This event is now fully booked, email [email protected] to be added to the waiting list.

The 2021 Charity Finance Investment forum will be returning on 29-30 November 2021.

The pre-forum reception and dinner provides the perfect setting in which to network with peers from other charities. This is complemented by a full day's programme of expert sessions giving insight analysis into a range of investment strategies and crucial investment topics.

Designed for finance directors, chairs, trustees and chief executives responsible for investment portfolios, the forum helps charities shape their strategies and maximise returns.

The Charity Investment Forum is an invitation only event for charities with investment assets in excess of £5m. If you are interested in attending, please contact our events team via email at [email protected]

Speakers

-

Gillian Morbey OBE

Gillian was the founder and chief executive of Scotland’s first charity for deafblind people, Sense Scotland. As the parent of a severely disabled baby who was diagnosed with congenital rubella, Gillian was shocked by the absence of services and support for families, and at the patronising and dismissive attitude of health and social care professionals. She resolved to create a better system, and a parents support group formed in 1985 was the genesis of Scotland’s first charity for deafblind people, Sense Scotland. Her dedication to the cause meant that she soon became its first paid employee and, as it grew, its first chief executive.

She led Sense Scotland for 25 years, overseeing its growth from a kitchen-table project to one of Scotland’s biggest charities with an annual income of over 20 million pounds. As well as creating a host of new services from scratch and convincing local authorities to buy them, it was also at the forefront of efforts to find and rescue scores of deafblind children and adults hidden away in long-stay hospitals and institutions, and resettle them in the community.

Gillian also helped to set up Sense International in the mid-nineties, which now operates across Africa, Asia and eastern Europe, and in 2007 she proudly oversaw the opening of Glasgow TouchBase, an enterprising community hub and services facility for families of children with special needs which also provided a new income stream for Sense Scotland.

In 2010, she was called on by the chair of Sense, the Midlands-based charity, to ask if she would help the board work through some issues. She agreed, moved to England, and stayed for eight years, leading the development of a new 14 million pound TouchBase in Birmingham. TouchBase social enterprises have now also opened in Lanarkshire and Ayrshire, enabling the expansion of services for families across Scotland and further reducing Sense Scotland’s reliance on shrinking social care budgets.

Nowadays Gillian is retired, although she continued advising Sense Scotland during the Covid pandemic, and she volunteers on a grantmaking committee at the Wolfson Foundation. She is still involved with Sense International and hopes to return to India at some point to see the many deafblind people she knows there.

Due to her phenomenal contribution to the disability sector in both Scotland and England she was awarded the 2021 Daniel Phelan Award for Outstanding Achievement at this year’s Charity Awards.

-

Philip Coggan

Philip Coggan has written on management and work for The Economist, penning the Bartleby column and looking at everything from leadership to the latest business buzzwords. Before that he was the Capital Markets Editor and author of the Buttonwood column, which analysed the latest financial markets news. He was awarded the title of Senior Financial Journalist in the Harold Wincott awards, and won the category for best personal finance story at the Business Journalist of the Year Awards.

Prior to joining The Economist Philip was Investment Editor of the Financial Times. He was at the FT for 20 years and also wrote the Long View and the Last Word columns. In other positions at the FT he was market editor, economics correspondent, personal finance editor and the Lex columnist.

Among his books are The Money Machine: How the City Works, a revealing look behind the hype and headlines at how the financial system really operates from crashes to currency rates. His book More - The 10,000- Year Rise of the World Economy tracks the history of markets, finance and economics. In Paper Promises he produced an accessible guide to debt, money and the financial crisis, whilst in The Last Vote he moved towards the political with an analysis of post-crisis democracy.

Itinerary and workshops

Monday 29 November

| 15.00-17.00 | Arrive and check in |

| 17.00-18.20 | Networking drinks reception |

| 18.20-18.30 | Welcome address: Matthew Nolan, CEO, Civil Society Media |

| 18.30-19.00 | Opening keynote: Philip Coggan, economic commentator |

| 19.00-21.00 | Dinner |

| 21.00- close | Informal networking |

Tuesday 30 March

| 7.00-8.30 | Breakfast |

| 8.30-9.10 | Workshops (details below) |

| 9.20-10.00 | Workshops (details below) |

| 10.00-10.40 | Refreshment break and networking |

| 10.40-11.20 | Workshops (details below) |

| 11.30-12.10 | Workshops (details below) |

| 12.25-13.05 | Workshops (details below) |

| 13.15-15.00 | Lunch and lunchtime keynote speaker. Gillian Morbey, president, Deafblind International and former chief executive, Sense and Sense International |

| 15.00 | Event close |

Workshop sessions:

You will be given the option to select the sessions most relevant to your organisation

Workshop One

CCLA: What makes a quality company

Quality companies are unique in their ability to generate consistent profitability and compound returns over the long-term. In this session we will present a discussion of the financial traits of a quality company, together with an assessment of the qualitative characteristics that provide them with an enduring competitive advantage. We will use case studies to illustrate and bring to life the discussion, together with some analysis of the potential pitfalls of assessing quality.

Panellists: James Ayre, co-head investment, Charlotte Ryland, co-head investment, Romain Mouquet, global equity analyst & Rob Lapsey, global equity analyst, CCLA

Workshop Two

Ruffer - 18 months on from the Pandemic; what has happened, where have we come from and where are we likely to go?

Here we will look at the impact of the pandemic across economies, but particular in the UK. We will see whether we can identify changes and new patterns in the economy going forward, and how an understanding of this change will be essential in allocating capital for charities.

Jamie Dannhauser, economist and Christopher Querée, investment director

Workshop Three

Knowing the best available investment options is important for your charity. Andrew Zazzi and Adrian Maxwell will explore the advantages and disadvantages of an income-only versus total return approach and consider the factors that you should take into account when deciding which approach is best for your charity.

Andrew Zazzi and Adrian Maxwell, investment directors

Workshop Four

Cazenove Capital - A portfolio for the next decade

This workshop will examine the themes that are likely to drive markets in the coming decade, reflecting on the current state of the economy and commenting on alternative sources of return.

Tom Montagu-Pollock, portfolio director – charities and fund manager, Charity Responsible Multi-Asset Fund

Workshop Five

Newton Investment Management - Bouncing back – a story of resilience and recovery

In this workshop, Rorie Evans, client director, will take you through the key findings from this year’s Newton Charity Investment Survey. While charities continue to suffer significant disruption from the coronavirus pandemic, we also see a clear story of resilience and recovery, with charities remaining steadfast in their investment strategies while benefiting from a rebound in performance. Increasing importance continues to be placed on societal and environmental issues, with the vast majority of charities believing it is their responsibility to consider climate change.

Rorie Evans, client director

Workshop Six

CCLA Risks for investors – what’s new?

The current global investment environment is truly remarkable from many perspectives. State intervention in markets is at levels never seen in modern history. All is not well with the classical risk-free benchmarks. So, what can investors worried about risk do? We uncover the various lenses that we use, standard and non-standard, to identify risks in our clients' portfolios.

Panellists: Michael Ekaette, fund manager, Michael Fowler, quant analyst & dealer and Tim Matthews, interim head of investment solutions

Workshop Seven

Ruffer - How safe is your portfolio?

The past 40 years or so have been a great period for investment – but that may be coming to an end and with it, the assumption that a ‘balanced’ portfolio will be enough to protect you. In this workshop we will consider why this assumption may be under threat and consider what a new portfolio model may look like for charities going forward.

Ajay Johal, investment manager and Chris Querée, investment director

Workshop eight

Rathbone Investment Management - Equities – which markets?

The events of the past 18 months have changed the course of markets and some areas have been worse affected than others. James Codrington and James Pettit will discuss the relative merits of investing in different regions around the world. If you are trying to choose between investing in developed vs. emerging markets, or UK vs. overseas, your decision will be greatly informed by this session.

James Pettit and James Codrington, investment directors

Workshop nine

Cazenove Capital – Greenwashing in a post-Covid world

This workshop will look at the huge shift we have witnessed to intentional investing and the things that trustees should be aware of.

Kate Rogers, head of sustainability and co-head of charities and Emily Peterson, portfolio director, charities

Workshop ten

Smith & Williamson – Events raise the risk of higher US inflation

The late ex-UK PM Harold Macmillan is reported to have once described the unpredictability of politics as ‘Events, dear boy, events’. While it may not have been clear at the time, events have shaped the inflation cycle. In this presentation, we show why the unprecedented pandemic-related policy response and the election of a pro-union US president could be an inflection point that leads to a higher future inflation rate. Moreover, these events are coming at a time when some of the disinflatonary drivers of the past 40 years, such as globalisation and the adoption of technology, are easing back.

Daniel Casali, chief investment strategist, Smith & Williamson

Workshop eleven

abrdn - Climate Transition Companies – Sustainable value investing?

Climate change is the challenge of our generation, but companies that generate the majority of their revenue from green sources are a scare and often expensive commodity. In this workshop we explore the role of ‘transition-companies’ which must be ambitious and credible in reducing their emissions and which can add much needed ‘value’ characteristics to your portfolio.

Ben Turner and Miranda Richards, senior charity portfolio managers

Workshop twelve

CCLA - The true impact of shareholder engagement: investing for good during a global pandemic

In a world of conflicting priorities, where can investors have the greatest positive impact? We will discuss the biggest social and environmental themes from the past 18 months, how we responded and our plans for the future. Charities wield great power through the weight of their investments; it is time those investments were put to work.

Amy Browne, stewardship lead

Workshop thirteen

Investec - Meeting your Mission – the non-financial aspects

This will be a fast-paced interactive workshop, focused on listening to your priorities. What non-financial investment goals do you want your investment manager to focus on? You may value ESG integration; exclusions, engagement; impact, perhaps a specific goal, such as climate change, or even ‘all of the above’. But what are the priorities, and what more can your investment manager do to help? You will decide!

Nicola Toyer, head of charities and Michael Turner, investment manager

Workshop fourteen

abrdn - Tuning out the noise – what really matters to long term investors?

In a period of uncertainty and profound structural change, what are the factors long term investors should place at the heart of their portfolios? In this workshop, we will explore the challenges and structural themes shaping the world and how to ensure your portfolio is firmly focussed on the future.

Laurence Gagen, head of charities and Julie-Ann Ashcroft, head of sustainable investment

What to expect at the Forum...

- Welcome drinks reception

- Formal three course dinner

- After-dinner networking reception

- A choice of 16 expert sessions

- Opportunity to network with leading sector professionals

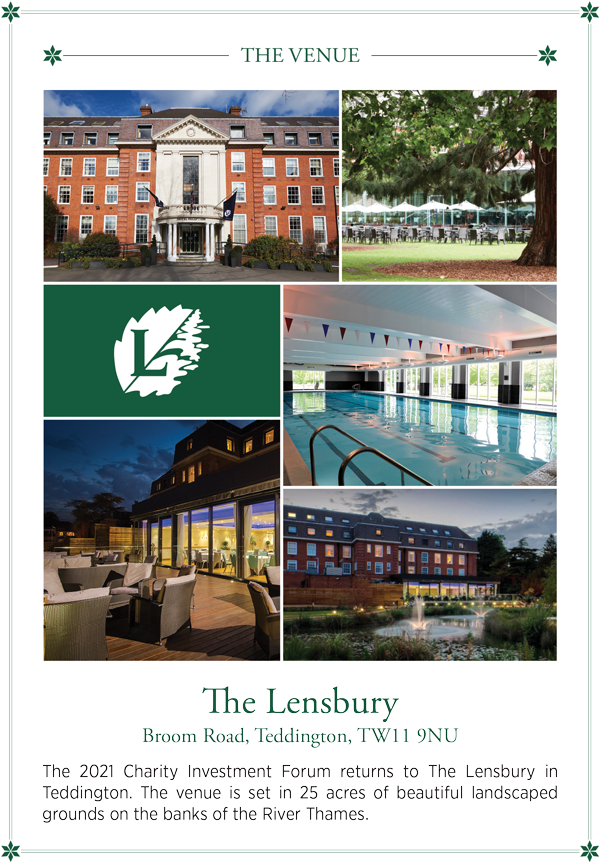

- A complimentary room and access to venue facilities