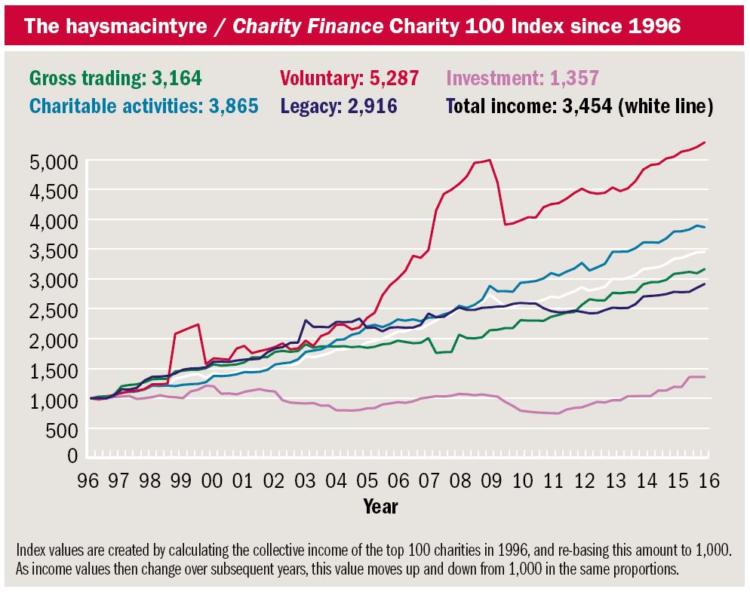

The Haysmacintyre / Charity Finance Charity 100 Index performed below expectation in quarter one, marking an abrupt end to three successive quarters of benchmark-beating performance. And as almost 60 per cent of charities in the Charity 100 Index have financial year-ends falling in this quarter (Jan-Mar), the latest figures provide a compelling indicator of income trends at the UK’s top charities.

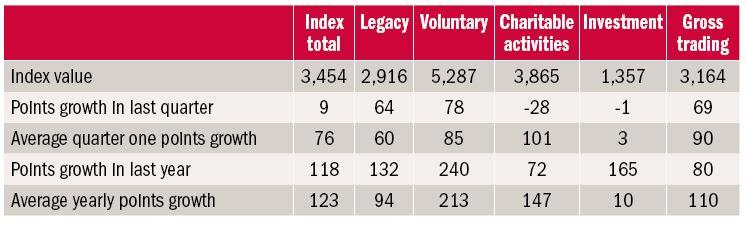

The Index rose by just 9 points in the first quarter of 2016, well behind its average rise of 76 points. The worst performing income stream was income from charitable activities, which actually fell by 28 points, underperforming its benchmark by 129 points. Trading, voluntary and investment income also performed below expectation, with legacy income beating its quarterly benchmark by 4 points.

Big drops

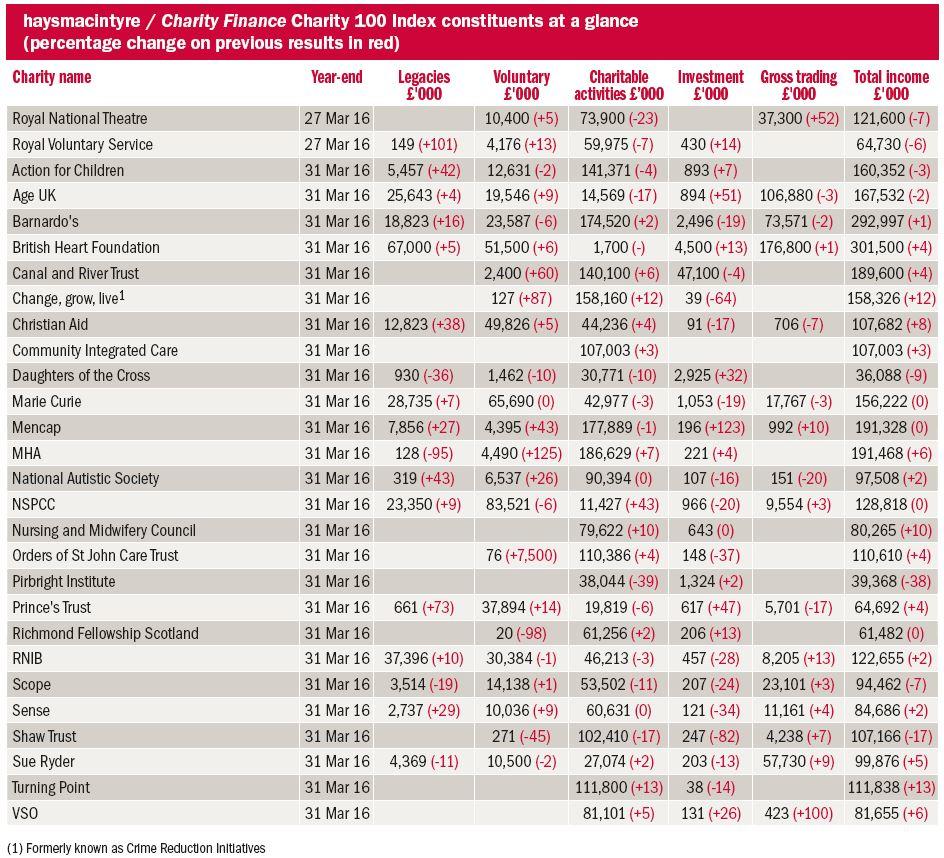

Over 60 per cent of Charity 100 Index charities with year-ends falling in quarter one report income rises in 2015/16, more than double the 29 per cent reporting income falls (9 per cent report minimal or no change). However, several of the income falls reported are fairly chunky and have clearly contributed significantly to the fall-off in income from charitable activities noted above.

The biggest drop was reported by Motability, which saw its income fall by 63 per cent from £181.9m to £67.1m. This derives from an exceptional 2014/15 financial year, when Motability received a £150m cash injection from its trading affiliate Motability Operations, a provider of mobility vehicles. The payment, originally from government, was intended to smooth the transition to the Personal Independence Payment (PIP) scheme, introduced in 2013 to replace the Disability Living Allowance (DLA).

The second largest drop in income was reported by the Pirbright Institute, which researches disease in farm animals. It saw its annual income fall by 38 per cent to £39.4m due to a comparable decline in grants and contracts.

According to chair of trustees Professor Quintin McKellar, many of the three-year grants awarded to the Institute “came to an end in 2015/16, and the grant success level for 2014/15 was not sufficient to supplement these reductions.” While the grant success level improved in 2015/16, this funding “will only have started part way through the year and will therefore not fully impact on the accounts until 2016/17,” he adds.

By contrast, the highest income rise in the quarter under review is a comparatively modest 23 per cent, reported by Citizens Advice. It saw its income increase to £108.6m. According to the trustees, the increase represents the first full year of funding from HM Treasury for pensions advice, and from the Ministry of Justice for witness services, along with a grant from a utility company for energy advice.

Children’s charities

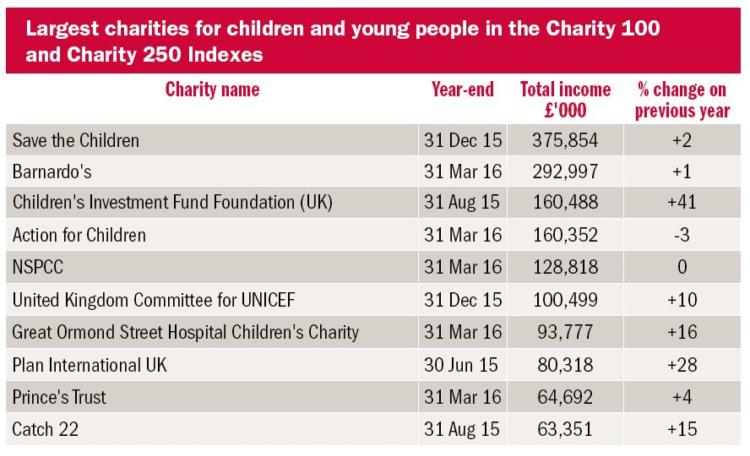

Across the Charity 100 and Charity 250 Indexes, there are almost 30 charities that exist for the benefit of children and young people. As around two-thirds of these have financial year-ends falling in the first quarter, a review of charities active in this sector is timely.

In terms of size, they range from Save the Children with annual income of £375.8m to the YMCA with annual income of £21.5m. They also span a diverse range of sub-sectors, including a hospital, an investment foundation, international development organisations, fundraising charities, youth organisations and service providers for children that are vulnerable or have specific health problems.

The income composition of charities in this sector is correspondingly diverse. Investment income accounts for 98 per cent of total income at the Children’s Investment Fund Foundation (UK), while voluntary income provides 91 per cent of total income at BBC Children in Need. Grants and fees for charitable activities provide the bulk of income at service providers such as Action for Children, where they account for 88 per cent.

Reliance on grants and fees

Taking all the children’s charities in the Charity 100 and Charity 250 Indexes as a composite, grants and fees for charitable activities is the main source of income, accounting for 53 per cent. It is followed by voluntary income at 27 per cent.

The danger of over-reliance on grants and fees for an individual charity is amply demonstrated by the demise of Charity 250 Index member 4children. As detailed on pages 38-39, it went into administration last August, citing the loss of key contracts and funding pressures. “Charities involved in service delivery do need to develop other income streams such as fundraising and investment income, as the funding from grants and fees frequently does not cover the full cost of the services provided,” says haysmacintyre head of charities and not-for-profit Richard Weaver.

Charities engaged in the direct delivery of care services are facing increased compliance costs due to the attention being paid to safeguarding by regulators. According to Weaver, the number of inspections by the Care Quality Commission (CQC) is on the increase. “Preparing for CQC Inspections and the additional compliance costs does add to the cost of service provision but it also ensures that high standards are met, as adverse reports can lead to reputational risk,” he says.

“Additionally, the prevalence of one-year contracts creates uncertainties over funding continuity and makes planning very difficult. Over the longer term, charities should be challenging funders for multi-year contracts and funding that covers the costs of the services they provide, but in the meantime, diversification of income streams is critical.”

Fundraising charities

Children’s charities that rely more on voluntary income clearly face a different set of challenges. In common with other fundraising charities, they face the requirement to comply with increasing levels of fundraising regulation, along with greater competition for voluntary income from other charities, who in line with best practice are looking to broaden their funding sources.

The NSPCC’s financial results have clearly been impacted by an overhaul of its fundraising activities in the wake of critical media coverage. In the second half of 2015/16, it suspended certain fundraising activities, including the use of some third-party agencies. As a result, voluntary income, which accounts for almost two-thirds of total income, fell by 6 per cent to £83.5m. Gains in legacies and income from charitable activities enabled NSPCC to maintain its total income level at £128.8m, before the addition of income from asset sales.

“For charities that derive a significant proportion of their income from voluntary sources, reputation is everything,” says Weaver. “They must proactively demonstrate compliance with fundraising standards and reassure their donors on how both their contribution and their information will be used.”

More from the Index