Global warming, pollution and ecological damage, inequality in all of its forms, obesity, malnutrition and corruption – these all make structural change away from the 20th century consumer-industrial complex a necessity.

The good news is that a combination of technological innovation and forward-thinking companies is dramatically increasing the opportunities for the world to make that positive change.

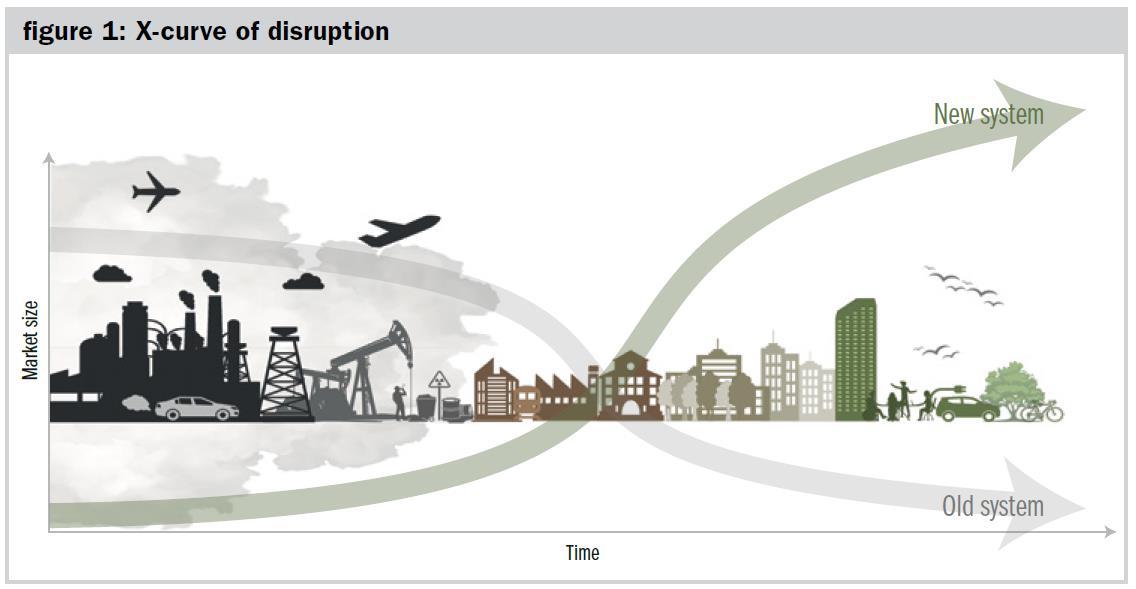

To use a term fashionable in financial markets, the 20th century consumer-industrial complex is being disrupted: old industries and damaging processes are being supplanted by businesses using new technologies to do things in different, better and more sustainable ways.

We are only at the beginning of this disruption and the opportunities to capture economic value from this transition are immense. By supplying capital to disruptive, innovative companies – and particularly to rapidly growing, smaller- and medium-sized companies – investors have the opportunity to be part of this transition and, we believe, earn superior returns along the way.

But what kind of companies are having a positive impact?

There are areas of the stock market that positive-impact investors can’t and won’t invest in because of their negative social or environmental impacts. For example, Artemis excludes companies involved in producing alcohol, weapons, tobacco, fossil fuels, nuclear power, gambling, animal testing, adult entertainment and genetic modification from our list of potential investments.

However, as impact investors, we want to go much further than this. We don’t simply want to screen things out for negative reasons – we want to identify innovative companies that are positively engaging with the world’s most critical sustainability challenges. As such, we focus on key societal frictions and track the emerging technologies that can address them.

Crucially, however, we don’t see this as a restriction, we see it as a liberation from the shackles of structural decline. Looking for companies with clear positive impact frees us to focus on transformational structural growth. It isn’t simply that we can’t invest in companies that are in decline; we don’t want to.

What does that mean in practical terms? It doesn’t only mean investing in companies that make electric cars or clean energy (although we do that too). There is a wide and growing range of emerging growth companies that are addressing key sustainability challenges. Here are just three examples, each of which contributes towards one of the UN’s Sustainable Development Goals (SDGs).

Having a positive impact by…broadening access to education

We see education as an area ripe for disruption. The education system has seen precious little innovation in the last 100 years but it has seen cost inflation as students have arguably pursued the middle-class dream. The high cost of education means the sector is neither as inclusive nor as diverse as it should be.

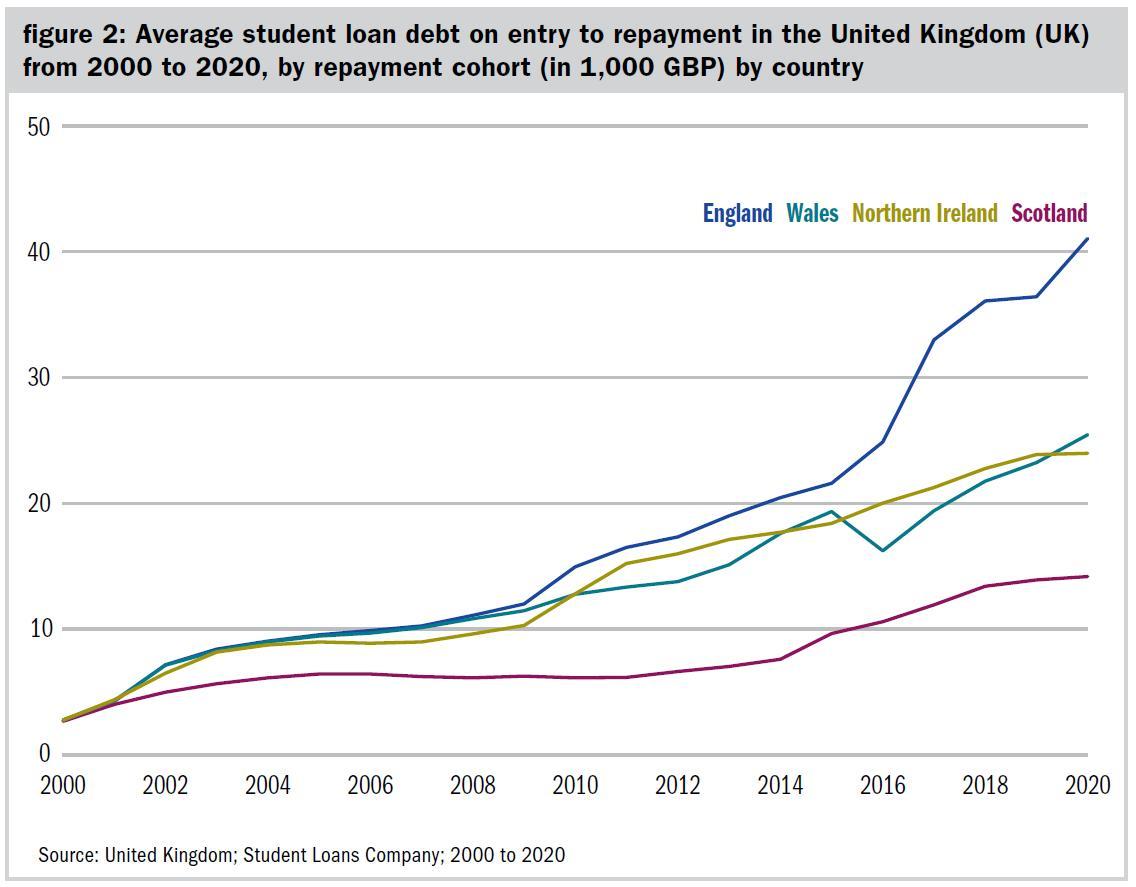

The average cost of attending university in the United States was $33,663 in 2019. Versions of this problem are replicated across the world. In the UK, the average student leaves university with significant debt (over £40,000 in England) and students from lower-income families shoulder a much larger proportion of that debt personally. The regrettable result is that high-quality higher education is becoming increasingly inaccessible for low-income households.

But that can change. The pandemic proved that education does not always need to take place in person. By making education more affordable, whether by reducing the cost of textbooks or by making the course itself cheaper, moving education online can promote inclusion. For example, Chegg, a Californian company, is disrupting the (very) high-cost academic textbook market and helping to lower the cost of education by offering tutoring online across a wide range of academic subjects.

Having a positive impact by…making cycling safer

The way we travel needs to change. Many of us need to exercise more. But at the same time, some forms of exercise, particularly cycling, need to be safer. Technology designed by a Swedish company, MIPS, can help. In contrast to the majority of products sold by the major sportswear brands, MIPS’ technology has a meaningful and measurable impact: it reduces deaths and injuries from road accidents, saving human lives by making cycling (and a growing number of other sports) less dangerous.

Existing helmet technologies do a good job of reducing the energy – and so protecting the brain – in the event of a linear impact. But here’s the problem: the most common type of impact from crashes or falls is actually an oblique or angled impact. And whereas a linear motion of the head can cause a skull fracture or contusion, rotational motion triggered by an angled impact may also cause injuries such as concussions, subdural hematoma (bleeding between the brain and the skull) or diffuse axonal injury (when the brain shifts rapidly in the skull).

MIPS designs multi-directional impact protection systems. These slip planes are, in effect, layers fitted inside helmets. They allow for 10-15 mm of rotational movement between the head and the helmet in the critical milliseconds after an impact. This reduces the rotational forces exerted on the brain in the event of a crash and so reduces brain injuries relative to the same helmet without MIPS fitted.

Its slip planes are not only found in helmets for cyclists (its biggest market) but also skiers, horse riders, rock climbers, ice hockey players and motorcyclists. It is now expanding into potentially a huge market for type II safety helmets used in industrial settings and by the police.

Although litigation risk prevents the company from stating helmets are the safest, its testing can demonstrate that a helmet featuring MIPS is at least 10% better at dissipating rotational impacts than the non-MIPS alternative. In some cases, the company suggests the actual reduction in strain can be as high as 40%.

Having a positive impact by…making fashion less wasteful

The environmental costs of fast fashion are all too familiar. The dominant, established technologies used to print many garments today – rotary-screen or automated-carousel printing – involve multiple time-consuming forms of pre-treatment. This consumes energy, water and often results in hazardous chemicals being discharged into waterways.

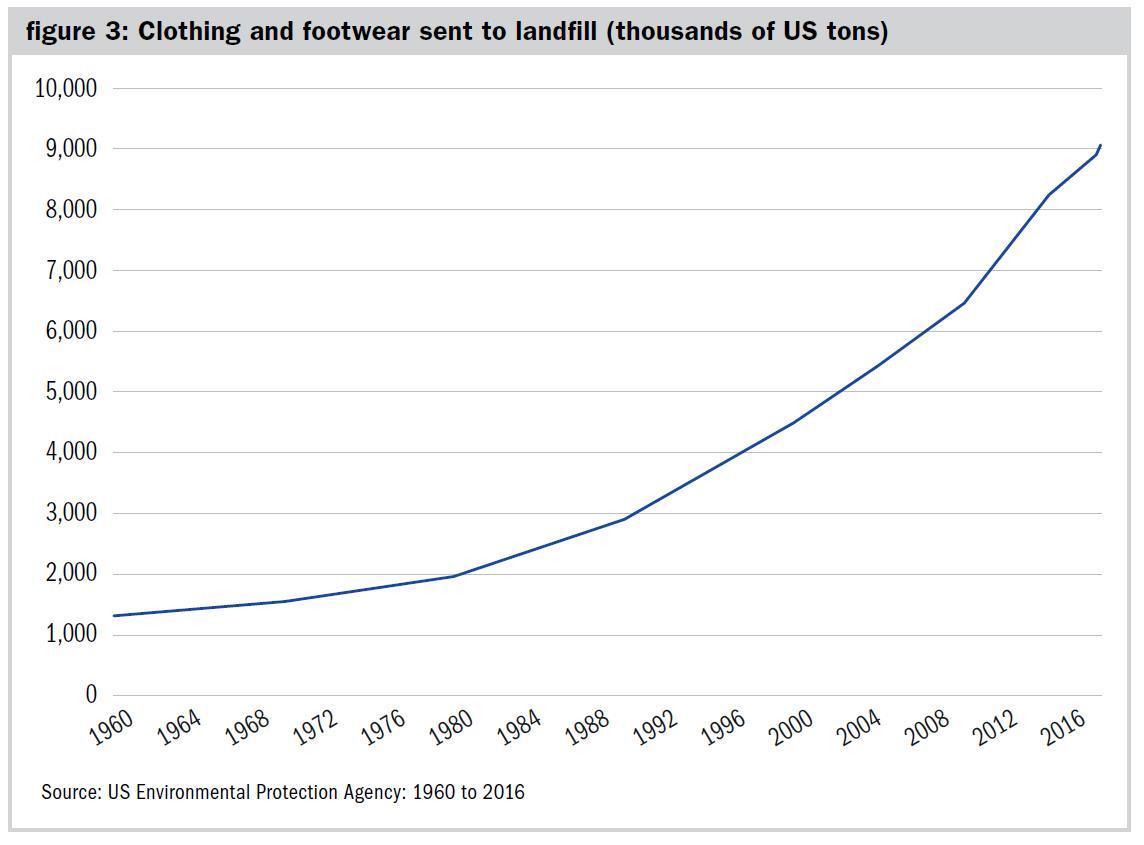

This old model of printing is also inflexible: large print runs are needed to be cost-effective. In the fickle world of fashion, this leads to waste, either physical (clothes being unused and sent to landfill) or economic (heavy discounting).

Another problem is that these technologies are labour-intensive and so are traditionally offshored to developing countries where environmental and labour standards tend to be lower.

Far too much clothing is being sent to landfill. Kornit Digital’s printing technology can help reduce waste.

Kornit Digital offers a different way. From its beginnings providing machines designed to print cheap-and-cheerful designs on cotton T-shirts, it is now demonstrating the potential for digital printing technology to supplant analogue technologies across a far wider range of fashions. Kornit’s machines enable shorter print-runs, reduce the time lag between design and production and decrease the risk of excess inventory – and so mean less clothing goes directly to landfill.

Moreover, because digital printing needs less labour and physical space, it can take place closer to market (shorter lead times) so clothing production can be onshored to areas where environmental and labour standards can be monitored.

Finding opportunities in change

These are just three of the stocks the Artemis Positive Future Fund currently invests in. Other impact investors have their own approaches, preferences and list of stocks but this gives you a flavour of the type of opportunities for investors to contribute to, and profit from, structural change towards a more sustainable world.

Ryan Smith is co-manager of the Artemis Positive Future Fund

Charity Finance wishes to thank Artemis for its support with this article