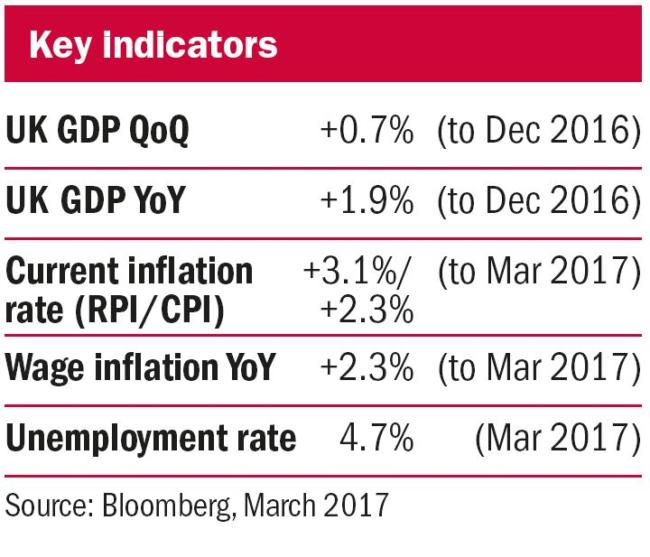

Our predictions for 2017 had three key features: slightly faster growth in the world economy; rising inflationary pressure; and increasing interest rates in the US. Data in the first quarter has generally supported this outlook. Growth numbers look encouraging, and signs that world trade is picking up are positive for emerging markets in particular.

Inflationary forces have been strengthening over the past few months, though the consumer price index (CPI) remained stable at +2.3 per cent in March. This reflects a late Easter, which will boost transport costs in the April data.

As a result of higher inflation in the US, the Federal Reserve has increased interest rates for the third time in the last two years. In the UK, the Bank of England is adopting a “wait and see” attitude as Brexit negotiations begin, with Mark Carney, making it clear he is not in favour of a policy response to rising inflation – for which he sees the fall in sterling as solely responsible.

The triggering of article 50 was so well flagged that it passed without disruption to markets. Indeed, despite further opportunities for political shocks this year, particularly in Europe, broad market volatility has remained at historically low levels. At the time of writing, we are yet to see whether there will be a sustained market reaction to the UK’s general election announcement.

Opportunities for active managers

As more evidence emerges of broader synchronised global growth rather than a dependency on the US, confidence in the durability of this upswing should increase. This is likely to support risk assets but prove challenging for bond markets facing the prospect of less accommodative monetary policy and rising inflation.

It may seem ironic that better economic conditions may lead to increased volatility in markets, but as liquidity is tightened we are likely to experience more oscillations. If, as we expect, volatility picks up and correlations between stocks and sectors fall, there should be better opportunities for active managers, many of whom have struggled to keep up with the index over the past 12 months.

Emily Petersen is a portfolio director at Cazenove Charities www.cazenovecharities.com

Related articles