New research from Sheffield Hallam University which explores charities’ compliance with the legal requirement to report on their public benefit has found that nearly half failed to submit a properly-approved Trustees’ Annual Report to the Charity Commission last year.

And only 11 per cent fully met the statutory public benefit reporting requirements.

The study, which was commissioned by the Charity Commission, exposes the full extent of the sector’s failure to stick to the law and its laissez-faire approach to regulation.

One participant even said: “We flagrantly disobey our objects”, having been refused permission from the Charity Commission to change them. And he added: “I don’t care. So now we are consciously doing work outside our objects. The trustees have not got time to bugger around with all this – we have other things to do.”

The researchers reviewed 1,402 Trustees' Annual Reports (TARs) and held talks with 30 charities. It was not a random sample – larger charities were included proportionately more than small ones.

Public benefit reporting (PBR) comprises two requirements within every charity’s TAR: the charity must explain what activities it undertakes to further its purposes for the public benefit, and it must state whether the trustees have considered the Charity Commission’s guidance on public benefit.

The PBR requirement took effect from financial years on or after 1 April 2008 so by January this year all charities should have published at least one TAR that includes PBR.

For charities in the highest income bracket – over £500,000 – a quarter fully and clearly met the reporting requirement. This fell to 10 per cent for charities with income between £100,000 and £500,000 and just 2 per cent of those with incomes below £100,000.

A number of charities came close to meeting the requirements but “lacked some clarity or completeness”. They comprised 67 per cent of those in the highest income range; 36 per cent in the £100,000 to £500,000 band; 15 per cent of those between £25,000 and £100,000 and 13 per cent of those under £25,000.

Nearly one in ten charities submitted no TAR at all

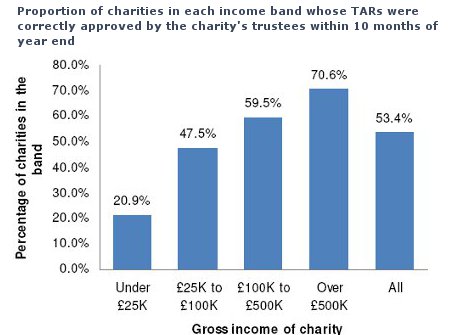

But perhaps the most startling finding was that 8.9 per cent of charities submitted no TAR at all, and overall, only 53 per cent of the sample had a properly-approved TAR. “We found several cases where charities had given much more effort to a non-statutory annual review than they had to their formal Trustees’ Report,” said the researchers.

Larger charities were better at compliance – just over seven in ten of the largest charities did have properly-approved TARs, whereas just 20.9 per cent of the smallest charities did (see above chart).

And where TARs were submitted, they often contained descriptions of many other activities that did not count towards PBR, such as fundraising events or staff or trustee meetings.

Other findings were that among charities with income above £25,000, 9.7 per cent had no independent scrutiny of their accounts despite the requirement to have either an audit or an independent examiner’s report, and a further 4.5 per cent had scrutiny reports which did not comply with the law.

The proportion of TARs considered to contain a clear explanation of the activities undertaken by the charity to further its aims for the public benefit ranged from 7.6 per cent in the smallest charities to 55.8 per cent for the largest. Overall it was 30.9 per cent. And only 51.5 per cent had a clear understanding of who the charity’s beneficiaries were.

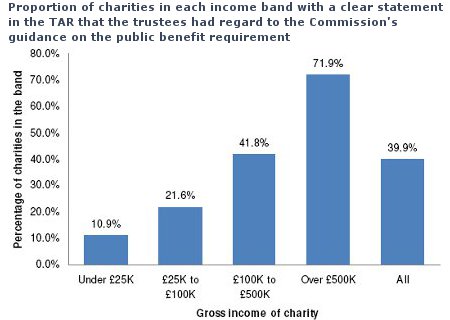

Respondents were no better at the second PBE requirement, that of including a statement in the TAR stating the trustees had considered the Commission’s guidance (see chart to left).

Across the whole sample, the researchers found 11.5 per cent of charities were judged to have met the full legal requirements on PBR, including 2 per cent that were considered excellent. A further 23.8 per cent came close – so just over a third fully or nearly met the requirements.

|

Housing charities the best at PBR

Housing charities scored the best, while organisations with ‘general charitable purposes’ fell down the most (see chart to right). But no sub-sector had more than one in five charities that fully complied.

Charity Commission chief executive Sam Younger (pictured) sought to accentuate the positive, saying it was “encouraging that overall progress has been made” in relation to PBR. He went on to say that it is not surprising that some trustees have not complied, because it is a new requirement and may take charities “some time to adapt”.

He added that charities are generally good at explaining what they do and who they help but not so good at explaining how they do so.

The Commission said it would be reviewing its public benefit guidance later this year.

On the wider issue of reporting compliance, the Commission said it sends charities several reminders each year to file their documents on time and within the ten-month deadline.

Click here to read about how well fee-charging charities are meeting the public benefit requirement.

Click here to read the Charity Commission’s own analysis of the Sheffield Hallam report.