Big Society Capital has released details on its new tranche of investments, which includes a £10m fund to provide finance for social sector organisations competing for government contracts.

A Big Society Capital spokeswoman could not confirm who would run the fund, which will provide finance to compete for statutory payment-by-results contracts, including through social impact bond structures.

Other investments include £10m into the Impact Ventures UK Fund, managed by LGT Venture Philanthropy and Berenberg Bank, to provide growth capital to social enterprises in the UK.

Big Society Capital will officially announce all the investments, worth £37m combined, tonight at a reception hosted by the City of London Corporation, where City investors will be briefed on the social investment market.

The City of London Corporation will also be announcing its own £20m social investment fund today which will have a principal focus on London-benefit.

The announcements coincide with a new report from the Boston Consulting Group, which finds that demand in the social investment market in England could reach £1bn by 2016 – a near six-fold rise from the £165m of done social investment deals in 2011.

The report says the growth in demand is forecast to be on average 38 per cent per year, and is fuelled by a set of favourable trends including more government contracts and corporate social investment being directed towards charities and social enterprises.

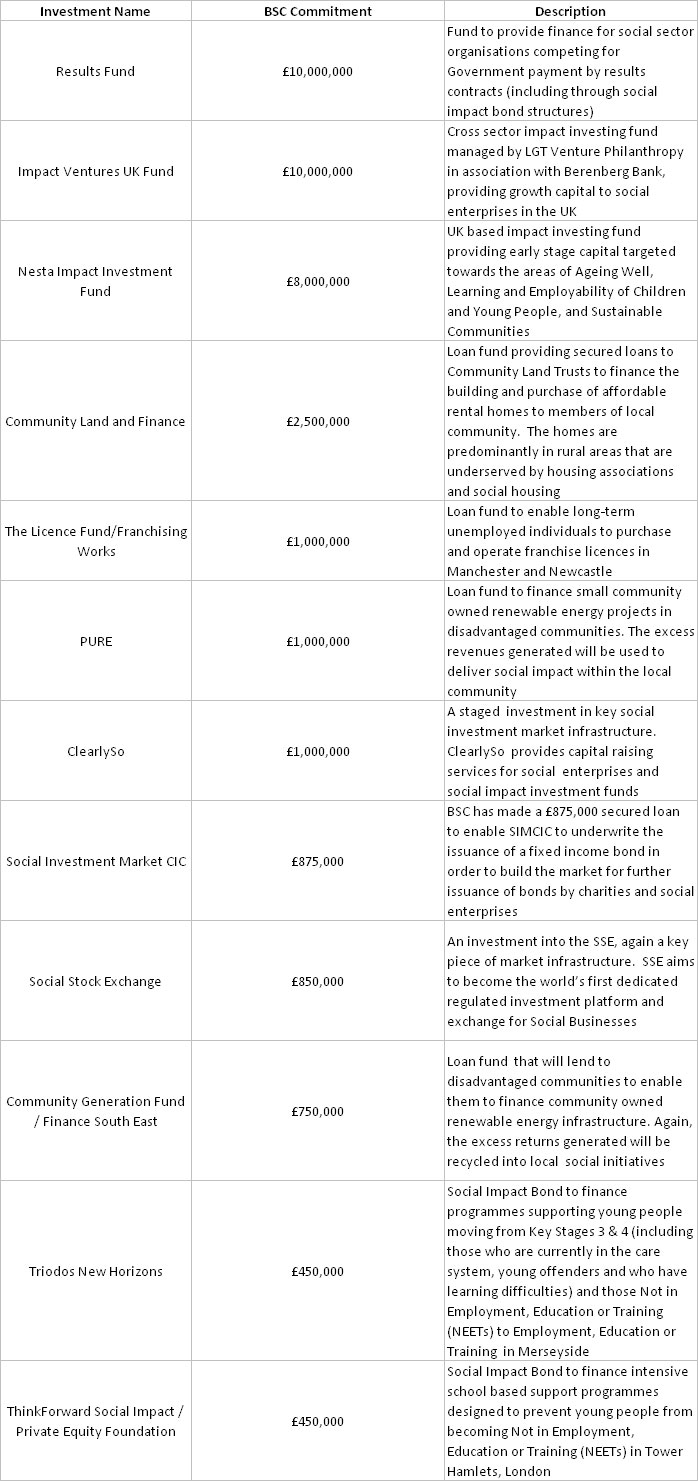

Details on all Big Society Capital’s investment commitments since its launch in April are below: