Investing ethically is a choice. Charity trustees are required to “select investments that are right for their charity” and also to “decide whether to adopt an ethical approach to investment and ensure it can be justified”. The main “justification” given for not investing ethically is that it may significantly negatively impact their investment returns. This is a valid concern. Thankfully, it is one that can be easily addressed.

Now as the chief executive of an investment manager that follows a Christian ethical approach, you may well think, to paraphrase Ms Rice-Davies, “well he would say that, wouldn’t he”. So I will try to tackle the issue head-on and outline why more charities should invest ethically.

The bear case

Firstly, let’s be transparent about the facts. Investing ethically means you will not invest in certain stocks and will invest a greater proportion of assets in others. So, by definition, your performance is likely to be different compared to the wider market.

Over the last three years, investing ethically has led to an underperformance compared to the market (standard FTSE Indices) of around 1 per cent per annum, largely reflecting the strength of alcohol and tobacco stocks over the period.

For many, that is the only fact they need to rule out ethical investment. I have some sympathy for this perspective, but it reflects a lazy approach to ethics. There are ethical approaches which can combine good returns with meeting the values of the charity.

Our approach

Our investment approach is very simple. Christian ethics are at the heart of everything we do and we understand that our role is to be the steward of our clients’ money. We undertake detailed company specific research and invest in companies that are sustainable. These companies take a long-term perspective, prioritise growth over short-term profits and we believe are less likely to fall foul of regulatory changes or be caught out by corporate governance scandals.

We also rebalance our portfolios at an economic level – avoiding one of the pitfalls of some ethical approaches. These typically invest a greater amount in all ‘included’ stocks, which can lead to unintended consequences eg. overweight financial stocks and underweight non-cyclical stocks.

Another factor I would highlight is engagement. The benefits of this can be seen very clearly in an area that is increasingly important to our clients - climate change. Exiting all fossil fuel related stocks is one approach that is advocated – but it is not our way. We undertake extensive research, looking at each company on a case by case basis – with one key criterion in mind – do they now, or will they, comply with the Paris Agreement (effectively to respond to the global climate change threat by keeping a global temperature rise this century well below 2 degrees Celsius). If we feel they are not focused on meeting the Agreement, then they will be excluded (eg. Glencore, Tullow Oil).

Some companies are responding well to engagement. Shell has produced their “Sky Scenario” which illustrates “a challenging pathway for society to achieve the goals of the Paris Agreement”. The important thing at this point is that they are being transparent about their emissions and are showing they are serious about trying to achieve the Agreement’s aims. Much work remains to be done. But we are comfortable that we are on the right path and that our engagement is key to the long term performance of our portfolios.

So what does all this mean for performance?

Ultimately, ethical or otherwise, investment mangers get judged by their performance.

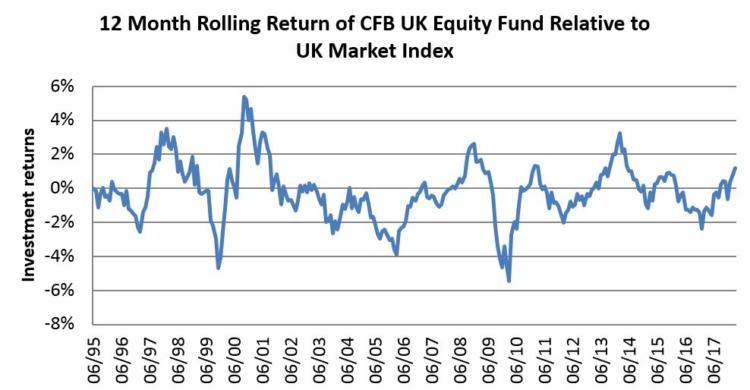

At a recent charity conference I shared the slide below, which highlights the performance of our sister organisation’s (The Central Finance Board of the Methodist Church) UK Equity Fund since 1995. Like most equity funds, its performance has been volatile. However, it has outperformed the stock market over the long term, despite around 15 per cent of the UK stock market being excluded on ethical grounds. So our approach seems to be working.

The cherry

The recent well reported address by Baroness Stowell, the new chair of the Charity Commission, raised some eyebrows among charities. She stated that the public trust charities “no more than they trust the average stranger they meet on the street”. That is not encouraging.

Increasingly charities are coming into focus for how they conduct their affairs. Expectations are changing and their staff, supporters and the media at large will question how they operate. This I believe will increasingly extend to questions about their investment choices.

The focus on performance is understandable but it is not the full picture. Charity trustees also need to consider the charities long term reputation. Ethical investing will help them address many of these reputational concerns and show that they are taking both the need for investment returns, and the need to have a positive impact on society, seriously.

The two are not mutually exclusive.

Enjoy your cake.

David Palmer is chief executive of Epworth Investment Management Limited.

This is an advertising feature.

Related articles