Many trustees of the UK’s 5,600 or so defined benefit (DB) pension schemes face the issue of their assets being exceeded by future liabilities to scheme members. Liabilities of £1.8tn outweighed assets by £180bn in the UK’s DB pension schemes at the end of April this year, according to PwC’s Skyval Index. Schemes in deficit face a number of challenges.

Over the years, demographic changes have increased deficits as growth in life expectancy means that people are spending longer in retirement. A recent modest reversal in this growth has helped to improve the financial position of such schemes, but the problem remains.

Meanwhile, since the financial crisis of 2007-08, lower interest rates and the resultant low yields on bonds have inflated the value of future liabilities, exacerbating schemes’ liability mismatches. Pension funds have had to look for higher income elsewhere, and this usually means taking on more risk, for instance in the debt of now highly indebted companies or less creditworthy nations, or even in potentially extremely illiquid investments such as private debt. These investments offer investors a higher yield, reflecting their illiquidity and higher risk.

Geopolitical tensions

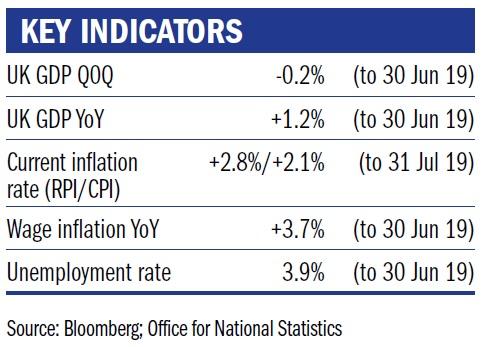

Recent developments have made matters even more difficult. Brexit uncertainty remains. Increasing geopolitical tensions and global growth concerns have depressed gilt yields further to near record lows – how all this will ultimately develop is still unclear, and for now, yields are likely to remain depressed.

Furthermore, the fact that the vast majority of DB schemes are no longer admitting new members means that the proportion of retired members receiving defined benefits will only increase over time. As it stands, around half of DB scheme members have retired. Increasing payout requirements mean schemes will continue to pivot from growth assets, such as equities, into those that provide a level of required income.

The challenge for schemes is reconciling the risks associated with these investments with the income they offer. But a focus on yield at any cost may mean more risk is being taken on than might be assumed. A material slowdown in the economy might threaten the flow of income from these riskier investments. This, in turn, would be accompanied by a markdown in their value, and with it a scheme’s assets.

Charles Auer is an investment associate at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles