Just over 7,500 charities missed last week’s deadline to file their annual accounts or annual return with the Charity Commission.

Charities with financial years ending on 31 March – the majority of the sector – needed to file their accounts and annual return with the Commission by 31 January.

Currently 7,198 charities with a year end of 31 March are overdue, while approximately 400 missed the deadline but have filed within the last week.

This is an improvement on last year when 10,818 missed the deadline.

Of those, over 2,000 have still not filed accounts.

Over half of those that missed this year’s deadline are charities with a legal requirement to file annual reports or accounts – those with an income over more than £10,000 and all charitable incorporated organisations.

Charities which are in administration, such as Kids Company, also show up in the figures, but they are not able to file.

Late filers highlighted on register

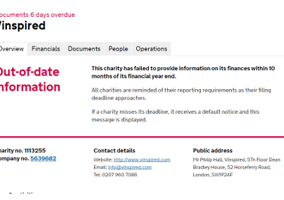

Every year the Commission runs a public campaign to encourage charities to file on time and tried to contact all charities with a filing day of 31 January ahead of the deadline. The Commission highlights any charity with overdue accounts on its public register.

At the moment the register reports that there are 16,000 charities that have out of date documents. This includes charities for whom the deadline is not 31 January. Of these, 244 have incomes over £1m. The vast majority - over 14,000 - are those with incomes of under £100,000.

There are 20 charities with incomes over £10m, which have overdue documents. Fourteen of these had filing dates of 31 January 2017.

Among the largest charities not filing accounts are Lifeline Project and Broadcasting Support Services, which are in administration, and the Garden Bridge Trust, which has said it will close.

|

Related articles