After an extensive review and consultation, the 2026 Charities Statement of Recommended Practice (SORP) was published in October 2025, introducing significant changes that charities must adopt in their annual accounts.

The SORP Committee’s theme throughout the consultation was to “think small first”, with a focus on enhancing transparency, consistency, and financial clarity.

This latest SORP aligns with recent changes to Financial Reporting Standard (FRS) 102, ensuring that charity accounting standards remain in line with broader UK accounting principles.

With implementation effective for financial reporting periods beginning on or after 1 January 2026, charities have limited time to prepare for these changes.

The SORP-making body has helpfully created a summary of changes alongside the new standard, which highlights those modules with significant, editorial or limited changes. While this is useful, some areas noted as having significant changes actually just include additional clarification or guidance rather than changes to the reporting requirements themselves.

The following sections outline some of the most significant changes and their potential impact.

Tiered reporting

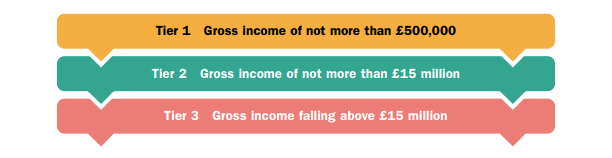

One of the key changes is the introduction of a tiered reporting structure. Reporting and disclosure requirements now vary based on the income level of the charity. This is designed to ensure that the financial reporting burden is proportionate to the size and complexity of the charity, fitting with the theme of “think small first”.

These new tiers are as follows:

Charities must determine which tier they fall within for each reporting period. This structure is designed to ease the burden on smaller organisations; for example a cash flow statement is now required only for tier 3 charities, those with income exceeding £15m.

Although the SORP offers reduced reporting requirements for smaller charities, it clearly encourages charities to provide additional information and disclosures from higher tiers where these would be relevant to the users of the accounts.

Charitable companies need to be careful when considering which tier they fall within. While the income level of £15m aligns with the revised turnover threshold for a small company, the criteria for a small company in the Companies Act is not solely based upon income. The definition also considers total assets and employee numbers. Charitable companies therefore must also consider if they meet the Companies Act criteria to determine eligibility for certain financial reporting disclosure exemptions for smaller entities.

In addition, the tiers have not been aligned with audit thresholds because the SORP applies across multiple jurisdictions, each with its own audit and examination limits.

The SORP-making body has confirmed they are committed to continuing to consider these tiers further during 2026-27, so more analysis along these lines can be expected.

Having considered the overall position, we now turn to some of the SORP modules with the most significant changes.

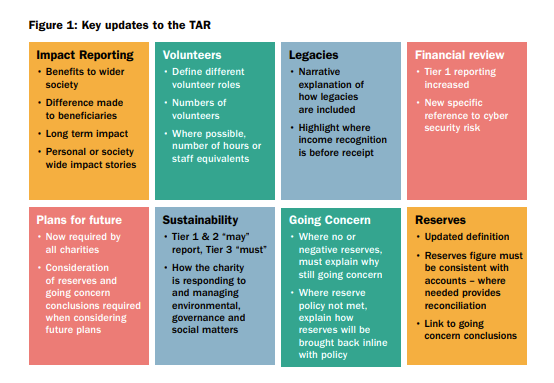

Refreshed approach to trustees’ annual reports (TAR)

This module of the SORP has been largely rewritten, and while there have been significant changes, the main purpose remains the same; to ensure public accountability and stewardship of funds.

The SORP Committee has acknowledged that trustees are most likely to engage with this module, noting that it was designed to bring clarity to the reporting requirements. Again, the reporting requirements differ depending on which tier a charity falls within. A number of changes will result in increased reporting for those smallest tier 1 charities compared to the previous SORP.

The overarching theme is to link the narrative to the numbers providing context to the results. This should create a report which clearly details the impact to both beneficiaries and wider society in a way which is fair, balanced and understandable.

The module clarifies that information should be reported in the most helpful way and therefore when preparing the report trustees should consider:

• Who are the users?

• What information do the users need?

In order to be more accessible, the module now includes prompt questions for trustees to consider in order to fully meet the requirements of the disclosures. However, these should not be considered as a checklist. The TAR continues to be the charity’s opportunity to tell the charity’s story, sharing its mission, activities, achievements, impact and performance. The report should therefore include specific content which is unique to each organisation.

The new SORP clarifies that there is the option to include additional information if considered helpful to the users. Examples include a chair’s report, environmental report, and impact assessment.

There has been the welcome removal of the requirement to disclose why exemptions have been taken to not disclose the names or addresses of key staff or trustees. The SORP now recognises that this disclosure was counterproductive and could increase the risk to those individuals.

Although there is now significant additional information required to be included in the TAR, the SORP-making body considered that this information should have already been available to the charity trustees in order to govern the charity appropriately and therefore believe that the additional reporting is proportionate.

Lease accounting

The new SORP introduces a dedicated module on leases, aligning with FRS 102. The key change is the removal of the distinction between operating and finance leases bringing the majority of lease liabilities onto the balance sheet in full, with a corresponding right of use asset.

For some charities, for example those with numerous charity shop property leases, this will substantially change their balance sheet. Charities will therefore also need to consider if these changes increase their gross assets above the asset threshold for audit and the potential effect this could have on any metrics which are part of bank covenants.

There are exemptions for short-term leases (those with a term of less than 12 months) and low-value leases (eg small items of equipment), which permit such leases to continue to be accounted for as lease payments are made.

Consultation feedback did suggest that some respondents were mistakenly of the view that the SORP could override the lease accounting requirements set out in FRS 102. As these requirements originate from FRS 102, changes in this area are not within the gift of the SORP-making body.

Social donation leases, which include those which are peppercorn or below market rate rents, also need to be considered. In both cases, the difference between the market value and the amount paid often needs to be treated as a donation. Judgement will be required to determine the value of the non-exchange (donation) element.

Nominal or peppercorn leases may have the legal form of a lease, however it is unlikely that they will meet the FRS 102 definition due to there being very small or no payments. These arrangements are likely to fall outside the scope of lease accounting with the nominal payments treated as an operating expense.

Where below market (but higher than nominal) rate agreements are in place, consideration will be required as to whether these constitute a lease or a donated asset. Whether it is a service facility or donated asset will affect whether measurement should be at fair value or value to the charity. For some charities, this could result in a need to include a donation along with the right of use asset and lease liability.

Income recognition

Following the significant changes announced in FRS 102 to revenue recognition, the new SORP also incorporates these changes, together with some additional guidance and examples for charities.

Previously income was recognised once the entitlement, probability and measurement criteria were met. Income is now clearly categorised as either exchange or non-exchange transactions, with distinct recognition criteria for each.

An exchange transaction is one where the charity is providing something – be it a return or benefit – in exchange for the income. Examples include contracts for services and grants with performance obligations. A non-exchange transaction is one where income is received without directly providing an equal value of return, eg a pure donation, legacy or unconditional grant. It is therefore vital to determine for each source of income whether it is an exchange or non-exchange transaction in order to establish the correct recognition and reporting criteria to apply.

Non-exchange transactions

Recognition remains linked to whether there is an obligation or condition attached; if not generally the income is recognised once the charity becomes entitled (rather than on receipt).

Exchange transactions

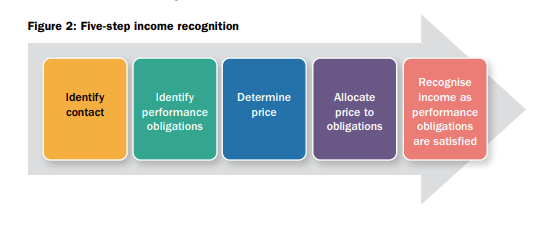

The SORP has been updated to align with FRS 102 requirements for revenue recognition for exchange transactions. The result is that exchange transactions must use the five-step income recognition criteria set out in FRS 102.

The five-step process includes identifying the separate performance obligations which arise from the transaction, allocating a price to each of these obligations and recognising the income as each obligation is fulfilled. In addition, where material, there may be the need to consider the time value of money, potentially using discount calculations.

The impact of these changes could alter the period in which revenue is recognised. For example, service contracts or multi-year funding agreements may need to be spread over the delivery period which could vary for the different elements of the contract.

The new income recognition requirements apply to all charities preparing accounts in accordance with the SORP, and therefore could have a disproportionate burden on smaller charities with exchange transactions. The new requirements could result in material changes for many charities and therefore early engagement with your accountants, examiners or auditors is advisable.

Social investments

The SORP introduces the term social investments, replacing mixed motive, and programme-related investments. This terminology aligns with the Charities Act.

Social investments are investments made for both a financial return and to further the charitable purposes, for example bringing benefits to beneficiaries within the investing charity’s purposes.

Those investments previously categorised as mixed motive or programme-related must now be categorised as social investments (assuming they meet the definition) with restatement of the comparative figures as far as practicable.

There are additional clarifications on social investments and the various types of benefit which can be considered as a return on investment. Judgement should be exercised to determine whether a transaction constitutes a donation/grant or a social investment.

There is also the welcome addition of much clearer guidance on investments and loans made to trading subsidiaries within the charity’s control.

Natural statement of financial activities (SOFA)

For the smallest charities falling within tier 1 (income below £500,000), there is more detailed guidance on how to prepare a natural SOFA. This offers simplification and allows customisation, which potentially could help with providing more user-friendly financial statements.

Heritage assets

There is additional guidance around the measurement of donated heritage assets where measurement and recognition may not be possible. The requirement to disclose assets which are unable to be measured reliably has been clarified with the need to specify the reason why a fair value could not be obtained.

Transitional arrangements

Implementation applies to accounting periods starting on or after 1 January 2026. For December year-ends, this will mean the year ending 31 December 2026, for March year-ends the first year affected will be the year ending 31 March 2027, and so on.

Comparatives will need to be restated, but thankfully there are exemptions for income and leases. In both cases, the modified retrospective approach can be taken, whereby the cumulative impact of the adjustment is recognised in reserves on the first day of the accounting period in which the standard is adopted eg 1 January 2026.

There are practical implementation advantages to this approach, however it should be noted it will create a lack of comparability with prior periods. Charities should plan now to gather any information required for the adjustments necessary on adoption or to restate comparative information where required.

Overall, the final SORP didn’t bring any unexpected surprises and there were some welcome clarifications and additional guidance included.

New financial thresholds

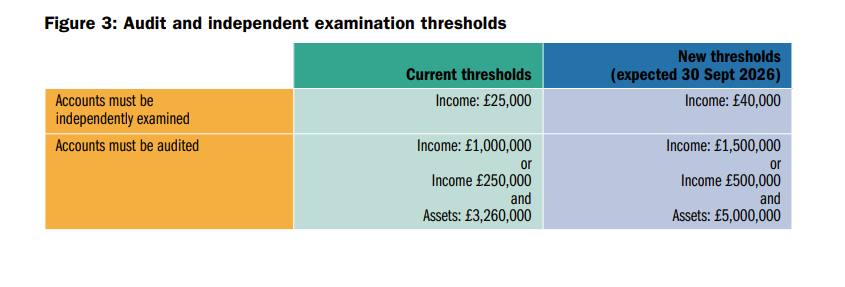

On the same day the SORP was released, the Department for Culture Media and Sport also released the consultation outcomes on financial thresholds for charities. Having not been updated for 10 years, there is a welcome increase planned to both the audit and independent examination limits, which are set out in figure 3 above.

The limits for simplified receipts and payments accounts have also been substantially increased to income of up to £500,000 (for non-company charities). Therefore, if your charity is not a charitable company, and the changes to the SORP reporting requirements are too much of a burden, there is the option to consider a change in accounting basis, removing the requirement to prepare SORP accounts if your income is below £500,000.

Key actions for charity leaders and finance teams to take now

- Finance teams should familiarise themselves with the changes. Speak to your auditors/examiners early to consider the impact.

- Determine your charity’s tier classification.

- If you are a charitable company in tier 2, check eligibility for reduced disclosures under Companies Act thresholds.

- Review and gather information on existing lease agreements including those below market rent.

- Review income streams to identify those with performance conditions, identifying exchange transactions.

- Map through the five-step model.

- Consider the impact on balance sheet totals for the financial and audit thresholds.

- Review any bank covenants based on the new balance sheet metrics, and consider the need to speak with funders.

- Consider the increased trustees’ annual report (TAR) disclosure requirements. Does your charity readily hold the information required in order to report on these? Or will new systems and processes be needed to collect this information? eg does your charity have

- systems to capture volunteer statistics?

- Review social investments.

- When completing your current year’s accounts consider disclosing in the TAR the expected impact of the coming changes.

As ever, the SORP is only one of the many pieces of legislation which govern charity reporting and it is important to continue to consider those other requirements such as the Charities Act, Accounting Regulations 2008, FRS 102 and company law.

Charity Finance wishes to thank A C Mole for its support with this article.