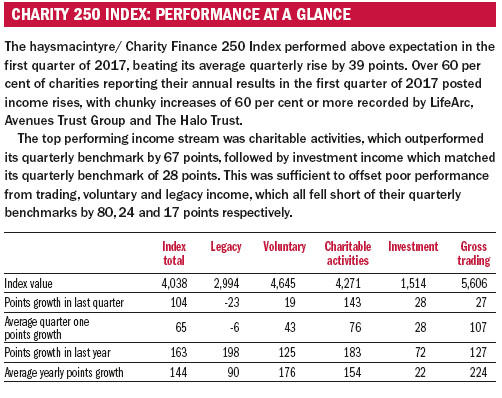

The top performing charity in this month’s review is LifeArc, which has more than tripled its annual income to £128.9m in the financial year ending 31 March 2017.

The increase at the medical research charity relates to the royalty monetisation of the drug Keytruda. This recently received approval from the US Food and Drug Administration (FDA), the European Commission and the National Institute for Health and Care Excellence for use in the treatment of advanced melanoma and particular forms of lung cancer.

As well as generating revenue of £115.6m, the development will also, according to LifeArc chairman Dr John Stageman, “secure our immediate financial future and enable the significant expansion envisaged in our exciting new strategy.” Over the next five years LifeArc will focus on four therapeutic areas, namely antimicrobials, neuroscience, personalised oncology and respiratory disease. “These enable us to focus our work in areas where we have recognised strengths and that have demonstrable unmet need that motivates charitable interventions.”

Formerly known as Medical Research Council Technology, the charity rebranded in June 2017 to LifeArc. According to the trustees, the name better reflects the charity’s purpose as “the arc or bridge between research and improving patients’ lives”.

Other charities that have performed particularly well in the quarter under review are the Avenues Trust Group, a social care charity, and the Halo Trust, which works for those affected by war.

At the former, total income rose by 60 per cent to £45.6m. This was largely as a result of the acquisition of Welmede Housing Association in November 2016.

At the latter, meanwhile, total income rose by 60 per cent to £40.8m. The charity saw a £9.1m increase in UK government funding, and contracts worth £4.7m subcontracted from its sister charity the Halo Trust (USA).

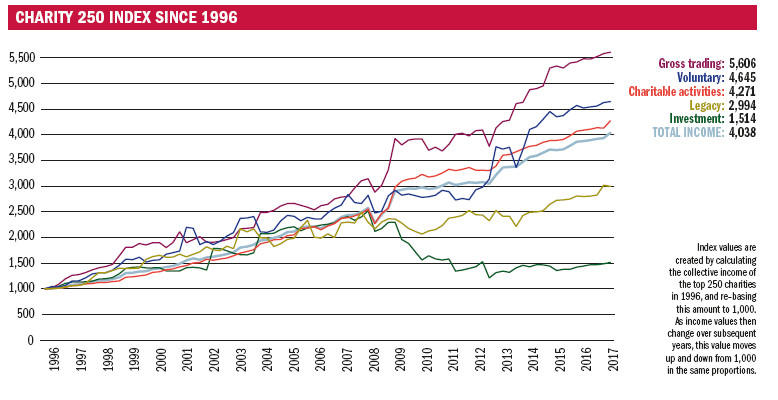

Investment income performed well in the first quarter of 2017, as illustrated by a 9 per cent rise in this income stream at Bridge House Estates to £27.5m and a 50 per cent rise at the Rothschild Foundation to £11.7m. The investment income sub-index has been in the doldrums since March 2009, when the Bank of England cut the base rate to 0.5 per cent, hitting returns on cash deposits and bonds.

Grantmaking charities

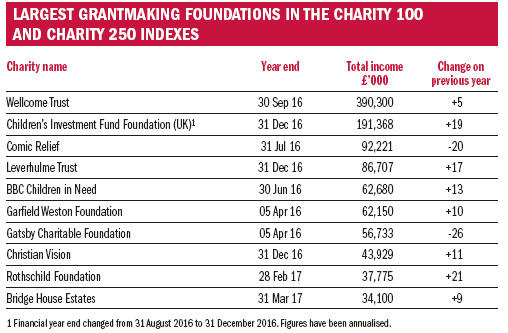

Across the Charity 100 and Charity 250 Indexes, there are almost 20 grantmaking trusts or foundations, who raise funds to donate to other charities that are more directly involved in service provision. They range from the Wellcome Trust, with annual income of £390.3m, to the Sigrid Rausing Trust with annual income of £20.2m.

It should be noted that while the Index tracks investment income such as interest, rents and cash dividends, it does not include gains on investments due to the difficulty of extracting these figures from charities’ accounts. They offer a much larger source of funding and explain why the investment sub-index has not kept pace with the others.

Investment and voluntary income are the two main sources of income for this segment. Investment income accounts for more than 80 per cent of income at the Wellcome Trust, Children’s Investment Fund Foundation (UK), the Leverhulme Trust, the Garfield Weston Foundation and Bridge House Estates. Voluntary income accounts for over 75 per cent of income at Comic Relief, BBC Children in Need, the Gatsby Charitable Foundation, Amanat Charity Trust and Goldman Sachs Gives (UK).

Some grantmakers are less reliant on individual income streams. The Rothschild Foundation, for example, generates 90 per cent of income in roughly equal shares from voluntary, investment and trading sources, with the rest coming from charitable activities. This is not, however, typical.

As the Charity 100 and Charity 250 Indexes are based only on income, it is likely that grantmaking charities are under-represented. Grantmaking bodies will tend to have large balance sheets and investment portfolios but their income levels may fall below the £21.2m three-year average annual income requirement for Index membership.

According to research by the Association of Charitable Foundations (ACF), family foundations, which are generally too small to be included in the Indexes, accounted for almost twothirds of the £2.9bn spent by the top 300 foundations in 2015/16. Similarly, the UK’s 46 community foundations are again too small to be included in the Indexes but collectively made grants of £77m in 2016/17.

Grant spending has certainly been affected by the recent recession, falling back from a high of £2.5bn in 2008/9 and only recovering to £2.6bn in 2014/15 despite falling income, according to ACF figures. However, haysmacintyre charities partner Anna Bennett says this was not the case for all foundations: “Many supported their beneficiaries during the recession by using their reserves to keep grantmaking budgets at the same level – or sometimes higher – despite fluctuations in their income.”

A more recent development is increased scrutiny on international grantmaking. “In general, a payment by a charity for its charitable purposes is charitable expenditure,” says Bennett. “However, a charitable payment made to a body outside the UK will only be considered charitable expenditure for UK tax purposes if the charity can clearly demonstrate that it has taken steps that HMRC considers are reasonable in the circumstances to ensure that the payment is applied for charitable purposes.

“In effect there is an extra condition on international grant-makers to ensure they have appropriate controls and reporting arrangements for grants made to overseas bodies.”

Related articles