years, whilst unemployment hovers at lows not seen since the mid-1970s.

Wages in the UK are now growing at their strongest rate in the last three years and real wage growth remains positive, despite inflation pressures continuing.

What came as a surprise in recent weeks was the move by the online retailer Amazon to raise the minimum wage paid to its 17,000 UK employees (as well as 250,000 in the US).

The commitment to pay £9.50 per hour (£10.50 in London) from next month will be higher than the £9 minimum the UK government has committed to by 2025.

Amazon may well be an idiosyncratic case due to political pressure and publicity regarding poor treatment of workers, but with an ever-tightening labour market, we expect wage pressures to extend to other employers.

Higher interest rates

We would expect this dynamic to support inflation data in the UK, so the question of higher interest rates should remain on the agenda for the Bank of England.

However, the path of raising interest rates is a difficult one.

The unhappy coincidence of positive news regarding the economy is that it questions the sustainability of ultra-low interest rates.

Given that the environment of low interest rates over the last 10 years has been supportive of asset prices, a reversal of this could be difficult for financial markets.

Since 2008, investors have been forced to hold riskier assets to achieve the level of income that they might have got from cash in the bank in 2006.

This search for income has helped to drive up the price of assets, so we remain concerned that as interest rates rise on cash in the bank or government bonds, the riskier assets (eg dividend paying equities) will get sold for the risk-free alternatives.

Jenny Renton is an investment manager at Ruffer