A study by the University of Oxford has found there is little evidence to suggest that social impact bonds lead to better outcomes than other commissioning models.

The report, Social Impact Bonds: The Role of Private Capital in Outcome-Based Commissioning, is based on four case studies: the Essex Multi-Systemic Therapy (MST) SIB, the Merseyside New Horizons SIB and two London Homelessness SIBs.

It found that within these contracts, presence of private social investment appeared to stifle the autonomy of third sector service providers to innovate and deliver according to their social mission.

Responsiveness of the service provision was improved through the SIB model but the report says this ran the risk of encouraging gaming of the results.

The report also concludes that SIBs appear to involve the replacement of state regulation with management by the private investors.

It warns that too much control over contracts by private investors is likely to exacerbate challenges already encountered through more conventional payment-by-results contracting.

“Due to their infancy, it remains unclear whether and under what circumstances SIBs might be considered appropriate or suitable within the broader context of public service reform,” the report says.

“To moderate some of the idealised claims surrounding SIBs, further critical and independent consideration is needed to establish the relative role and significance of private capital in outcome-based commissioning.

“Without this and evidenced effects of improved and sustained social outcomes, the public sector runs the risk of paying increased transaction costs associated with private social investment without realising the putative benefits offered through the SIB model.”

See in Charity Finance

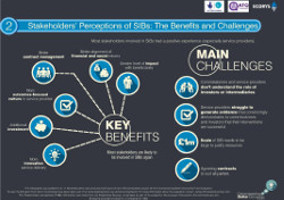

SIBs have been a controversial measure since their introduction by the previous coalition government in 2010.

While they transfer the financial risk of a social investment being unsuccessful from the government to an independent philanthropist, they are arguable more expensive that other funding mechanisms due to a need for results to be measured.

With government funding only paid when an intervention meets certain outcomes, some in the sector have questioned whether social benefits achieved by social investment schemes can be measured.

There are 32 SIBs in the UK, with an average contract value of just under $6m (£4.8m) and an average investment of just over $1.5m.

Last July, the government launched its £80m Life Chances Fund to underwrite more social impact bond funding.

Related articles