A UK-based international Christian charity has been “absolutely stuffed” by a high-street bank which missold it four aggressive financial products, says a financial consultant who is representing the charity in its claim for compensation.

In January, the Financial Conduct Authority (FCA) said banks would be required to compensate customers who were misled or not given relevant information when they were sold interest rate swaps – loan protection products to guard against interest rates going up.

Charities are among the 40,000 plus small and medium-sized enterprises which have been affected by the issue. They were sold interest rate swaps on the basis that the products allowed borrowers to fix their rates and control their costs, but when interest rates fell after 2008 the ‘swap’ became very costly. Exits are also extremely costly.

Daniel Fallows, a director at Seneca Banking Consultants, which is handling claims for the unnamed Christian charity, said: “Banks have targeted some organisations as vulnerable types and really took advantage. In the Christian charity case, they were sold four aggressive products which are complex and risky; it’s certainly not suitable for charities.

“One of them is a 15-year product – it’s a ridiculous time to speculate on interest rate rises.”

Fallows added that banks in general were being very unhelpful in processing claims: “The bank has no timeframe, there is no appeal system, there has not been any guidance on what constitutes a missell. There has been absolutely nothing from the bank. They are proving very difficult to deal with.”

Fallows says he has written to the FCA about the issues.

He said that the charity he is representing feels they have been taken advantage of by the bank: “If you see the emails and presentations before they were sold the swaps, they’ve been absolutely stuffed which is not nice. At a time when interest rates have been 0.5 per cent for five years, this charity has been paying 8 per cent in interest.”

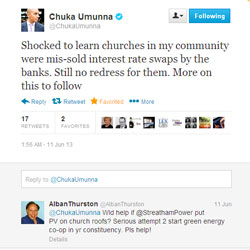

The issue has also recently attracted political attention, with shadow business secretary Chuka Umanna recently tweeting –