To accelerate net-zero objectives, investors are well placed to leverage their voice as asset owners through stewardship and engagement activities with investments not aligned with a net-zero pathway.

Climate-related engagement can yield significant positive outcomes, and there are multiple ways to engage depending on an investor’s capacity and resources.

Recent research shows that material engagement can be an effective tool associated with companies reducing downside risk, decreasing carbon emissions, and improving profitability.

Engagement and net-zero policy goals

In a net-zero context, the objective of engagement is to align company business plans with the Paris Agreement objective of a 1.5-degree Celsius scenario, beginning with decarbonising the real economy through investing in transition assets and establishing credible transition plans and science-based targets.

Engagement is an essential element of a net-zero investment policy, which clearly articulates net-zero goals and provides framing for priorities, investment manager selection, and engagement.

An engagement policy should include setting expectations of its investment managers’ approach to engagement, proxy voting, and escalation. An escalation policy outlines general steps for increasing engagement with a manager or companies to promote behaviour change and its general timeline to assess developments before determining whether to dissolve the relationship.

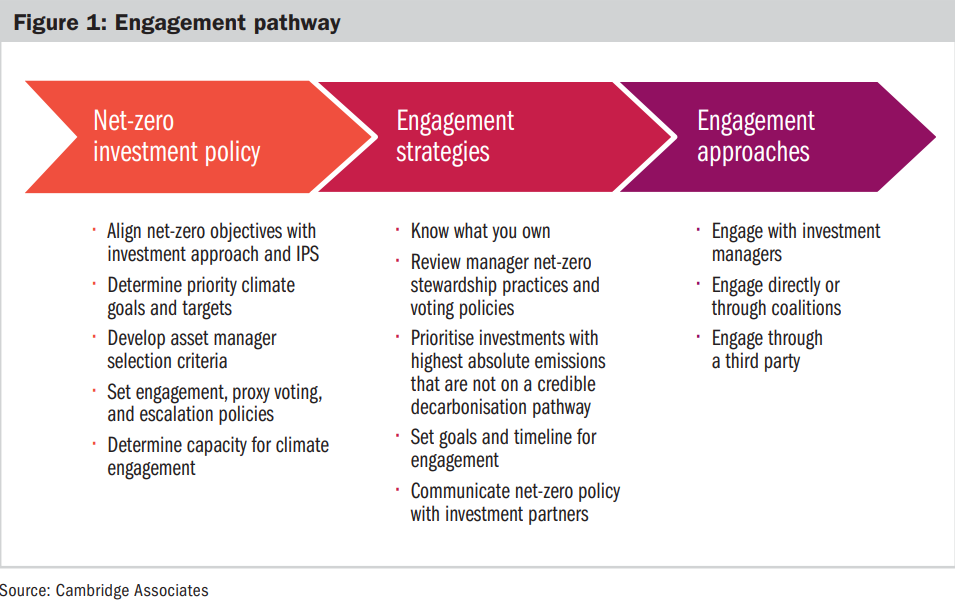

With these policies crafted, investors have a road map to engage more deeply in net zero, both with existing and prospective investment managers (see figure 1).

Strategies for deeper engagement

Investors should determine their capacity for climate engagement and decide what potential approaches best fit their team as part of their theory of change, especially as some engagements can be multiyear efforts. Figure 2 outlines the three major approaches.

To start, investors should understand what they already own by reviewing their investment managers and portfolio holdings and evaluating whether they are aligned with a net-zero pathway. Investment managers need a strong ability to assess an investment’s net-zero activities to accurately price a company’s alignment.

Investment managers can drive change by interacting with non-aligned investments and staying invested in high-emitting sectors as active shareholders, thus encouraging a shift toward sustainable practices.

Managers with strong engagement practices will have a clear thesis on the materiality of engagement topics such as net zero, a well-equipped engagement team that contributes to the work of investment teams, a clear strategy for engagement escalation and proxy voting with associated milestones, transparent reporting to investors, and an outcomes-based focus that recognises the long-term nature of engagements for meaningful change.

After a review, an investor can then easily prioritise investments with which to engage.

Engage with investment managers

When engaging with managers about net zero, investors have an important opportunity to convey how a net-zero strategy can help enhance returns given the systemic risks and rewards in a transitioning world. If managers do not show adequate action over a reasonable amount of time, an escalation policy might come into play.

Engaging with passive index providers is as important as engaging with active investment managers, particularly as systemic climate change risks materially threaten market-wide returns (ie beta). Index providers cannot diversify away from systemic risks and can only address systemic threats by effecting real world change. Indexes are therefore effectively universal owners in what protects the long-term health of the system as a whole to preserve long-term returns.

These efforts are most applicable to marketable securities. But private investments also play a significant role in achieving net-zero goals, whether by funding climate solutions or funding net-zero-aligned high-growth companies that will be the industry leaders of tomorrow.

General partners have a high degree of influence over portfolio companies and therefore a particular responsibility to achieve positive outcomes via engagement, as part of their wider value enhancement activities.

Investors should allocate capital to managers with a clear playbook to limit climate risk and reduce carbon intensity across their value chain. The Initiative Climat International’s (iCI) Decarbonisation Roadmap and the Institutional Investors Group on Climate Change’s (IIGCC) Net-Zero Investment Framework for the Private Equity Industry provide a clear pathway toward assessing, setting targets, and engaging in net-zero alignment.

Engage directly or through collaborative initiatives

If seeking to engage with companies, the IIGCC’s Net-Zero Stewardship Toolkit is a useful resource to develop an approach. However, engaging with companies individually can be time consuming, and specific expertise and dedicated staff resources are required to manage and implement the engagement.

Many investors find it simpler to work with collaborative investor coalitions that help coordinate, reduce duplicative efforts, and frame the engagement process on behalf of investors. Collaborative initiatives can positively contribute to the effectiveness of engagements over environmental, social, and governance (ESG) topics.

By joining wider coalitions, investors can leverage collective bargaining power and create broader visibility of issues. There are a range of organisations (eg Interfaith Center on Corporate Responsibility, UN Principles for Responsible Investment, Climate Action 100+, IIGCC) for investors to join and take action together.

Engagements through these groups can include lower touch actions such as signing onto joint letters (see Nature Action 100, IIGCC Net-Zero Engagement Initiative, and ShareAction). Higher touch engagements can include leading or co-leading a deeper discussion and engagement with a company typically held over at least a 12-month period.

Investors cannot engage with every holding, so it is important to prioritise initiatives that focus on portfolio components with the highest emissions reduction potential and that may be under-engaged by other investors.

Employ a third-party service for engagement support

Investors can focus their engagement capabilities by hiring third-party services to perform engagement and/or voting services. Investors can specify their climate priorities, engagement preferences, and voting predisposition from the provider’s options to be executed by the overlay service that takes over responsibilities from the asset manager.

Outsourcing can be simple, but expensive to execute. We instead encourage asset owners to select managers that are aligned on net-zero objectives in the first instance. However, overlay services may suit investors who prefer to select and invest directly into listed equities through separately managed accounts and do not have the staff to manage engagement and voting activity, as opposed to investors who invest through selecting asset managers.

Case studies

Asset owners can use multiple tools and approaches to engage for climate objectives. Here are two illustrative examples of asset owners engaging on net zero in different ways and levels of engagement with multiple beneficial outcomes.

Case study 1: A conservation and nature foundation (CNF)

Mission: To preserve natural and historical places, with a strong focus on promoting net zero and biodiversity.

Engagement approach: Engaging with managers and collaborating with several coalitions. The trustees developed an ambitious net-zero policy and approach to engagement, which includes:

- A sub-committee that conducts annual investment manager reviews looking at each manager’s ESG and stewardship teams, ESG integration, ongoing net-zero alignment and climate risk management, engagement, and voting activity, and progress since the last meeting.

- Targeted collaboration with other asset managers and asset owners through coalitions such as Climate Action 100+ (CA100+) where CNF has successfully co-led direct engagements with high-emitting companies and participated in industry consultations.

Annual manager reviews provide information on the net-zero alignment of the overall portfolio, which helps CNF determine where changes to managers or the portfolio might need to be made.

Outcomes: The investor’s pressure and accountability mechanism of regular meetings has contributed to managers formalising and enhancing their approach to ESG and net zero, as well as their reporting practices. Their leadership in a collaborative engagement led to a company aligning its corporate disclosures in accordance with the CA100+ NZ Company Benchmark indicators.

Case study 2: A university endowment (UE)

Mission: This prominent university has a history of scientific discovery and is focused on developing and commercialising solutions to accelerate a transition toward net zero.

Engagement approach: Combination of engaging directly with companies, managers, and several coalitions and, at times, leveraging its student population to participate in engagement activities.

The UE has a focused approach to engage with banks that lend to fossil fuel companies because banks provide the largest share of fossil fuel financing, and new fossil fuel infrastructure results in 30 years of new carbon emissions. UE engages both directly with banking management and through coalitions. UE also engages with its managers about fossil fuel financing. It focuses on three simple questions:

- Did the manager vote against the re-election of directors of companies on the CA100+ list based on climate-related concerns and make clear that climate was a reason for the vote?

- How many climate plans of banks did the manager vote against?

- How many primary market investments (ie new bond issues, initial public offerings, equity issues) did the firm invest into new fossil fuel infrastructure?

Annual answers to these questions then set escalation priorities, which include the threat of termination.

Outcomes: Focusing engagement priorities with managers makes engagement unambiguous and monitoring outcomes (ie letter writing campaigns, collaborative efforts, and manager engagement) easier to accomplish. For example, UE successfully contributed to increased emissions disclosure by a global bank and hastened another bank’s timeline in phasing down fossil fuel financing.

Conclusion

Engagement is the opportunity for investors to bring their voices to the table and practice their fiduciary responsibility to participate actively in the global effort to reduce real world greenhouse gas emissions.

If left unabated, these emissions will result in catastrophic impact born from physical and transition risks, which pose significant, underpriced dangers to the global economy, the global financial system, asset values, and, ultimately, portfolio returns.

The financial materiality of the climate crisis requires fiduciaries to protect their portfolios from the risks presented by climate change, while investing in opportunities to transition to a lowcarbon economy.

Collective participation is needed, and accountability mechanisms are important. As shown through the case studies, asset owner participation can be a powerful voice to encourage climate risk disclosures and align portfolios on the net-zero pathway. Engagement is an imperative toward positively impacting the real economy and protecting portfolios.

Deborah Christie is managing director, public equities, and Marie Ang is investment director, sustainable & impact investing, at Cambridge Associates

Charity Finance wishes to thank Cambridge Associates for its support with this article