Civil Society surveys lend understanding to why remote working helps the voluntary sector tick, says Daniel Phelan.

The publication of our annual Charity IT Survey has coincided with the publication of the Charity Finance Directors’ Group/Hays annual salary and employment survey. Comparing the two throws up an interesting confluence of information streams, which lends force to the notion of the changing nature of the workplace.

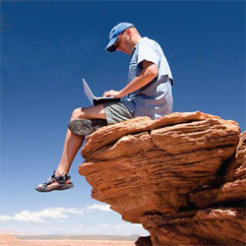

In our IT survey, the proportion of charity staff with remote access has risen from 30 per cent in 2007 to 57 per cent this year, to all intents and purposes doubling in three years. Meanwhile the CFDG/Hays report found that by far the most important benefit for all respondents was flexible working, by which it meant flexitime and the ability to work from home.

Clearly the now fairly well established technology allowing remote access to internal networks and the growing acceptance of flexible and off-site working are combining to make a happier work force.

This is supported by the finding that turnover of finance staff has fallen to historically low levels, although it isn’t clear whether the remote access trend or the mean streets of postcredit- crunch Britain is contributing most to this. With over two-thirds of responding charities showing no turnover at all and another 17 per cent with very low turnover, retention rates must surely be at an all-time high.

One of the key messages from our IT Survey is that mobile and remote working is on an accelerating trend. This appears to suit staff but will have implications in all kinds of ways. In the IT field, it must surely lead to growth in software as a service and it can only be a matter of time before this penetrates the heart of the finance function, however nervous finance directors may be about security issues.

Income and inflation

Something else that must be making finance directors nervous is the continuing low returns on cash available and the stubbornly high rate of inflation in the general economy, let alone the particular fields of work in which charities tend to operate where it is often even higher. For a sector that loves to sit on lots of cash, this is becoming increasingly costly.

In this environment, it would be staggering if the juicy yields that the specialist charity property funds are carrying did not catch the eye, especially as the heart-stopping scares of recent financial history begin to recede in people’s minds.

Similarly the high yield equity funds appear to be positioned to pay well into the future. Common sense would imply that companies capable of paying high dividends have good cash flows. They should also be more stable and resistant to downturns and credit squeezes, as well as able to continue investing and thus improving their relative market positions.

Of course, there are always risks in any investment and professional advice must be taken before plunging in. Will inflation turn to deflation and make you wish you’d hung onto that cash? Will equities take another tumble? Will commercial property crash as everyone increasingly works from home and buys their goods on the internet? Maybe all of those things will happen or none of them will. But one thing is certain, the purchasing power of cash is eroded by inflation and we seem to have plenty of that right now.