As investors seek to make their investments work better, one solution is to delegate more of the day-to-day activity to professional specialists. Duncan Higgs explores further.

Investment is fundamentally a competitive activity, and the effort to generate investment returns is becoming increasingly complex. As David F. Swensen, chief investment officer at Yale University, remarked: “I see every day how competitive the markets are, and how tough. So the idea that you can do this yourself, that’s out the window.”

More than ever, investors are engaged in a global contest for returns. Large institutional investors such as corporate pension funds, sovereign wealth funds, large endowments, foundations and family offices compete with smaller investors such as retail clients and indeed the majority of charity investors for higher investment gains. With a restricted pool of talent, diversifying assets and hedging strategies from which to choose, getting ahead of the competition is critical. In this contest the mega funds – those with multi-billion-dollar asset portfolios – typically hold an enviable advantage over the average investor. Their investment expertise, access to opportunities, ability to be dynamic and bulk purchasing power are hard to compete with or replicate.

For investors to succeed in this environment, it is vital to consider whether their current investment approach is appropriate, and just as importantly whether they have the right level of governance to execute this. In particular, a misalignment between the preferred investment approach and the level of governance could jeopardise the chance of meeting the investment objectives.

A challenging environment

Expectations for global economic growth are at best mediocre in the short to medium term. With equities and bonds looking expensive after extended rises in markets, the forwardlooking returns from these traditional assets look muted. Generating sufficient and sustainable returns to meet ongoing spending requirements is therefore becoming ever more challenging.

At the same time, our view is that the potential for a significant economic shock (such as a negative fallout from the recent EU referendum or US election results) over the next three to five years is elevated. In the event of a major downturn in the markets, traditional assets such as equities and bonds are likely to suffer sizeable losses. Charities, who have to date invested heavily in these types of assets, could therefore find their ability to maintain the level of spending for their operations materially or irretrievably impaired.

We believe the ability to navigate this difficult market terrain and the governance capability of an investor are intrinsically linked. But how can the average investor improve governance without the budget of a mega fund?

Bridging the governance gap

There are two main options to enhance how investments are governed – building an in-house team of investment expertise, or delegating to a specialist third party to provide this.

Building an internal team can offer attractive benefits. However, for many it is simply not realistic, as only the largest funds will have sufficient scale and budget to make this genuinely viable. A sustainable and effective in-house team requires substantial resources.

For investors that cannot build internally, delegation to a third party, sometimes referred to as fiduciary management, may offer a solution. This allows investors to address the need for increasingly efficient investment strategies and real-time decision-making within a governance budget that is (as in the case of many charities) subject to constraints.

These challenges are, of course, not unique to charities – pension schemes have grappled with similar issues in recent years, and are increasingly embracing the concept of fiduciary management. While it is estimated that over 30 per cent of total UK pension scheme assets are managed in this way (and we only expect this to increase), the equivalent figure for charities is much lower.

Better governance = better value

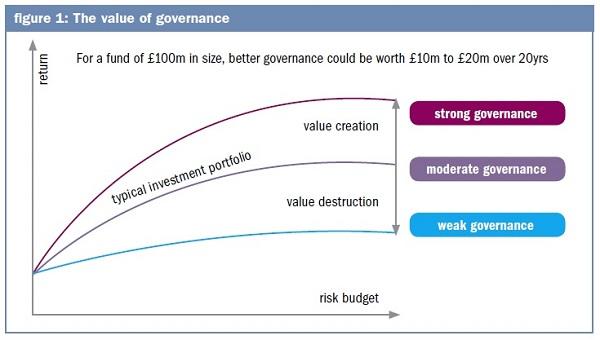

It makes logical sense that improving the investment governance should lead to better outcomes, and ultimately provide the best chance of achieving the investment objectives. Conversely, having weak governance can potentially destroy value relative to a typical low-cost investment approach (see figure 1). What is less clear is how much better or worse those financial outcomes might be.

Although measuring the positive return impact of increasing governance capabilities is not straightforward, major studies point to a positive correlation, with a return boost of between half and one per cent each year from enhanced governance.

So what could a fiduciary manager do for me?

The fiduciary management model is comparable to that of a business corporation. The corporate board sets the direction for the business, while the management team takes responsibility for the operational aspects of executing the agreed strategy.

In this analogy, a fiduciary manager takes the role of the management team, responsible for a number of activities within well-defined guidelines and to achieve objectives that have been carefully set by the trustees.

A fiduciary manager may, as part of their remit to execute the trustees’ agreed investment strategy, take responsibility for some or all of the following:

- Asset allocation: The allocation over time of funds to different asset classes and sub-asset classes. This will change over time as economic conditions vary.

- Manager selection: The selection and replacement of the underlying managers, ensuring changes are made quickly.

- Negotiating lower fees: Using the combined assets under their management, a fiduciary manager can secure lower management fees than a single investor acting alone. Charities can therefore benefit from the bargaining power enjoyed by larger funds.

- Access to new opportunities: The expertise and scale of a delegated manager makes it possible to invest in opportunities which would not be accessible to most charities.

- Monitoring: A fiduciary manager will assess the risk and return of the underlying investments using their own substantial research resources, and report to the trustees on an ongoing basis.

- Day-to-day management of investments: This covers the heavy-lifting administrative tasks required to manage a diversified portfolio, which require both scale and expertise.

Allowing a fiduciary manager to take on some of the governance burden gives the trustees more time to focus on the key strategic issues and long-term goals of their investments. Crucially, accountability for the investment strategy remains with the trustees. The implementation of the investment strategy is however professionalised via delegation to the fiduciary manager. Research indicates that the separation of the governing and execution functions in managing investments is the single biggest influencer in going from good to great. Through delegation, the trustees are now able to invest like a mega fund, and reap similar benefits.

While this may sound like a radical change, most charities already employ some form of delegation by hiring investment managers to choose their equities and bonds. Using a greater degree of delegation frees up time and resources previously spent on other tasks such as manager selection, in order to focus on the strategic issues and oversee the performance of the investments. For charities that find themselves restricted in time and resource, this can be invaluable.

Sustainable investing and fiduciary management

Successful long-term investment outcomes are not just about meeting the return objectives but also how these are achieved. Sustainable and responsible investment is at the heart of this and fundamental for many charities – a fiduciary manager can drive this agenda due to their scale and through adherence to the following principles:

- The integration of environmental, social and governance (ESG) factors into the investment process.

- Effective stewardship and responsible ownership practices.

- The recognition and management of long-term investment horizons.

- Ensuring future commitments are not compromised by meeting short-term goals.

While charities will potentially delegate some of the management of their investments, this does not remove the responsibility to ensure investment returns are generated in a sustainable and responsible manner. Requiring fiduciary managers to be signatories of recognised codes, such as the United Nations Principles for Responsible Investing (UNPRI) and the UK Stewardship Code, should be a requirement from trustees.

Going from good to great

Previously a well-resourced, dynamic and fee-competitive approach to investment was the privilege of the largest investors. Fiduciary management now offers investors of all sizes the opportunity to adopt an enhanced approach akin to the largest funds.

This means that, while the investment environment is as challenging and uncertain as ever, in answer to David Swensen, these days you no longer have to tackle this alone.

Duncan Higgs is a senior investment consultant at Willis Towers Watson

Civil Society Media wishes to thank Willis Towers Watson for its support with this article