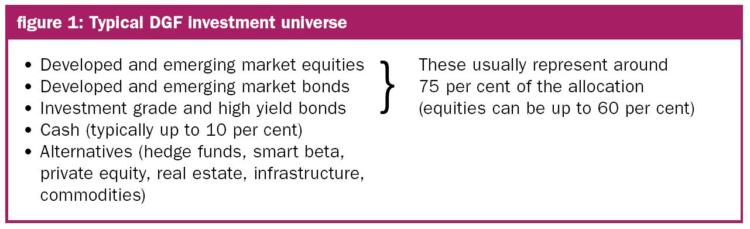

Diversified Growth Funds (DGFs) represent a subset of multi-asset funds and invest across a range of asset classes, aiming to deliver equity-like returns with lower volatility over the longterm and are typically offered via daily dealt vehicles.

DGFs gained prominence in the early-to-mid 2000s, evolving from the traditional balanced equity/bond funds. Following the financial crisis, demand for DGFs soared as investors sought effective risk management through diversification. According to the Q1 2017 CAMRA Data Report, assets under management for DGFs totalled £176bn.

These funds typically generate returns through their long-term strategic asset allocation and can combine this with active exposure management and security selection. While most DGFs invest the majority of their assets in internally run strategies, some adopt an open-architecture approach which allows them to invest in external fund managers and theoretically expand their investable universe. Through research conducted in 2015 Willis Towers Watson set out to analyse whether DGFs have actually delivered what they promised and opined on the opportunity set for these funds going forward.

What does our research show?

DGFs tend to express their performance objectives relative to local inflation or cash over a period of three to five years. Of the wide universe of funds that we analysed, the majority achieved their targets since inception. Not surprising given the strength in growth assets over this period, especially given low cash rates. On a risk-adjusted basis, we observed good results across DGFs since their respective inception dates, albeit with considerable dispersion in the returns.

Another way to assess the value-add of DGFs is by evaluating an investor’s opportunity cost of opting for a DGF over a cheap balanced fund. We analysed the performance of each DGF within our universe against a traditional balanced portfolio of 60 per cent global equities and 40 per cent global bonds, from Q1 2009 to Q3 2015, with a particular focus on the drivers of performance. We found that the average DGF performed more or less in line with the balanced portfolio over the period with the vast majority of returns being explained by equity and credit beta (market returns that can be accessed cheaply through passive funds or ETFs). There appeared to be some value-add from dynamic asset allocation but this was eroded by security selection and fees. We also found a relatively high correlation (greater than 0.6) within the universe, in other words – there was little value add in employing more than one traditional DGF manager.

What does this mean for investors?

It is important that investors scrutinise fund managers on their ability to generate alpha (returns in addition to market returns also defined as a skill premium) and the sustainability of that return generation over time, particularly as they grow in asset size.

The heavy influence of traditional equity and credit betas (market returns) in DGF returns also give us pause regarding the level of diversification that investors are accessing in these funds. This point is particularly important when we consider limited upside and greater volatility in these markets going forward.

High correlation across DGFs also implies that many funds have similar exposures and investment approaches. While this highlights a challenge for investors in finding a differentiated solution, greater competition in the market should and is leading to fee pressure across the industry.

We continue to believe that multi-asset strategies have a valuable role to play in investors’ portfolio, however, without some evolution in their structure, we believe they will find it challenging to achieve their performance objectives.

Looking forward

We continue to advocate innovation in the multi-asset industry and below we discuss some ways in which multi-asset solutions can and have evolved to provide investors with better net outcomes over the long-term, not only by way of greater diversification of exposures but also by lowering the cost of implementation.

Greater investment efficiency through smart beta strategies

Within the rich and diverse universe of alternative investments, there exist certain liquid solutions that were previously considered expensive hedge fund strategies that generated so-called alpha. The majority of this return premium can be captured in a relatively systematic manner and accessed at a much lower cost. We call this smart beta. Such investment strategies are expected to perform quite differently to traditional asset classes such as equities and bonds and are therefore useful tools for DGFs to build greater diversity within their portfolio in a cost efficient manner.

However, we caution that many managers implement smart beta in traditional asset classes such as equities and bonds. This adds limited diversity and only improves risk-adjusted returns at the margin. In many cases, smart beta strategies are accessible only through third party specialist managers. This requires a DGF manager to both adopt an open architecture model and have a strong manager due diligence resource to select the most skilled managers.

Greater diversification through alternative investments

Separate to the smart beta strategies mentioned above, there are skill-based hedge fund strategies which cannot easily be replicated and requires identifying discretionary active management skill. While this typically commands higher fees, truly skilled managers can add attractive value after costs for their investors and we believe they should be considered alongside smart and traditional betas when building a diversified multi-asset portfolio.

A segment of the alternative investment universe which typically makes up a low representation in daily dealt DGF portfolios is illiquid alternatives such as direct private equity, property and infrastructure. Illiquid alternatives can provide long-term investors with a valuable source of return which are not necessarily correlated to liquid traditional markets.

With the exception of UK defined contribution schemes, few investors need access to daily liquidity. Also, where they do need some liquidity it is unlikely to be for the majority of their investments. By maximising their illiquidity budget, DGF managers and investors expand the universe of opportunities dramatically.

Consider an open-architecture approach

In order to achieve best execution and maximise capture of the investment opportunity set, we advocate the use of best-in-class strategies and specialist managers to implement any multi-asset portfolio. We reiterate the point that managers who look beyond their internal capabilities have a better chance of being able to achieve this (subject to their manager research capabilities). There are of course additional costs and fees (which are typically passed through to investors) for both managers and investors to bear in mind.

Provide better value for money

An important factor for any investor is whether their investment provides value for money. That is, are the fees charged commensurate with the skill of the manager and how differentiated this is versus peers. Whilst we have seen fees come down in the DGF industry, we believe there is further to go, particularly for traditional active DGFs which have struggled to deliver material returns above balanced funds on a net of fees basis. Indeed, the recent creation of multi-asset index funds has somewhat met investors’ need for long-term strategic asset allocation at a much lower cost than active DGFs albeit sometimes with the acceptance of greater volatility.

Conclusions

DGF investors need to consider their options carefully as they seek to balance the often conflicting objectives of achieving optimal risk-adjusted returns and doing so at a reasonable cost. We have also highlighted some areas in which DGFs can evolve their product offerings to deliver investors better net-of-fees, outcomes be it via greater diversification through alternative investments, more efficient implementation through smart betas, and/or lower cost strategic asset allocation which is becoming increasingly competitive.

Actively managed DGFs continue to have a place in investor portfolios, with the potential to provide valuable downside protection. However, we believe greater scrutiny should be placed on managers’ abilities to add value, given the higher fees charged to ensure that downside protection is not at the significant expense of net returns over the long run. We also encourage long-term investors to recognise the limitations of daily dealt DGFs which are less able to participate in illiquid investments.

When pondering their options in this saturated DGF market, investors should venture beyond the seemingly obvious solutions and ask themselves: is there a better way?

Pallavi Aston and Alice Lee are senior investment consultants at Willis Towers Watson

Charity Finance wishes to thank Willis Towers Watson for its support with this article