While charity investors may be more comfortable investing locally than exploring opportunities further afield, internationally diversified portfolios are more likely to maximise investment returns over the long run.

There’s no place like home

Charity investors may require little convincing to maintain local exposure in a portfolio. After all, for many trustees, this has been the long-term basis of their organisation’s investments, and their home market tends to be the most familiar one.

However, a common finding is that investors over-invest in their home market due to a preference for domestic equities. This is known as home bias, where investors overweight their own market and so invest disproportionally more in assets locally compared to their share in the global market.

Home bias has been well documented and is seen across countries, asset types and both charity and individual investors, though the degree to which it occurs varies substantially.

Some home bias is expected for investors operating in the world’s largest economies, such as the US. It can make sense to prefer investing in companies operating in the countries with the strongest economic standing. This may explain US-centric portfolios even for investors outside the United States.

The status quo

Why do many charity investors exhibit home bias? Historically, many charity investors have employed an overweight to the UK within their equity allocation. For many, this overweight allocation has been driven by a desire to achieve a steady and higher level of income, with the UK traditionally being a higher dividend paying market than other economies around the world.

Regulation has also played a part with the Trustees Investment Act 1961, and later the Trustee Act 2000, restricting what charities could invest in. This led to a concentration of charity funds in UK equities and gilts. These influences were compounded by a historic lack of global investment options for UK-based investors.

Despite vast developments in the range of investment solutions available to UK charities and updated Charity Commission guidance allowing permanently endowed charities to adopt a total return investment approach without seeking prior approval, many charitable organisations maintain their overweight to UK assets and focus on income-only returns.

Income levels have also seen a continued decline since the financial crisis in 2008 and this trend has only been exacerbated by the Covid-19 pandemic. Reduced bond yields and dividend cuts have impacted many charities who rely on this income to deliver their services. This has prompted some to review their strategy in a desire to create a more sustainable operating model.

An explanation from behavioural economics

Aside from the historic context, a range of other explanations are also given by trustees, including a general optimism for, and strong belief in, domestic assets, ambiguity aversion, perceived competence and past experience, foreign currency risk and transaction costs.

A key behavioural explanation stems from the desire for familiarity. Familiarity can give us a feeling of control; we feel we can influence the outcome. Investors may perceive an information asymmetry concerning foreign-based companies, attaching more risk to investing abroad than is deserved simply because overseas companies are understood less. There tends to be an aversion to ambiguity, and since most people are ambiguity-averse, this can breed home bias. Investment committees may also perceive themselves as more competent about assessing domestic assets and overestimate their judgements.

Another reason relates to foreign currency exchange risk. Many charities invest locally to trade in their home currency and avoid hedging currency exposure. Exhibiting a home bias may be seen as hedging against additional uncertainty.

Risk of lower performance

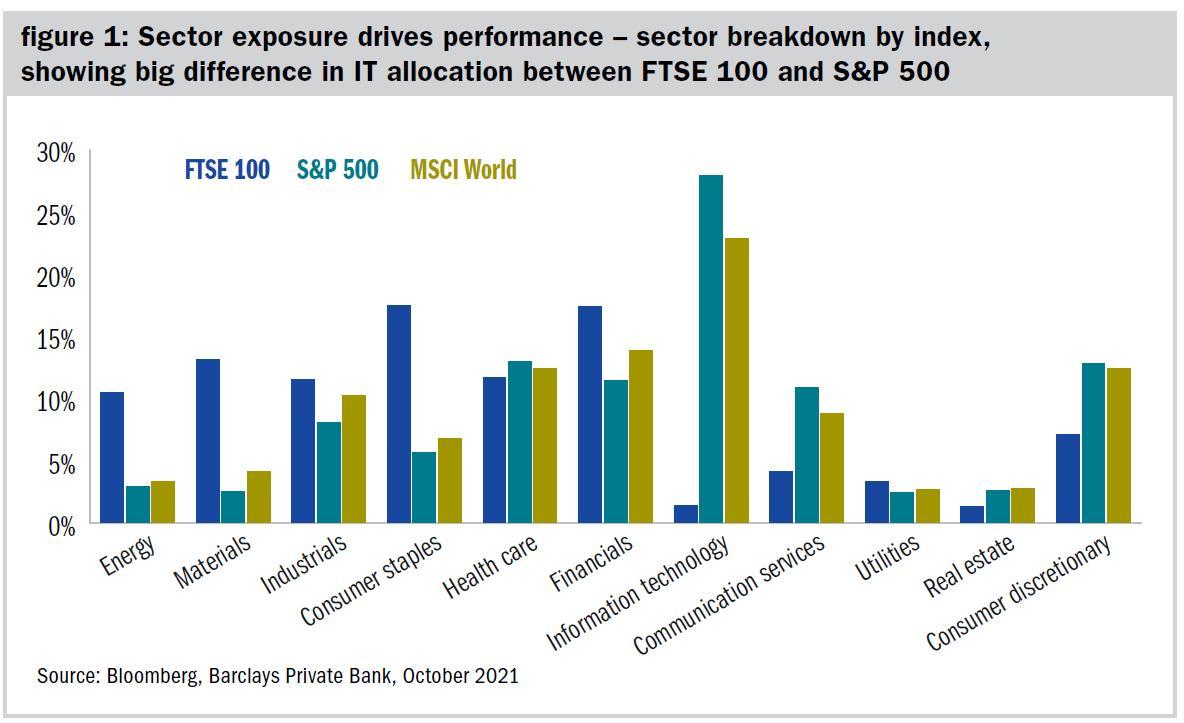

By overly concentrating on one region versus others an investor can miss out on particular sectors that play an important role in economic growth. For example, the FTSE 100 lacks the large technology component of US peers (see figure 1), which have driven stock market valuations in the latter to record highs.

Our perceived knowledge and experience of our home region is independent of the factors driving its performance, or that of regions that an investor may overlook or underweight. If the region we focus on performs well, but underperforms relative to others, an investor will not maximise their returns.

Familiarity can cost

While a home-biased portfolio may provide an investment committee with comfort, it risks limiting financial returns and lifting portfolio risk. Much of the reason that many charity investors prefer local assets that they are familiar with is the feeling of control over the outcomes. In other words, investing in these assets is seen as less risky.

However, a home-biased portfolio can do the opposite. The charity will be overly exposed to the specific risks inherent to that particular country or region. The most obvious recent example of this would be Brexit and the associated country-specific risks. Having a portfolio that is overly concentrated in a particular region increases the risk in a portfolio relative to one with a wider geographical spread.

ESG considerations

An important consideration for many charities is that capital is invested sustainably. One avenue that many take is a responsible investment approach, which involves taking into account environmental, social and governance (ESG) criteria in the investment decision making process.

The core premise is that by considering ESG factors, an investor can take account of a broader set of data and so can make a better judgement about the financial performance and longer-term value of a company. In essence, ESG credentials aren’t only an important source of information, but can also help identify material ESG risks that could affect the reason for investing in a company or group of companies.

We are seeing strong capital inflows into to sustainable-focused investments, and much of this is a growing realisation of the value of sustainable strategies and the consideration of companies with strong ESG practices. Sustainability is becoming a key driver for financial returns. Companies with more effective operating practices may be more likely to create value and perform better in the long run.

With a home-biased portfolio, investors risk incidentally excluding companies from their investment universe companies, which may score higher on ESG metrics. The result may be a portfolio which is less aligned with the aims of the charity, but which may also be less financially resilient. Market data during the pandemic analysed by Barclays Private Bank (June 2020) has suggested that companies with higher ESG scores are more resilient (Assessing Sustainable Investing’s Outperformance).

Where portfolios are constrained by an investment policy that stipulates a focus on a particular region, charity investors can be inadvertently increasing ESG risks. For example, the UK has a concentration of fossil fuel companies, which for many organisations will contravene a commitment to address climate change, even with robust engagement practices in place. By favouring certain regions less, investors may also potentially be missing out on supplying capital to businesses tacking some of our greatest social and environmental challenges.

In addition to positive alignment with an organisation’s mission and/or values, many charities apply ethical screens to their portfolios. A home bias, of course somewhat restricts an investment manager’s opportunity set, and by adding additional restrictions associated with ethical considerations, as many charities do, the investable universe is narrowed even further.

Allowing your investment manager to consider the widest-possible opportunity set increases the likelihood of identifying investments that can deliver all of your charity’s objectives, both financial and sustainable.

There’s a bigger world out there

So what is the implication for investors? While having over or under exposure to a region may boost returns for some time, for reasons specific to that time period (which are likely to be clear only with hindsight), this is unlikely to be in the best interest of long-term charity investors.

We believe a diversified portfolio provides the best building blocks for sustained investing success. While diversification is frequently discussed in relation to asset classes, this also applies to investment locations. Because international markets rarely move in the same direction at the same time, a period of lower returns in one region can be offset by outperformance of others in the portfolio.

The location of a stock’s listing should not be used as the primary driver for inclusion or exclusion in a portfolio. Geographical diversification is important, but this should be considered in relation to a company’s wider exposures, such as the location of their customer base and supply chain, rather than the location of their stock exchange. Each security should be considered on its merit and value-add in a portfolio rather than a biased-preference towards those listed in the UK.

Income only v total return

Transitioning your organisation’s portfolio to a global approach, with a reduced allocation to the UK, may result in a reduction in the income generated via coupons and dividends. And as such, this transition will often coincide with a decision to move from an income-only to a total return approach.

By adopting a total return approach, you remove any specific income target and focus on maximising risk-adjusted returns through a combination of capital appreciation and income generation.

A UK-focused income-only approach is favoured by some for providing a steady level of income that is easily identifiable. Adopting a total return approach that is global in nature, could reduce this income but may enable your organisation to maximise overall total risk adjusted returns. For those organisation’s that continue to require a higher level of naturally generated income, other income-generating asset classes such as hedge funds or private credit could be included as part of a diversified allocation.

Focus on the outcome

Charity investors have a balance to strike between the comfort provided by a home-biased portfolio with a steady income-stream, and potentially more profitable investments which they are less familiar with. This can also extend to factors such asset classes and financial instruments. Familiarity and emotional comfort may make the investment journey more enjoyable. However, the outcome at the end of that journey may be impacted if broader aspects are not considered.

Considerations for trustees

Arguably a trustee’s key financial concern is whether they are utilising all of the tools at their disposal to have the best chance of reaching their organisation’s financial and strategic objectives. Regularly reviewing your investment policy and existing portfolio is a sensible base line to ensure you are continuing to evolve in line with changing stakeholder demands and market conditions.

Next steps:

- Review your investment policy – is it up to date and fit to meet your organisation’s needs in the current market environment?

- If you’re not doing it already, consider whether a global total return approach is appropriate.

- Speak to your adviser – they are there to help you navigate the investment universe and find the right solution for your charity.

Alexander Joshi is a behavioural finance specialist and Olivia Lewis a private banker – charities & not-for-profits, at Barclays Private Bank

Charity Finance wishes to thank Barclays for its support with this article

Related articles