Diane Sim reports on a positive quarter for the Charity 100 Index, and takes a closer look at charities active in heritage, culture and the arts.

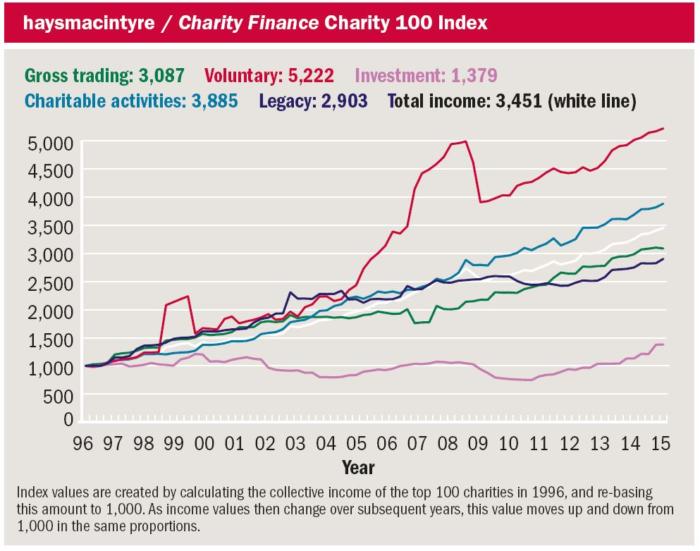

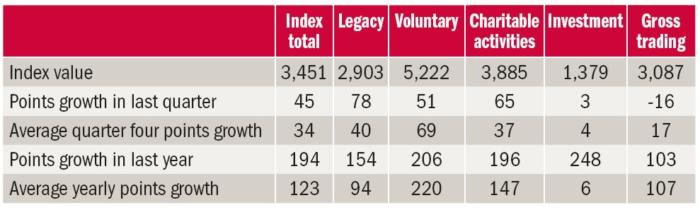

The Haysmacintyre / Charity Finance Charity 100 Index performed above expectation for the third successive quarter in the three months to 31 December 2015, rising 45 points, some 11 points ahead of its average quarterly rise.

The top performing income stream was legacies, which beat its quarterly benchmark by 38 points. It was driven by chunky double-digit increases in legacy income reported by the British Red Cross Society, Dogs Trust, Guide Dogs for the Blind Association and Save the Children.

Income from charitable activities also performed well, beating its quarterly benchmark by 28 points. This was spurred by double-digit increases at Islamic Relief Worldwide, the Archbishops’ Council, ActionAid and Fusion Lifestyle.

Some 16 of the 20 charities with financial year-ends falling in the fourth quarter reported income gains, including 11 with increases of over 10 per cent.

In spite of there being more winners than losers in the quarter under review, trading, voluntary and investment income all performed below their quarterly benchmarks.

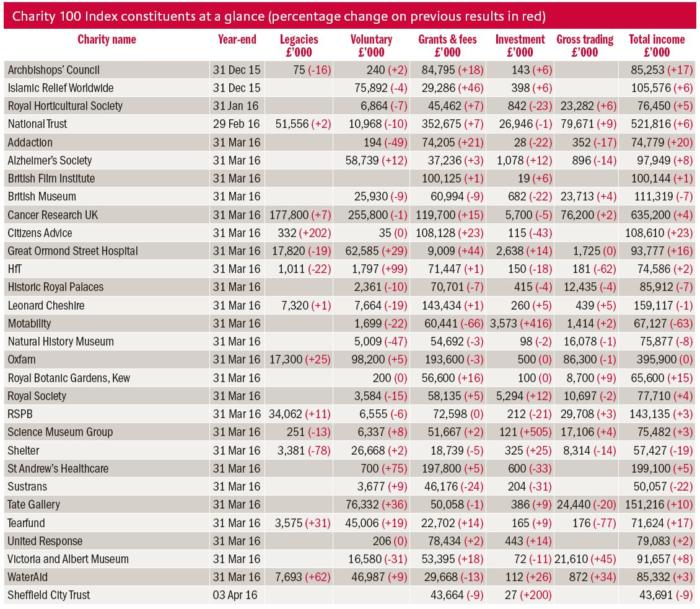

Looking ahead, around half of the charities with financial year-ends falling in the first quarter of 2016 have now filed their accounts and these are included in the table below. Almost 60 per cent of charities in the Charity 100 Index have quarter-one year-ends.

Heritage, culture and the arts

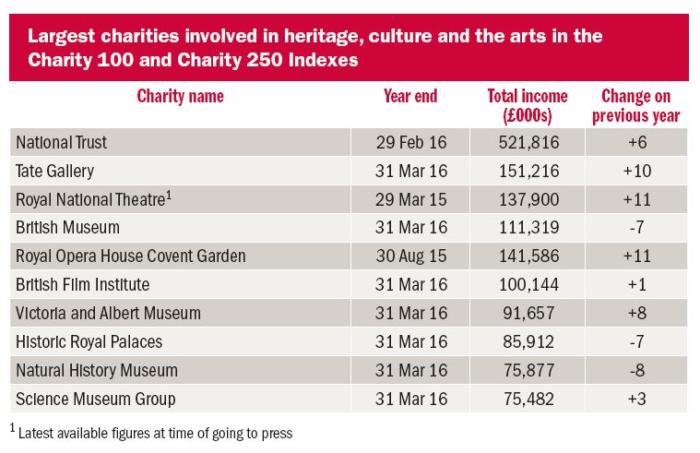

Among these early filers, there is a strong prevalence of charities active in heritage, culture and the arts. Across the Charity 100 and Charity 250 Indexes, there are almost 30 charities involved in this broad sector. They span the National Trust with annual income of £521.8m to National Galleries of Scotland with annual income of £19.6m.

In-between are a diverse range of sub-sectors including the performing arts (mainly theatre, opera and ballet), museums and art galleries, and heritage properties and sites of historic interest such as Historic Royal Palaces.

The museums and art galleries included in the Indexes are generally national collections in England, Wales and Scotland, such as The Tate, National Museum of Wales and National Galleries of Scotland, with the only regional collection being National Museums and Galleries on Merseyside.

Similarly, the performing arts charities tend to be large national groups such as the National Theatre, the Royal Opera House and the Royal Shakespeare Company, with the only regional player being the Birmingham Hippodrome Theatre Trust.

Museums and art galleries

As custodians of national treasures, museums and art galleries receive a significant proportion of their income from the state in the form of grant in aid and Heritage Lottery funding. Trading can also make a significant contribution to income, though this tends to reflect the take-up of the main programme of events.

“The success of the trading operation is entirely dependent on the popularity of the exhibition programme,” says haysmacintyre’s head of charities and not-for-profit Richard Weaver. A case in point is the Victoria and Albert Museum (V&A), which reported a 45 per cent increase in trading income to £21.6m in the year to 31 March 2016, as a result of its commercially successful exhibitions programme, which included the very popular Alexander McQueen: Savage Beauty show.

Voluntary income can also be a significant contributor to income, as it is in the case of The Tate, the British Museum and the V&A. “Fundraising in the context of a museum or art gallery can be quite challenging,” says Weaver. “‘It is important for fundraisers in both revenue and capital teams to have a combined and holistic, rather than distinct, strategy. They should also understand donor motivations, especially where the same donor may be approached for both causes.”

Performing arts

The funding of the performing arts is much more diverse, encompassing theatres that receive no public funding and others that do – largely via the Arts Council – to innovate and develop productions that would not be commercially viable in their own right. Commercial sponsorship can also be a contributor to income in this sector.

A key development over the last 18 months has been Theatre Tax Relief (TTR), introduced by the Finance Bill 2014, which enables theatrical production companies to claim tax relief on their preproduction costs. “The financial benefit of TTR is significant, though there are anomalies in the rules, which make it difficult in some instances for charities to meet the conditions and at the same time comply with charity tax law,” comments Weaver.

The legislation is, however, unlikely to be revised and has been rolled out to other areas of the performing arts in the shape of Orchestra Tax Relief, introduced in the Finance Bill 2016.

Brexit takes a bow

The arts community has been fairly vocal in expressing its views on the likely impact of Brexit on its activities, though not everyone is singing from the same hymn sheet.

A survey conducted by the Creative Industries Federation in the run-up to the EU referendum found 96 per cent of its members in favour of remaining in the EU, for reasons including access to EU funding and the free movement of talent.

High-profile figures such as Martin Roth, director of the Victoria and Albert Museum, and National Theatre director Rufus Norris have publicly voiced their dismay at the outcome of the referendum. Many are of the opinion that the referendum was a contributory factor in Roth’s decision, announced in September, to step down from the V&A.

Norris has since announced the National Theatre’s plans to launch a “Brexit verbatim” project, involving interviews with people across the country to tell the story of the vote to leave the EU. Dubbed “Missing Conversations”, the project will create a massive archive from which future theatre productions will be developed.

It’s not all doom and gloom, however. Celebrating the 30th anniversary production of The Phantom of the Opera, theatre producer Sir Cameron Mackintosh said that the weak pound was drawing visitors to the UK and boosting West End ticket sales.

“There are going to be winners and losers in this, but there is no doubt that the entertainment business and theatre is really benefiting from where the pound is at the moment and visitors saying ‘we are going to come to London’. Theatres are really doing well,” he said.