Due to exceptional demand, we are launching a second annual Charity Finance Investment Forum & Dinner on the 4-5 December 2023.

The Winter edition will follow the same format as the spring event.

The pre-forum reception and dinner provides the perfect setting in which to network with peers from other charities. This is complemented by a full day's programme of expert sessions giving insight analysis into a range of investment strategies and crucial investment topics.

Designed for finance directors, chairs, trustees and chief executives responsible for investment portfolios, the forum helps charities shape their strategies and maximise returns.

The Charity Investment Forum is an invitation only event for charities with investment assets in excess of £5m. If you are interested in attending, please contact our events team via email at [email protected]

What to expect at the Forum...

- Welcome drinks reception

- Formal three course dinner

- After-dinner networking reception

- A choice of 16 expert sessions

- Opportunity to network with leading sector professionals

- A complimentary room and access to venue facilities

Programme

Monday 4 December

| 15.00-17.00 | Arrive and check in | |

| 17.15-18.20 | Networking drinks reception | |

| 18.20-18.30 | Welcome address: Matthew Nolan, chief executive, Civil Society Media | |

|

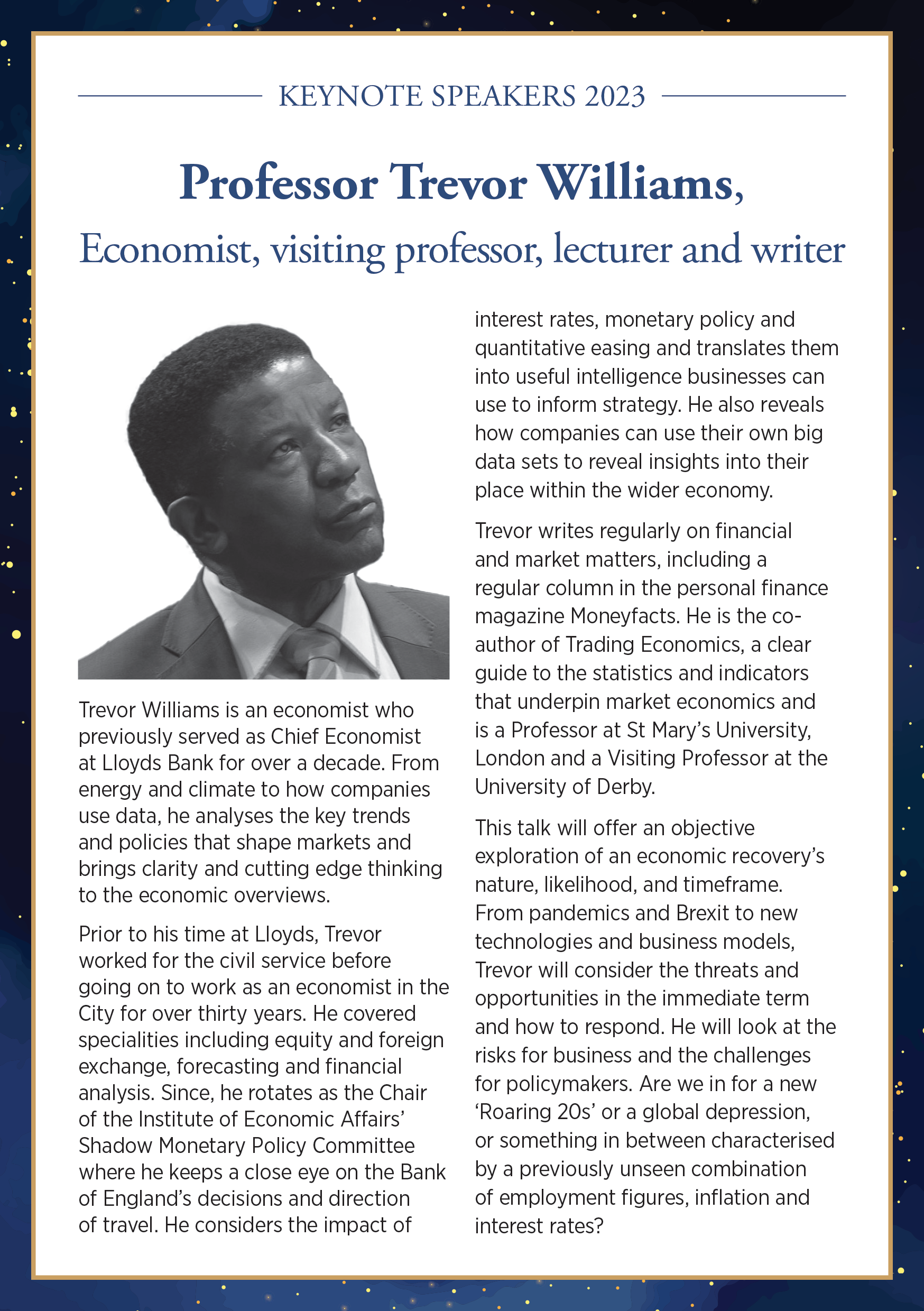

Opening keynote: Recovery Prospects This talk will offer an objective exploration of an economic recovery’s nature, likelihood, and timeframe. From pandemics and Brexit to new technologies and business models, Trevor will consider the threats and opportunities in the immediate term and how to respond. He will look at the risks for business and the challenges for policymakers. Are we in for a new “Roaring 20s” or a global depression, or something in between characterised by a previously unseen combination of employment figures, inflation and interest rates? Profesor Trevor Williams, former chief economist, Lloyd’s Bank |

|

| 19.00– 21.00 | Dinner | |

| 21.00- close | Informal networking |

Tuesday 5 December

| 07.00– 08.30 | Breakfast |

| 08.30 – 09.10 | Workshop choice 1 |

| 09.20 - 10.00 | Workshop choice 2 |

| 10.00 - 10.40 | Refreshment break and networking |

| 10.40 - 11.20 | Workshop choice 3 |

| 11.30 - 12.10 | Workshop choice 4 |

| 12.20 - 13.00 | Workshop choice 5 |

| 13.15 - 14.30 | Lunch & networking |

| 14.30 - 15.00 |

Closing keynote: The robots are coming – or are they? Artificial intelligence is poised as the biggest opportunity for transformation but also the biggest risk to humanity. This session will focus on the reality and the risks of artificial intelligence, busting common myths and offering plenty of time for Q&A. Dr Daniel Hulme, leading AI entrepreneur and academic |

| 15.00 | Event close |

Workshops

W1: You can’t always get what you want, but you might find you get what you need

What returns can investors expect from multi-asset portfolios? This session offers some historical, empirical and fundamental perspective.

Ben Funnell, head of investment Solutions, CCLA

W2: A new world order

This session will explore some of the big picture trends shaping a more volatile investment era for charities.

Ajay Johal, investment director, Ruffer

|

W3: Climate Confident: Charity investments and net zero This session will cover the findings from Cazenove’s latest research, which highlights a groundswell of concern and action by charities around climate change. Over three-quarters of the survey respondents believe that charities should be making commitments to act, however only 54% have done so to date. While charities recognise the importance of addressing climate change to help achieve their charitable objectives, many are looking for more guidance on how to incorporate their climate commitments into their investment strategy. This session will outline the actionable steps charities can take to get started and will include case studies from organisations that have already set a net-zero strategy. Emily Petersen, portfolio director and Tom Montagu-Pollock, co-head of charities, Cazenove Capital W4: Engaging with the engagers Charities place significant trust in their investment managers to invest responsibly on their behalf, and this includes the way in which they engage with the companies they invest in. In this session, we will explain how an outcome-focused engagement approach in the form of purposeful dialogue can be key to adding value or reducing risk. We will also consider how you can ensure that your investment managers are engaging effectively, and the key questions you should be asking. Sarah Dickson, Head of charity business development and Sakshi Bahl, Head of sustainability research, Newton Investment Management W5: What’s the money for? – spending decisions in an era of high inflation. Inflation has robbed us of our spending power, and recent investment returns have felt lacklustre. In the long run, real market returns will bounce around a long-term average, but trustees serve for a shorter-specific-segment of that arc to the long term. There is building pressure on trustees to choose between the needs of today and the needs of the future. This interactive workshop will be led by two investment practitioners who are experienced trustees. Covering the high-level theory on sustainable spending levels, it will focus on the decisions available to trustees. Should they increase risk to generate more return? Reduce expenditure to replenish buffers? What stops them from spending rainy-day-funds when it’s pouring outside? Participants are encouraged to share their experiences and views. Laurence Gagen, senior investment manager and head of charities, and Miranda Richards, senior investment manager, LGT W6: ESG and the new era of economic uncertainty This session will consider how the new era of economic uncertainty might change the emphasis within ESG investing for charities. Macro events such as the war in Ukraine, which disrupted global supply chains for energy, and changed the conversation on climate change, has challenged charities and their investment managers. How do charities work with their investment managers to maximise investment returns but remain responsible. How do they continue to meet their charitable goals while remaining aligned with the recently updated CC14 guidance? In this increasingly complex financial landscape, this session will explore the different routes charities can take and the role of their investment manager. Nicola Toyer, head of charities, and Michael Turner, senior investment director, Investec W7: An ESG Carol – the ghost of sustainable investment past, present and yet to come In Charles Dickens’ classic novella, A Christmas Carol, an elderly miser Ebenezer Scrooge is visited by the spirits of Christmas Past, Christmas Present and Christmas Yet to Come and - after this journey of self-realisation – rediscovers the true meaning of Christmas to become an all-round better man. In this session, a middle-aged miser will explore the past, present and future of sustainable investment. Through this revelatory journey, he will show how the industry has got a little lost and stopped delivering what charities really need and discuss what we need to do together to get back on track before it is too late. James Corah, head of sustainability, CCLA W8: Portfolio construction in a new regime Alternative and unconventional assets could be of importance in helping charities to protect capital in a more volatile investment regime. Ajay Johal, investment director, Ruffer W9: Investment policy health check After several years of consultation, a court case and various delays, the Charity Commission for England and Wales published updated investment guidance in August. In this session we will look at the practical implications of the new guidance alongside broader charity investment trends including spending, set against persistently high inflation and expectations that rates will need to stay higher for longer, as well as opportunities when investing for the long term. Tom Montagu-Pollock, co-head of charities, Cazenove Capital W10: Reflection point: Findings from the 2023 Newton Charity Investment Survey After a year characterised by considerable volatility for the charity sector, 2023 has seen a continuation of the challenging backdrop, resulting in some divergence in how charities are approaching the world. With ten years of findings, the Newton Charity Investment Survey has uncovered unique industry insight and trend comparisons. In this session, we will reflect on the greatest concerns facing charities, and will consider how they have adapted to these challenges, so that you can discover how aligned your investment experience and intentions are with those of your peers. Rorie Evans, Head of charity clients and Lucy Hyams, Client director, Newton Investment Management W11: Engagement and the power of relationships – it’s about time Do companies really listen to their shareholders? As a charity is your voice heard? This session explores the role of engagement in your charity investment portfolio and the questions you should ask your asset managers. We will discuss the importance of time and how a long-term mindset is essential to open doors and influence outcomes across the world. Through case studies, we will explore the benefits of that engagement and how you and your charity can have a part to play in influencing companies for the better through your investments Seb Petit, investment specialist, Baillie Gifford W12: ESG masterclass: using ESG to drive value This session will use real life company case studies to demonstrate how ESG can be integrated into financial modelling, with the goal of driving stronger investment returns for charity investors. Olivia Lewis, charity investment advisor, & Mike Topley, head of sustainable portfolio management, Barclays Private Bank W13: In your interest At a time when interest rates are (finally!) offering investors more options for their short-term reserves, how can trustees maximise returns on these assets while not taking their eyes off their longer-term investments. Oliver Jones-Davies, director, client investments and Sidhant Mehta, fund manager, CCLA W14: How can charity capital shape the future? Many charities have a very long-term time horizon. What matters to you and your organisation when you look out over the next five, 10, 20 years? What role can your capital play in developing future innovations that will shape the world in which we live? This forward-looking session looks at those opportunities that are challenging the status quo and providing solutions to some of the biggest problems we face, whether that is climate change, social inequality, or access to healthcare. Diana Philip, investment specialist, Baillie Gifford W15: 60:40, 80:20 or something else? This session will explore, review and challenge the concept of a diversified portfolio for long-term investors. We will share our latest capital market assumptions and long-term risk and return estimates for major asset classes, and discuss how charity investors can think about their asset allocation. Nandu Patel, head of charities and investment consultants, & James Twigden, charity investment advisor, Barclays Private Bank W16: Can your charity’s equity investments impact society and the environment? In this session we will explore some of the ways in which charities could use their equity investments to broaden societal and environmental impact, while furthering the charity's own mission, including:

Andrew Pitt, head of charities, and Gareth Pearl, investment director, Rathbones W17: Making an impact with private markets The number one aim of any charity is to make an impact on their beneficiaries. It is therefore imperative that all aspects of a charity’s operations are structured to maximise their impact. This is no more true than in their investments. This session will discuss the impact an allocation to private markets can have on the long term expected returns of portfolios as well as discussing how, in order to truly access impact investing, an allocation to private markets is a must. Russell Hooper, charity investment counsellor, and Emma Cory, alternatives specialist, HSBC W18: The impact of inflation in a low return environment This session will discuss how charities should manage their reserves in a world where spending rates are matching if not exceeding the rate of return they can achieve on their investment portfolio. It will evaluate whether we should rethink the traditional 60% equity, 40% fixed income portfolio, and consider the role that alternatives and less liquid investments might play. Christopher “Kif” Hancock, international CIO, Brown Advisory |

Testimonials from Spring 2023

- Excellent opportunity to network. Interesting, informative and thought-provoking. - Andrew Wimble, D'Oyly Carte Charitable Trust

- Opportunity to meet with peers in the 3rd sector and to have a professional overview of the sector / market at the current time and moving forward. - Okehampton United Charity

- A brilliant opportunity to step back and think about your investment strategy and consequences of your decision making. - Nicholas Bull, The Queen's Nursing Institute

- An excellent opportunity to hear differing investment houses' views on current and developing topics. The in person networking with others in this field is invaluable. - Sheffield Church Burgesses Trust

- Gaining lot of insights from the event and it's a good opportunity for networking. - Doris Yuen, Lionheart

- An excellent event for Charity Trustees with investment responsibilities - Gary McKenzie, IMarEST

- Very good event that enables participants to gain knowledge from peers and their fund managers to assist in managing finances better - Paddy Zervudachi, Buttle UK

- Excellent event with first class presentations from the fund managers - John Story

- I was not quite sure what to expect from the event. I presumed it was going to be a hard sell from potential fund managers but in reality, it was a series of really interesting talks and discussions. Not to mention the great setting for the event. If I am able to come again, I would get there early to take advantage of the venue, not much spare time once the programme started! Thanks to the team who planned and managed a really interesting couple of days. - Richard Corbett, Hampshire and Isle of Wight Air Ambulance

- Excellently planned and executed with stimulating company and presentations. - D'Arcy Myers, Smallwood Trust

- I really enjoyed the event and found the content really helpful - HAC

- Enjoyable and proves F2F events still have relevance in the post Covid world - Michael Vlasto, Fishermen’s Mission

- Very enjoyable, valuable, and worthwhile. - Andrew Wauchope, The Solicitors Charity

- A wide spectrum of presentations from very different perspectives, from investment managers at all levels - something for every type of charity, and some outstanding eye-opening visions of possible future developments - Virginia Salter, Chair, SBA/The Solicitors’ Charity

- Excellent opportunity to meet with like-minded people, facilitated in an easy and comfortable manner as a result of the superb organisation skills of the Civil Society team. - Paula Kelly, Dominican Sisters

- I learnt a massive amount from this event - Judith Shepherd, FSRH and Six Crown Street Endowment Fund

- Really enjoyed the event, learnt a lot from the sessions but also from the networking opportunities and a lot of thought provoking discussions were had! - Julia Megone, BHE

- Great event with great opportunities and excellent content, delivered impeccably by the civil society team. - Jeremy Godfrey, Milton Keynes Parks Trust

- Great event, which keeps you up to date with Investments. Also good to network with other charities - Tonya Goldring, Clergy Support Trust

- This is such a good opportunity to update my investment knowledge as well as meet people from very diverse charities. - East of England Agricultural society

- Excellent content and insights. Very well organised in the perfect setting - Caroline Rand, RSPCA

- Really useful and valuable opportunity to hear from a wide range of fund managers. Thought provoking workshops that added real value to my own understanding of things and gave me plenty to think about for the future. - Victoria Southwell, Triangle Trust 1949 Fund

- Very helpful event to update investment opinions. - Geoffrey Purves, ABS