Garfield Weston Foundation saw its investments grow by 16% last year, according to recently filed documents.

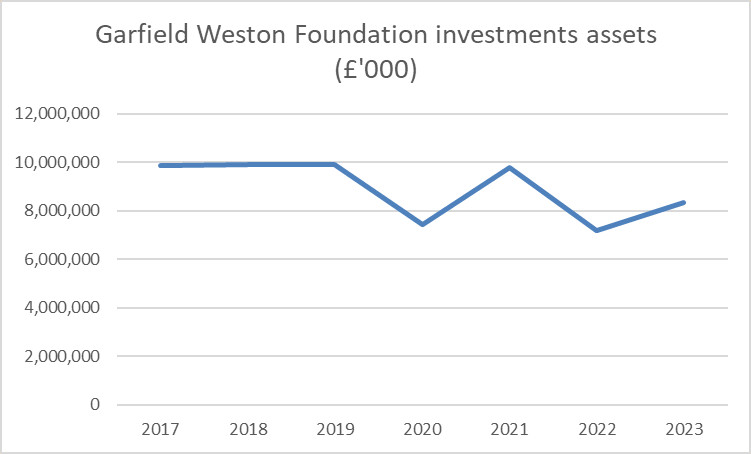

Its financial accounts for the year ending 5 April 2023 show that its fixed asset investments increased from £7.16bn to £8.33bn.

This makes it the third-richest charity registered with the Charity Commission after Wellcome, which most recently reported £40.3bn in long-term investments, and the Church Commissioners for England, which reported £9.67bn.

Investments ‘continue to fluctuate’

The foundation’s latest report states that its trustees are satisfied that the trust’s investment structure “remains a sustainable long-term model” in “providing a regular and reliable income stream” for it.

It was created in 1958 from the endowment of Canadian businessman Willard Garfield Weston, who created the trust with an endowment of his shares in Associated British Foods Wittington Investments.

“The value of the group of companies (which is directly attributable to the share price of Associated British Foods) continues to fluctuate in line with equity markets generally, but the trustees remain confident that any such fluctuations will not have a lasting effect on their ability to provide support to grant applicants”, the accounts read.

Grants increase

Garfield Weston Foundation awarded 2,147 grants worth £91.1m in 2022-23, compared to £89.8m the previous year.

The trust said it would take into account its level of total income reserves when assessing its grant-making for the next year.

It ended the 2022-23 financial year with total income reserves of £24.1m, the same as the previous year.

“The foundation will continue to do its best to react to the changing needs of the charitable sector and to provide support where it is most needed and can most effectively be utilised to make a difference,” its accounts read.

“The trustees will continue to maintain our ability to respond promptly and effectively to the requests in support of a broad range of charitable causes, relying upon the consistent performance of the foundation’s investment endowment and prudent income reserves.”