The Church Investors Group will use its shareholder power to demand BP reviews its risk assessment and emergency response plans at the firm's AGM in April.

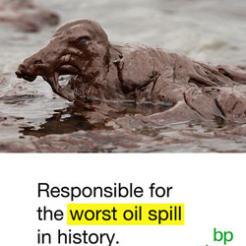

In light of BP’s oil spill in the Gulf of Mexico last year, the Church Investors Group (CIG), whose members include the Church of England and the Joseph Rowntree Charitable Trust,will demand that that oil giant systematically addresses operational and strategic risks.

The Group had intended to go one step further and file a shareholder resolution.

However, CCLA, acting as secretariat for the CIG and Christian Brothers Investment Services, brokered an agreement under which this will only happen in the 2012 AGM, giving BP until Autumn this year to make changes.

CIG entered in the agreement alongside US-based Christian Brothers Investment Services.

Bill Seddon, vice chair of CIG and the CEO of the Central Finance Board of the Methodist Church, said: “This historic cross-border collaboration will result in innovative ways for CIG and ICCR members to hold multi-nationals to account.”

Julie Tanner, assistant director of socially responsible investment at Christian Brothers Investment Services, added: “If BP fails to demonstrate board oversight and improve disclosure by the fall, there will be a Christian Brothers Investment Services/CIG shareholder resolution in 2012.”