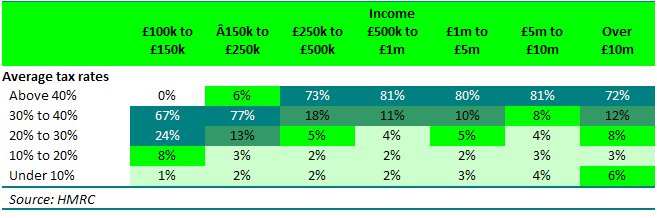

The Treasury has published data showing that some of the UK’s wealthiest citizens pay as little as 10 per cent of their income in tax by claiming tax reliefs, as its seeks to justify its plan to limit the amount of reliefs they can claim.

The Treasury said the figures clearly illustrate the importance of the principle behind the cap, “showing that people earning £20,000 pay a higher rate of tax than some people earning millions”.

“Data like this hasn’t ever been published before,” it said. “By making it available, the government is shining a light on the way the current tax system works and demonstrating a clear commitment to creating a fairer system.”

The published figures show that while the vast majority of high earners do pay at least 40 per cent of their incomes in tax, a minority use various tax reliefs to slash their tax bills.

Consultation in the summer

The government also said today that it would launch a formal consultation on the proposed cap in the summer. NCVO said this was "old news" and would come too late.

Public and backbench discontent

Meanwhile, a YouGov survey of 1,650 adults on 12 and 13 April commissioned by the Sunday Times found that 60 per cent agreed that charitable donations should be excluded from the new limits. A quarter said tax relief on donations should be capped, while 15 per cent didn’t know.

And a poll of 71 Conservative and Liberal Democrat MPs commissioned by Charities Aid Foundation and conducted by ComRes, found that 65 per cent supported exempting charitable donations from the cap. Some 68 per cent said the government should review the proposal.

Philanthopists added their own voices to the clamour, with 46 major donors and foundations signing a letter to the Sunday Telegraph opposing the cap. The signatories, who included BodyShop founder Gordon Roddick, Localgiving.com founder Marcelle Speller and three members of the Sainsbury supermarket family, described the proposal as “confusing and dispiriting”, and urged the government to think again.

Concessions being considered

Various media outlets were today claiming that government sources were hinting at a climbdown over the issue.

The FT claimed the Treasury was considering a separate tax relief limit for donations, or the possibility of allowing donors to ‘roll over’ unused tax reliefs into future years.

The Today programme suggested the Treasury was considering introducing a system of lifetime legacies in order to compensate charities for the losses they would sustain because of the cap.