Today, we are witnessing a global movement of change that challenges the core of traditional capitalism and investing. We see this movement manifest itself in different ways. For example:

- There is an extraordinary rise in mass protest against profit-making that involves harm to people and the planet

- Shareholders are increasingly calling for businesses to divest from products and services that negatively affect people and the environment

- Investors are keen to engage actively with businesses about their environmental, social and governance (ESG) practices

- There is an increasing demand for more sustainable and solution-driven products and services that make a positive contribution to society.

A part of this movement is a call to investors not only to scrutinise their investments purely for returns measured against traditional risk models but also to consider the non-financial positive and negative outcomes of their investments.

Increasingly, investors are themselves coming under the spotlight for their investment approach and the policies they follow. As a result, there has been immense debate among trustees and executives at charities about devising and executing responsible investment policies. This is a big ask of charities given they have different characteristics, personalities and priorities.

Moreover, responsible investing has evolved in financial markets to embrace multiple meanings. Depending on who you talk to, investing in a responsible way might involve one or more of the following approaches:

- Aligning investment policy to one’s mission or values

- Commitment to ethical screening

- Investing only in businesses with good ESG practices

- Seeking out investments delivered by environmental sustainability, or Impact investing.

At Guy’s and St Thomas’ Charity, we have worked hard to define our investment approach by different layers of impact and I am pleased to share the highlights of the journey that we embarked on many years ago and continue to refine and develop today.

Focus on urban health

Guy’s and St Thomas’ Charity is one of the largest independent health foundations in the UK and we focus particularly on improving urban health. Given our place-based approach, our philanthropic work focuses on specific health programmes targeting the population of the London boroughs of Lambeth and Southwark. We focus on a small number of complex health issues, including tackling childhood obesity, slowing progression to multiple long-term conditions and addressing health problems arising from poor air quality.

Through these philanthropic activities and our work as the charity of Guy’s and St Thomas’ NHS Foundation Trust, we have put millions every year into improving health and wellbeing for the local population. Our long- term plan will see us putting around £250m over the next ten years towards improving health and healthcare in Lambeth and Southwark. We believe that our resources can be worked harder to enhance the impact of our programmes.

Sticking to values

With around £900m of assets, we have one of the UK’s largest charitable endowments, including a diversified portfolio of investments and properties. To achieve our charitable goals, we work to produce investment returns ahead of inflation so that we can spend the surplus today and allow the endowment to grow by inflation for future generations. Alongside our property, we invest in the financial markets and use the returns to fund charitable activity.

Being a responsible investor is at the heart of our endowment management. We work to minimise our investments’ potential for negative health impacts, direct or indirect. For example, we do not make any direct investment in tobacco-related shares, bonds or property and we monitor carefully to keep any indirect investments in tobacco down to the minimum (currently 0.25 per cent).

We also use investments to create health benefits, complementing the work we do through our programmes and as a hospital charity. Our aim is that our investments meet recognised ethical, environmental and governance standards, and are consistent with our values and our need to generate financial returns. For example, issues that we engage on with fund managers and businesses include:

- Diversity and inclusion initiatives

- Impact of business operations on the environment, particularly the use and impact of fossil fuels

- Behaviours of food retailers and producers in the use and marketing of sugar.

Around one third of our endowment is in property, much of it located in the London boroughs where we work. Alongside managing our property commercially, we think about ways in which it can support good health. This applies to both who uses our property (for example, clinicians and medical researchers) and how we develop it (where we increasingly look to embed principles of health, wellbeing and sustainability).

Impact investment strategy

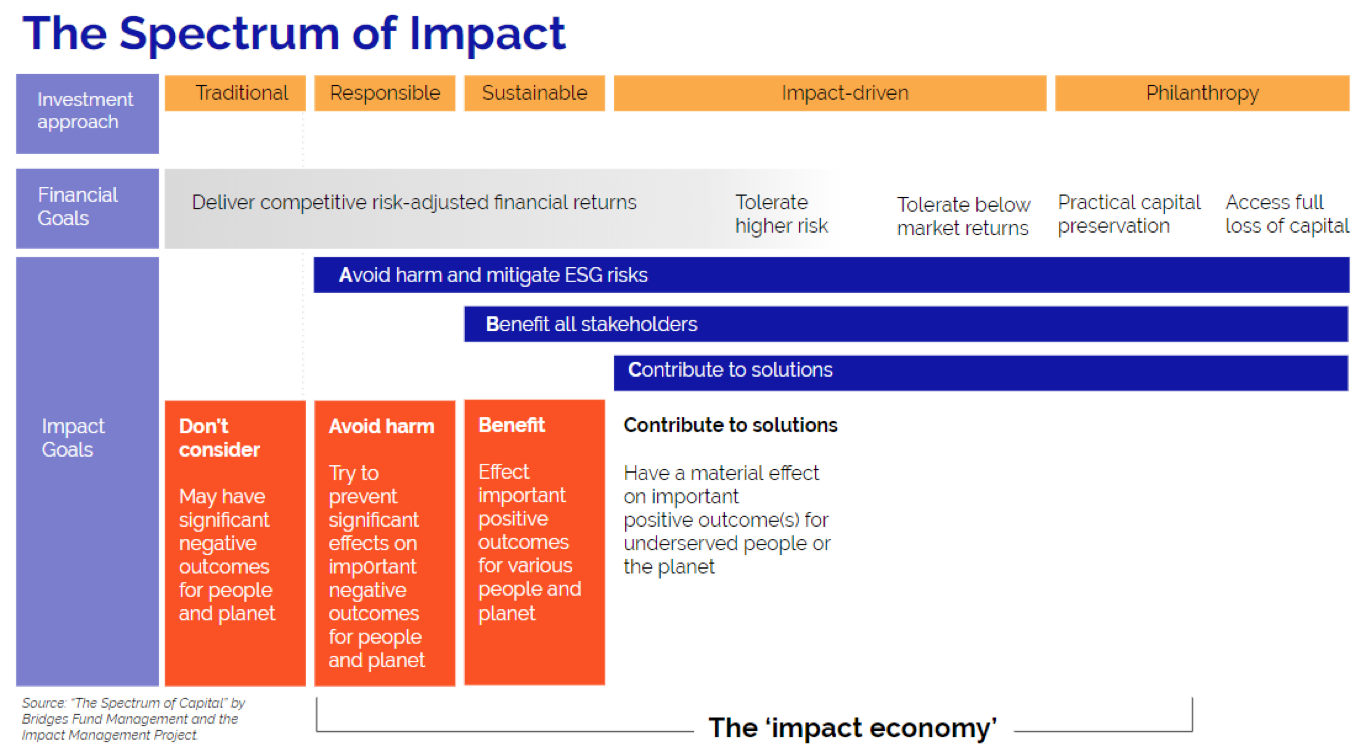

Over the last few years, we have explored how we could be more impactful through our endowment investing activities. The Spectrum of Capital framework devised by Bridges Fund Management and the Impact Management Project show that not only can investors avoid causing harm to people and the planet, but they can also invest to make positive contributions and help tackle severe problems in our communities.

The motivation behind our move into impact investment was quite simple. The challenges we look to address as a charity are significant and need both innovation and new sources of finance. Aligning our investment approach to our mission therefore was a compelling proposition.

In early 2018, we launched the charity’s impact investing strategy. This involved a 5 per cent carve-out from the main endowment (about £50m) to be allocated to fund investments that would enable us to deliver our two-fold objective:

- Commercial risk-adjusted returns, and

- Health impact in the UK.

Our enhanced investment approach saw us committing dedicated resources to this initiative. We created an impact investment committee of experts who are passionate about the effects of what we do; we also developed a new investment process including an impact management framework.

One difference between our approach and that of other UK foundations is that our carve-out is seen as part of the endowment – using similar tools and approaches – rather than a grant to the spend side of our work, and is to be used as a pool for more flexible funding. Our rationale is that if we can make this approach work for 5 per cent of our endowment, why not a much higher percentage?

As a charity committed to tackling major health issues that affect people in inner-city areas, we aspire for change in different ways.

A focus on the breadth of impact enables us to address the negative impacts on the population at large:

- Conditions like diabetes, cancer, heart and respiratory diseases are increasing

- There is rapid innovation in health-based products and services that change people’s lives for the better, but they may not be accessible by vulnerable communities.

We also aspire for positive change through the depth of impact, tackling the negative issues that affect the poorest and the most vulnerable groups in society:

- A growing homelessness crisis

- Poverty and deprivation

- A rise in mental health conditions

- The threats to our urban environment.

Building a portfolio of health impact investments

In our efforts to seek competitive returns and positive health and wellbeing outcomes in the UK, we began to map out health impact in the UK. We engaged impact investing consultant Tideline to help us identify the sectors that resonate with our impact objective. We categorised these into two groups:

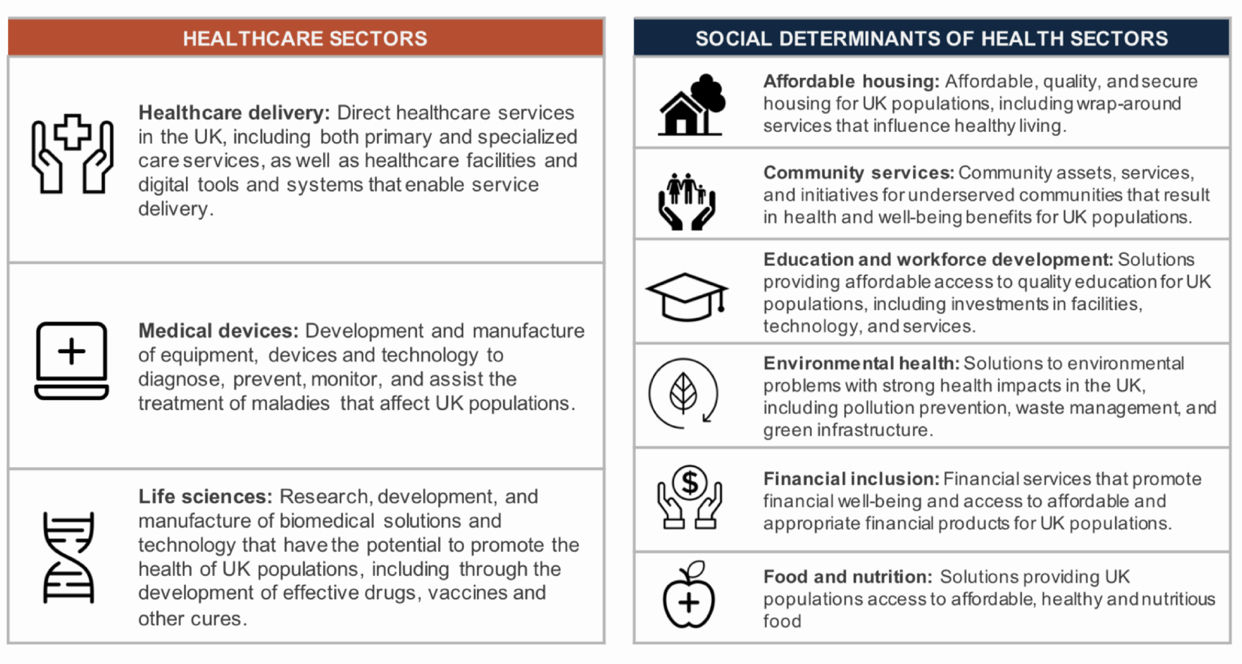

- Healthcare sectors: around 20-30 per cent of our health and wellbeing is determined by access to medical services and treatments

- Wider determinants of health sectors: around 70-80 per cent of our health and wellbeing is determined by the places we live, work and grow up in.

We scoped nine broad sectors: three in healthcare (healthcare delivery, medical devices and life sciences), and six in the wider determinants of health, such as affordable housing, financial inclusion, and food and nutrition. This broad sector focus allows us to seek returns and health impact through different themes and asset classes.

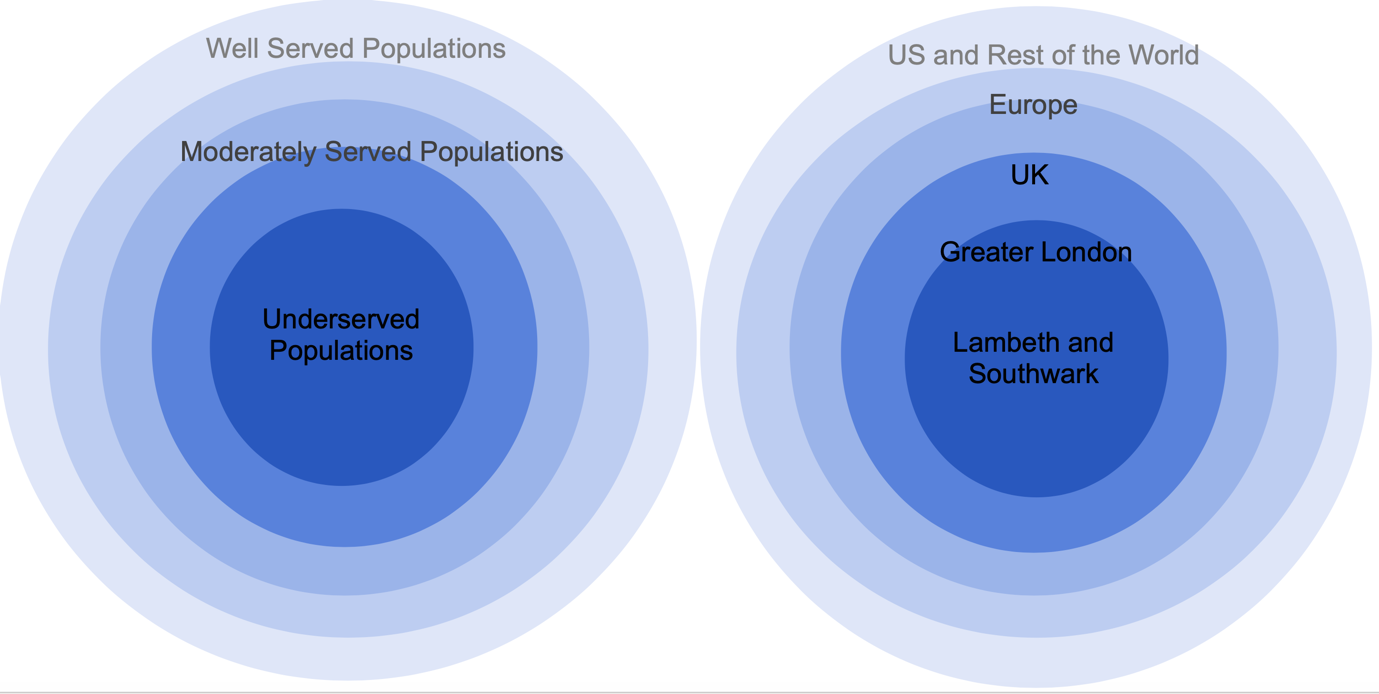

We then spent time focusing on the target populations for our work. As an urban health foundation, we see a clear income gradient to health. People from lower-income backgrounds tend to have the least access to healthcare, and their health is disproportionately impacted by social determinants such as housing and the environment. Given our place-based approach, we also thought it important to identify opportunities to support health locally.

This focus carries trade-offs. We found the tighter we defined the population we want to seek impact for, the smaller the potential pool of investments with both competitive returns and positive health outcomes. We therefore developed a bull’s-eye model to target both population and geography. Our aim is to hit the centre of the target on both or to get as close as possible.

Our investments

In the last 18 months, we committed over £20m of our capital to impact investments. Our first investment was in Apposite Healthcare Fund, a healthcare specialist private equity investor with a core focus on healthcare delivery throughout the UK. Apposite invests in businesses that have the potential to deliver high quality, efficient and cost-effective care solutions. The range is broad and includes genetic testing and complex home care services.

Homelessness is a major issue in London. It also impacts directly on the health of some of the most vulnerable groups. We invested in Resonance Real Lettings Property Fund, which seeks to build resilience against homelessness by purchasing and refurbishing homes in London, working with St Mungo’s charity to let the properties to individuals and families at risk of homelessness.

We concluded an investment in the Bridges Social Outcomes Fund, where returns are contingent on predetermined public services delivery outcomes. This fund tackles homelessness, health and wellbeing in local communities, children and adult social care services, and education and training.

Earlier this year, we invested in two life sciences funds, supporting start-ups that strive to discover and develop groundbreaking, cutting-edge treatments that tackle diseases and enable patients to manage their conditions more effectively.

Our portfolio is still young, but we are already witnessing the impact of our investment and we are still actively investing, with a strong pipeline for 2020 and onwards.

Challenges

Our journey, while rewarding, has faced some hurdles along the way.

Seeking competitive returns

As investors, we chose at the outset to seek out opportunities that would deliver health impact alongside commercial risk-adjusted returns. What we found while we sourced and screened opportunities, even to this day, is the varied nature of returns, ranging from highly competitive to sub-commercial returns.

In some instances, investment propositions were about impact first and returns as a secondary objective; others were more returns-driven with impact as a side effect. In the main, however, we have found that an unconventional approach doesn’t mean the risk-adjusted return has to be concessionary.

Scale and flow of private capital

A lot of managers in this space are raising small-sized funds with small teams that have shorter track records. While there is momentum behind impact investing, the slow flow of private capital means that many impact managers struggle to raise capital. This means we need to be flexible in embracing the challenges that come with a niche market for the greater good. For example, we have found that some of our investments are “catalytic”, such as where emerging technologies are not yet valued, pioneer companies are disadvantaged or collective action problems require coordinated investment. Others of our investments are “impact managed”. These are investments that could sit in the main endowment but, with our health focus, we are supporting the underlying managers to achieve an even greater impact.

Impact measurement

In line with our objectives, our approach to measurement is holistic in that we believe it is important to monitor and report on the financial performance of our investments alongside health impact. We monitor standard financial metrics and periodically meet with our fund managers for discussions on their pipeline of investment opportunities.

Impact measurement, on the other hand, has no standardised metrics that we can use across all our impact investments. For example, metrics for a housing fund are difficult to compare to a venture fund investing in early-stage life sciences. We resolved to start with a relatively simple framework, measuring our portfolio against the five dimensions of impact as identified by the Impact Management Project, then assessing each individual investment against the impact we hoped it would achieve. In time, we hope to identify and apply metrics tailored to specific strategies.

Impact investment is a relatively new area for foundations. By taking a bold step into this space, we are testing new approaches and learning by doing. Our hope is that, by sharing the motivations and learnings of our impact investing strategy, we can build confidence and direct more investment capital to solutions that can positively impact people and planet.

Anita Bhatia is investment director at Guy’s & St Thomas’ Charity

Related articles