ESG stands for environmental, social and governance and an analysis of these three factors is a way of assessing whether or not a company is socially responsible and, therefore, suitable for inclusion in a socially responsible investment (SRI) portfolio. Some companies have recognised, and responded to, the fact that these values are important to the end customer and, as a result, have placed a great deal of emphasis on these values in their conduct and day-to-day management. Aligned with this, investors have started to reward companies that either score highly from an ESG perspective or are on an improving trend, and penalise companies that fall short. We believe that assessing ESG factors will become the norm for all investment houses in the future, and will not be used solely in the analysis of companies for investors with a more ethical mindset.

There long has been a requirement for ethical portfolios, where businesses that are deemed harmful from a social or environmental perspective, such as tobacco or arms, are excluded. The word ethical comes from the Greek word ethos, meaning moral character and its roots can be traced back to Methodist thinking when the church asked its followers not to invest in sin industries.

However, particularly among those for whom ethical issues are not important, there is a widely held belief that ethical portfolios underperform the wider market due to the fact that certain business sectors are excluded and, therefore, that the investment universe is narrower. Such thoughts are changing rapidly: the investment opportunities today are much broader, with whole new industries available for investment. In addition, the moral values of investors are changing, and social and environmental values are increasing in importance.

This change has led to an evolution from solely negatively screened ethical investments to positively screened socially responsible investments. It is, in part, recognition that profit and purpose are complimentary, not contradictory. Morgan Stanley in 2015 wrote: “Sustainable equity mutual funds had equal or higher median returns and equal or lower volatility than traditional funds for 64 per cent of the periods examined”.

We combine three building blocks in our SRI proposition: first, we implement the traditional negative screen, excluding business engaged in certain activities that we deem immoral. However, we also place importance on positive screening – investing in businesses that respect the values of their employees and shareholders, and which incorporate environmental, social and governance factors into their daily operations. This is a particularly significant innovation as there is strong evidence to suggest that companies with improving or high ranking ESG scores are safer long-term investments. We have also added a third dimension, known as impact investing, which we define as investments made into companies, organisations and funds that generate a measurable and beneficial societal impact alongside a positive economic return.

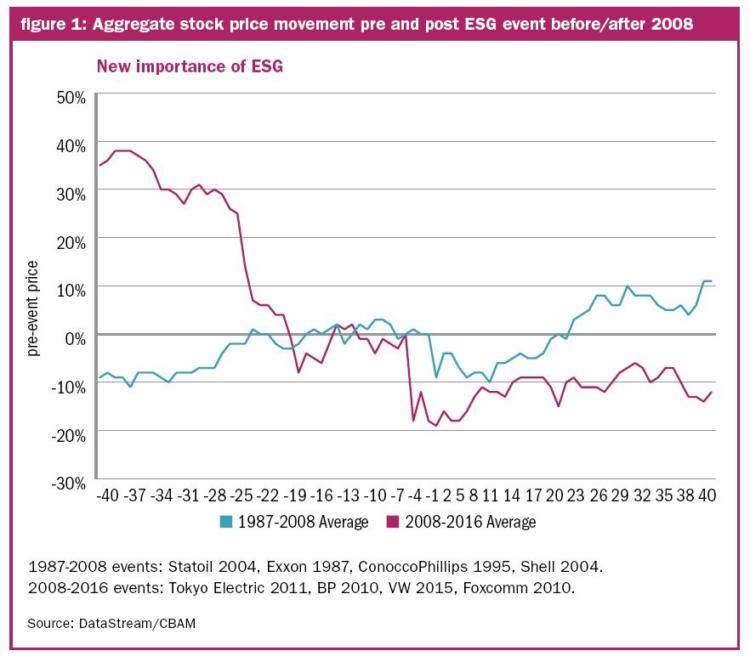

Our guiding investment principles are to maximise long-term returns at an appropriate level of risk. We look at the ESG values of all the companies in which we invest as part of our normal research process, because we believe it can be an important determinant of the future prospects of the company, and we do this regardless of whether there is an ethical or socially responsible element to the portfolio. We believe there is a strong correlation between the way companies behave and are run, and the longer-term performance of the share price.

Our own research shows that the average decline of a company which suffers an ESGrelated event has been approximately -35 per cent since 2008. Recent examples include the Macondo disaster at BP and the emissions scandal at Volkswagen.

Our analysts assess the ESG values of each investment in their universe, considering the company’s position relative to its peers in the sector.

Figure 2: Impact theme – climate action: electric vehicles and cyber security

German company, Infineon, is one of the global leaders in sensors and software used in autonomous and electric vehicles. China is forcing auto makers to accelerate production of electric vehicles by 2019 and 12 per cent of all vehicles produced must be either electric or low emission by 2020. China is leading the way, but in the UK, electric vehicles will overtake gas/diesel by c.2033 and, by 2040, 80 per cent new car sales in the UK will be electric vehicles.

Infineon reuses 66 per cent of its waste. The company saves more energy than they use during production, saving 52.4m tons of CO2 over the life of the company. Infineon, through its smart card and security division, is also a leading provider of security solutions. Infineon’s technologies help reduce the effects of climate change by driving energy efficiency and utility fuel switching. They are also improving lives through cyber security.

Infineon ranks in the top quartile versus its peer group. On Bloomberg, Infineon scores better in overall environmental, social, and governance categories than its peers. Its carbon intensity (GHG/revenue) is low, driving its strong environmental score. Its workforce and board outperform the median of its peers in terms of female diversity, driving its social and governance scores.

Within our SRI portfolios we invest only in companies with either a high relative score or with a score that is on an improving trend. The research is carried out on a sector basis because different factors are important in different industries. For example, water usage in the consumer sector is significant and, therefore, is assigned a high weighting in importance in the calculation of the overall ESG score for companies in that sector.

One key point of interest in monitoring ESG factors is that it encourages companies to address a wide range of issues, make themselves stand out from the competition and, most importantly, make themselves more attractive long-term investments. They are also an important risk mitigating research tool because they:

- Drive competitive advantage by engaging with all stakeholders – behaving responsibly with employees, communities and shareholders creating an attractive workplace;

- Enable companies to attract and retain good employees. The Harvard Business Review 2016 found that morale was 55 per cent better in companies with strong sustainability programs compared to those with poor ones and employee loyalty was 38 per cent better. Happy employees are more productive;

- Improve financial performance by energy saving through better management of natural resources. A PwC survey of business executives showed 73 per cent of respondents indicated cost savings as one of the top three reasons companies are becoming more socially responsible; and

- Show that sustainably driven companies drive innovation because new products are needed to meet higher environmental standards and social needs.

The third dimension of our SRI portfolios is Impact Investing. Investments which fall under this heading also conform to both ethical and ESG requirements. Our experience of impact investing encompasses companies in growth segments such as artificial intelligence, robotics and electric vehicles: long-term secular growth themes which have a positive social and environmental impact which we think have attractive return characteristics.

So how do we create a positive impact? We are modifying our stewardship code so that we take a more proactive approach to shareholder engagement, using our voice as a shareholder and exercising our right to vote to effect change or endorse the status quo. We also are providing a vehicle for private clients, trusts and charities to invest in a way that combines their philanthropic aims with their investment portfolio without sacrificing returns and to align their investments with their social, environmental and ethical objectives.

We have no doubt that this is the direction of travel for all investments in the future. The predicted demand by millennials is acute given the prevalence of social and environmental issues highlighted through social media and the importance of sustainability. Among 18-29 year-olds, 93 per cent consider sustainable investing (ie. ESG, thematic and impact first solutions) an important part of investing, and 85 per cent say their investment decisions are a way to express their social, political and environmental values, according to the 2016 US Trust Wealth and Worth Survey. But it isn’t just the younger generation: we are fielding enquiries from families, trusts and charities so this service matters to a wide-ranging audience and, we believe, it will continue to grow in importance.

Amy Lazenby is head of the discretionary management service and socially responsible investing at Close Brothers

Charity Finance wishes to thank Close Brothers for its support with this article