Mark Salway urges charities to think carefully about business models - and social investment in particular - at every level of the organisation.

Since I joined Cass Centre for Charity Effectiveness about eighteen months ago I have been focused on helping nonprofits and charities understand what social investment is and how it could help them.

This has typically started with a discussion about what social investment is, but has quickly turned into a conversation about business models, and how the client uses finance to survive, or create impact, or ensure the ability to take their work to scale.

They soon realise that finance is a tool to help them deliver their work, but they need to understand their business models better to use it effectively. That learning can be profound and I feel real pleasure when boards and senior teams achieve that eureka moment.

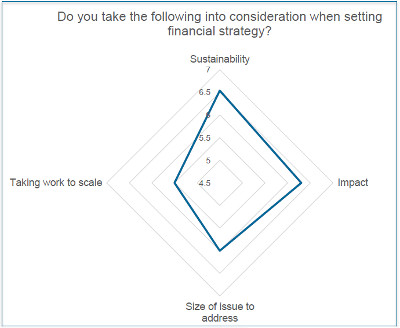

Our research has shown that while 59 per cent of charities consider sustainability when setting their finance strategy, and a similar figure (57 per cent) consider impact, less than half think about the more complex factors related to their business models such as the size of the issue they are addressing and taking work to scale.

I am the first to admit that the balance between social impact and finance is complicated and it took me years to really understand the complexity of my last charity’s business model. Granted, at surface level, I understood in a few months but to understand in depth how finance enables growth, facilitates impact, ensures knowledge transfer and maintains a sustainable business platform took several years. Sometimes you need to take a step back and look at your organisation with a different lens - external assistance can help you to do this.

Another considerable barrier to change is the comfort that donations and grants have afforded. Why should charities try other things? The answer is that many charities are running out of money and that growth is becoming increasingly difficult through fundraising or grants alone. Social investment offers a potential new path.

Social investment is an easy concept to grab hold of, but a difficult one to define - in essence, it uses investment style tools to fund charities. It moves charity funding away from grants and donations to create a more balanced funding model and therefore enables organisations to address and adapt their business models.

Together, with Geoff Burnand (Investing for Good) and Martyn Drake (Binley Drake) Cass CCE has just launched a new social investment toolkit. You can download it for free as part of our Tools for Success guides (they are free too).

The guide helps organisations understand what social investment is, how it can be used, how to engage investors and what they are looking for. It also talks about business models. It’s a simple how-to guide. All we ask in return is that you help inform our future work by completing a quick questionnaire. On completion you will get immediate feedback and will be able to see how your results compared to other organisations.

When presenting at seminars and conferences, I often display a picture of the poor communities I used to work with across the world to remind myself and attendees of the motivation and the social missions behind our work. Social investment can help achieve these missions in a sustainable way.

So think about your business models… really think about them, and how finance isn’t just something that the finance team does. As Paula Laird, the FD at WaterAid, is inspirational in saying, “finance delivers impact and ultimately saves lives”. It really does.

Mark Salway is the director of social finance at Cass Centre for Charity Effectiveness.

Civil Society News would like to thank Cass Centre for Charity Effectiveness for this blog.