There has been lots of activity in pensions over the last year, which throws up both opportunities and threats for charities. Here’s a whistlestop tour of the main developments across defined benefit (DB), local government pension schemes (LGPS) and defined contribution (DC), which tend to be the main pension arrangements for charities.

Defined benefit

Endgame planning and insurance buy-out

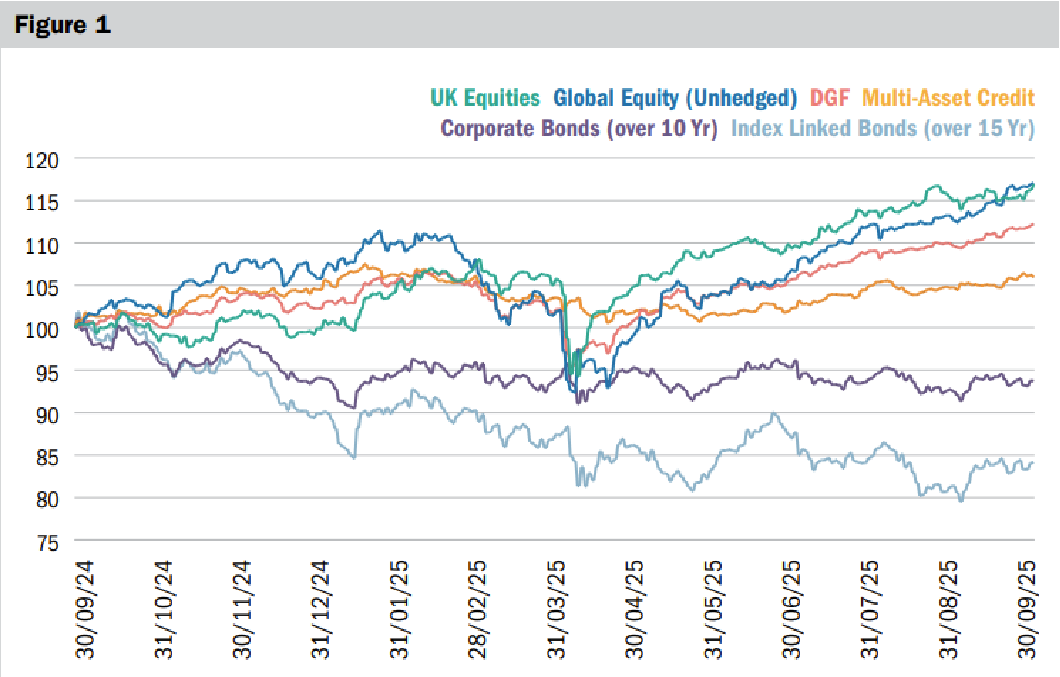

The key priority for most charities with their own DB scheme is to execute an endgame strategy. Financial conditions continue to be favourable, and have improved further over the last year. Figure 1 shows how the main asset classes have performed over the 12 months to 30 September 2025. DB liabilities broadly move in line with the light blue line (index linked bonds), which have fallen 15% over the year off the back of lower inflation expectations and rising yields. In contrast all other asset classes have done better than this. With DB funding being driven by the difference between the asset and liability values, this has led to further funding improvements over the last year. The Pension Protection Fund estimated that on average schemes were 95% funded on a buy-out basis at 31 March 2024 – I expect this is now over 100%. Insurance buy-out may therefore be in reach for your charity – it’s worth getting a current funding position from your actuary if you have not had one for a while.

Consolidators

An alternative to insurance for settling your DB liabilities and removing them from the charity’s balance sheet is now developing with pension consolidators or superfunds. These vehicles operate under the pensions regime rather than then insurance regime, and can provide a lower cost settlement solution than insurance for slightly lower member security. Clara Pensions is currently the main provider in this market. It has now completed 4 transactions, including one in 2025 in the charity sector for the £55m Church Mission Society pension scheme. TPT Retirement Solutions has also just launched its own superfund. This breaks the link to the sponsoring employer (like insurance and Clara), but runs on for the long term, rather transferring schemes to the insurance market over time like Clara. Other providers are expected to enter this market, so this could become a more mainstream option over the coming years. The TPT option could be particularly interesting for charities that already participate in a TPT scheme and want to settle their liabilities at a lower cost than insurance buy-out.

Run-on

The government continues to look at ways to encourage run-on of DB schemes so that the £1.2tn of assets in occupational DB schemes can be better used to help grow the UK economy. The key development in the last year has been the Pension Schemes Bill 2025. This introduces measures to make it easier for employers to access surplus in DB schemes, recognising there is currently an asymmetric risk for employers whereby they have to fund deficits but cannot easily access surpluses.

In my experience, most charities still want to settle their DB liabilities and get them off balance sheet, rather than continue to run-on to access surplus. However, these developments will be relevant to a minority of charities with larger DB schemes that are already running their own investments and might therefore see run-on as attractive. Unfortunately, the new regime will not go live until 2027 or 2028, but charities interested in this can still get the required surplus policies and guardrails in place ahead of go live.

New funding regime

For charities with less well funded schemes, the key priority is a new funding regime for DB schemes which came in for triennial valuations from September 2024 onwards. This requires charities to target funding their schemes to a more prudent low dependency basis, where the scheme has sufficient assets to have a low dependency on the employer for future contributions. This could lead to a significant increase in the required level of contributions for some charities with more poorly funded schemes.

Pension scheme trustees now also need to quantify a range of new metrics to assess the employer covenant, including items like the covenant reliability period and the maximum affordable contribution. Charities should engage with pension scheme trustees and their advisers to ensure this process is adding value and is proportionate.

Managing running costs

Another area the new funding regime shines a light on is running costs, with the need to add an expense reserve to the liabilities in some cases. This can be a material additional liability. Our analysis of 50 larger DB schemes in the sector showed average running costs of £500,000 per annum, equivalent to 0.3% of the liabilities. It’s easy to see how capitalising this can add over 5% to the liabilities, in some cases becoming the sole source of a deficit.

There are a range of expensive data projects already in progress or on the horizon including equalising guaranteed minimum pensions and connecting schemes to the pensions dashboards. Different administrators are using different approaches with a wide variance of costs, so charities should ensure they understand the full range of options available in the market rather than just going with the approach proposed by their current administrator. They should also consider operational consolidation solutions that are now available and can streamline the governance and running of DB schemes, including multi-trust solutions where economies of scale are shared across a book of schemes. We have seen costs reduce by 30% in some cases from adopting these models.

Multi-employer DB pension schemes

The favourable market conditions I mentioned above have had a particularly strong impact on LGPS schemes. These schemes tended to not hedge much of their interest rate risk, meaning their assets have remained buoyant while their liabilities have shrunk (in contrast many standalone DB schemes hedged interest rate risk and therefore some of their assets have fallen in line with their liabilities). Charities in LGPS should therefore assess their funding positions, and if they can exit for nil cost or in many cases even access an exit credit payment back from the fund. The payment of an exit credit is a discretionary decision for funds, but I have experience of funds paying these exit credits particularly for charities that have been fully on-risk during their period of participation and can argue they should share in the upside on their cessation.

A lot of charities also participate in multi-employer schemes operated by TPT. A long-awaited court case in relation to the legal effectiveness of a raft of historic benefit changes across these schemes was heard in February 2025 with the ruling expected imminently. If the court finds these changes were not legally effective, this will trigger additional liabilities, and likely additional contribution demands on charities in these schemes. Charities therefore need to monitor their TPT position closely during over coming months.

Defined contribution and broader pensions policy

DC is the typical pension arrangement for charities for future pension contributions. Strong investment markets and higher interest rates mean projected pensions that employees can expect from DC funds are now far higher than three years ago. That said, contribution levels generally remain low and in many cases are at or close to the statutory minimum levels (a 3% employer contribution and an 8% overall contribution).

We continue to see a lot of competition and innovation in the DC provider market, particularly with DC master trust offerings. If you have not reviewed your provider for some years, it is worth doing this as you may be able to generate significant savings for your employees and a better member experience. You may also want to review contribution levels as part of this review if they are at statutory minimum levels.

Any DC review should also consider salary sacrifice for employee pension contributions. The November 2025 budget introduced a cap of £2,000 a year on the amount of salary that can be sacrificed for pension contributions without incurring national insurance payments. Consider introducing salary sacrifice for pension contributions if you do not currently offer this option. In many cases the cap will not bite (eg the cap equates to a 5% employee contribution for an employee earning £40,000 a year), and it saves charities and employees national insurance. For charities that already offer salary sacrifice, review the impact of the cap and consider offering support to any affected employees to help them understand the impact and options available to them.

Lastly, 2025 has seen further progress in the development of a new type of pension scheme – conditional defined contribution (CDC). The first of these schemes was launched by the Royal Mail for its employees in October 2024, and in October 2025 regulations were passed allowing unconnected multi-employer CDC schemes.

This last development is significant as it allows commercial pension providers to offer this type of pension, opening it up for smaller employers and charities. TPT has already announced it will be launching a CDC scheme, and others are expected to follow. From an employer perspective, CDC is like DC – contribution levels are certain with no risk of deficit contributions being payable. But from an employee perspective CDC looks like DB targeting a particular level of pension. The Royal Mail scheme targets a pension of 1/80ths of salary per year of service and a lump sum of 3/80ths of salary per year of service. The reason no deficits emerge is that the pension is a target rather than a guarantee and the annual increase is flexed in response to funding levels (so higher increases are awarded when funding is strong and lower or no increases are awarded when funding is weaker).

So, in summary lots of opportunities in DB and LGPS to de-risk and potentially access surplus, and an interesting new type of pension arrangement in CDC, which could be a good fit for the charity sector.

Alistair Russell-Smith is the charity and corporate advisory lead at Spence & Partners.

Charity Finance wishes to thank Spence & Partners for its support with this article.