Quarter three results boost the Charity 100 Index and highlight the affordability issues facing independent schools, finds Diane Sim.

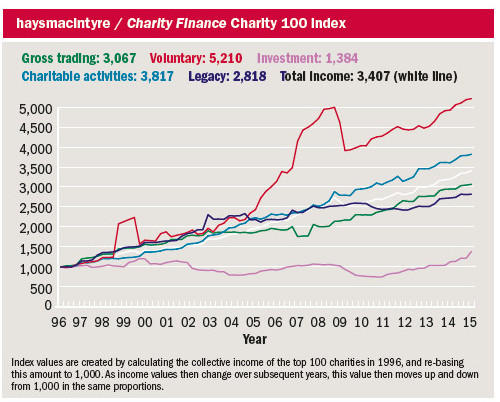

We are pleased to announce that from this month the Charity Indexes are being supported by haysmacintyre, and the newly-named haysmacintyre / Charity Finance Charity 100 Index has seen strong performance this quarter. Notably, it rose by 51 points in the three months up to 30 September 2015, 35 points ahead of its quarterly benchmark.

Furthermore, two-thirds of the 15 charities with financial year ends falling in the third quarter reported increases in income, with half of these reporting rises of over 20 per cent.

The top performing income stream was investment, which outperformed its quarterly benchmark by 157 points, driven by a 41 per cent increase at the Children’s Investment Fund Foundation (UK) and by a 26 per cent increase at the Wellcome Trust. Investment income accounts for 98 per cent of total income at the former and 89 per cent at the latter.

Other strong performers include Comic Relief and World Vision UK, which both reported total income rises of 26 per cent, and Royal British Legion, up 21 per cent.

The biggest fall was at United Church Schools Foundation, where income was down six per cent.

Strong schools representation

Schools, which account for 17 per cent of the 350 charities included in the Charity 100 and Charity 250 Indexes, comprise 66 per cent of charities reporting their results in the third quarter. A review of the sector’s performance is, therefore, timely.

The schools included in the Indexes range from the large groups such as the United Church Schools Foundation and the Girls’ Day School Trust (GDST), with annual income of £336.3m and £258.9m respectively, to individual schools with turnovers of £21.4m and above. Most are independent schools, as academies are not eligible for inclusion.

There are, however, some mixed groups such as the aforementioned United Church Schools Foundation and GDST, which manage both independent schools and academies. The Whitgift Foundation also has a mixed offering, in that it provides sheltered accommodation and nursing care through three care homes, alongside its main activity of running three independent schools.

As a collective, the schools represented in the Charity 100 and Charity 250 Indexes have performed reasonably well in their most recent figures – three-quarters of them reported increased income. The biggest rise, reported by Shrewsbury School, was 15 per cent, while the highest income fall, reported by Felsted School, was 13 per cent.

The median annual change for the group as a whole is a 5 per cent increase. The simple message from these figures is that incomes are holding up well and certainly outstripping inflation, but in fact the reality is a little more complex.

Affordability issues

According to research published last year, school fees are at their least affordable for middle class parents since at least the 1960s. In The Old Boys, a historical account of the public school system, author David Turner claims that for all but the wealthiest 10 per cent of the workforce, fees for the average day school are now more than a quarter of a year’s pre-tax pay, compared with less than one seventh back in 1968. Tony Little, headmaster of Eton College until last summer, has also argued that Britain’s top independent schools have become too expensive for middle class families, their traditional clientele.

Earlier this year, Barnaby Lenon, chair of the Independent Schools Council, told the Telegraph that the time was right for private schools experiencing faltering demand to consider cutting fees in order to increase pupil numbers, given low inflation and the pressure on state school budgets.

haysmacintyre’s audit and advisory partner Sam Coutinho, who leads on independent schools, says that “average fee increases at independent schools, which peaked at 9 per cent in 2003/4, fell to just below 4 per cent in 2009/10 following the 2008 financial crisis and have stayed at that level since, averaging 3.6 per cent in 2015/16”.

She says that schools have been able to limit fee increases in recent years by controlling costs, particularly by limiting inflationary pay awards.

“With increases to employers’ contributions to teacher pensions and the Apprenticeship Levy on the horizon, however, the scope to keep a cap on staff costs is limited,” she adds.

In some cases, delays to capital and maintenance projects have served to keep cost down, though this too cannot be sustained indefinitely. Indeed, research undertaken by haysmacintyre shows a 23 per cent increase in average capital expenditure by schools in 2016, and concludes that “capital projects seem to be firmly back on the agenda”.

And with limited scope to cut costs, schools are looking increasingly to income generation to keep fees affordable.

International developments

A key area of expansion for independent schools in recent years has been overseas. The trend started in 1998, when Harrow School opened Harrow International School in Bangkok. It was followed by others with strong brands including Repton, Sherborne, Marlborough and Dulwich.

At the start of this year, members of the Independent Schools Council operated 46 overseas schools serving 27,619 pupils, more than double the 20 that existed at the start of 2012. Growth has been focused on the wealthy countries of the Middle East and the fast-growing markets of East Asia, including Mainland China, Thailand and South Korea, where fee levels can be on a par with their UK counterparts.

As well as raising the profile of the brand abroad, the additional revenue can be used to keep UK fees down and fund bursaries for pupils from low-income households, which helps to satisfy the public benefit requirements introduced by the Charities Act 2006.