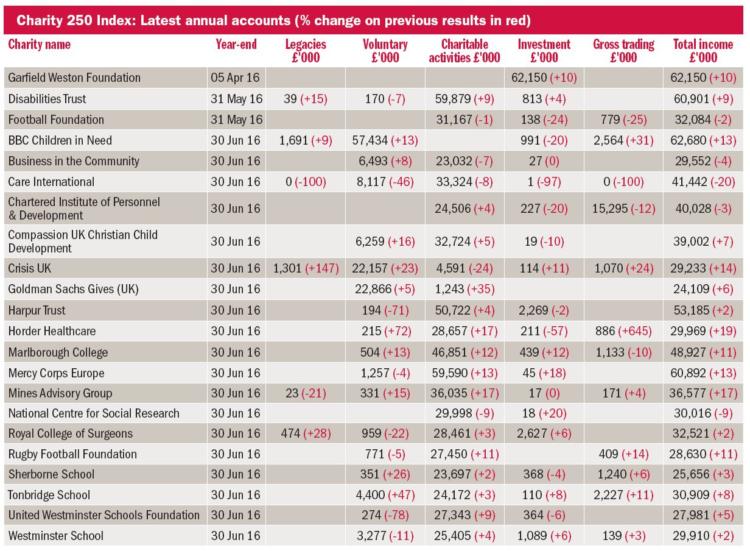

It has been a strong quarter for the haysmacintyre / Charity Finance Charity 250 Index, with over a third of its member charities reporting double-digit income rises in the year to 30 June 2016. The largest rise was recorded by Horder Healthcare, with income up by 19 per cent to £29.9m. Specialising in orthopaedics and physiotherapy, it operates through its Sussex-based hospital, the Horder Centre, and clinics in Sussex and Kent. In July 2015 it acquired a second hospital, the Mclndoe Centre, which specialises in plastic reconstructive surgery.

According to the trustees, the acquisition of the Mclndoe Centre and the enhanced range of procedures now available made a significant contribution to a 17 per cent increase in income from charitable activities. However, the additional cost of supporting the enlarged organisation has resulted in an 80 per cent fall in the surplus generated to £0.8m.

Horder Healthcare is one of a small but significant group of 14 hospitals with charitable status that are members of the Charity 100 or 250 Indexes. These range from the largest charity, Nuffield Health, with annual income of £764.2m, to King Edward Vll’s Hospital Sister Agnes with annual income of £22.9m.

For such a small group, they encompass a wide range of medical specialisations and access criteria. St Andrew’s Healthcare focuses on mental health, while the Royal Hospital for Neuro-Disability specialises in complex neurological conditions and disabilities caused by damage to the brain or nervous system. Great Ormond Street Hospital Charity (GOSHC) focuses on services to children, while King Edward Vll’s Hospital Sister Agnes and Erskine Hospital prioritise current and former members of the services.

Daughters of the Cross of Liege and Emms Nazareth are religious orders that run hospitals and other healthcare facilities, while the Benenden Hospital Trust provides services to members of the mutual Benenden Healthcare Society, which tend to be members of trade unions and friendly societies.

Many provide services to NHS patients via referral, alongside privately-insured and self-paying patients. Only GOSHC, however, is a member of the Association of NHS Charities, whose 120 members tend to be associated with NHS Trusts.

A level playing field

Fee-paying hospitals with charitable status have attracted – and continue to attract – controversy. This tends to focus on three main areas: the public benefit requirement; high salaries paid to senior staff; and the need for a level playing field in healthcare provision.

In 2008, a report from the Directory of Social Change concluded that some major feecharging hospitals would struggle to meet the public benefit requirement. However, Charity Commission plans to undertake a public benefit assessment of private hospitals were scrapped in 2010 due to budget cuts.

In 2012, private healthcare provider HCA International submitted formal written evidence in response to a review of the Charities Act 2006, stating: “The charitable status of organisations like Nuffield Health and the London Clinic, which operate in the same way as private healthcare providers, undermines the accepted amendment to the Health and Social Care Act 2012, which aims to ensure ‘a level playing field between NHS, third sector and independent providers’.”

Such organisations compete for the same patients, charge similar rates and pay similar salaries to private healthcare providers, HCA International argued, but “enjoy charitable status benefits such as exemption from capital gains tax, corporation tax and hefty VAT exemption on expensive medical equipment and supplies.”

The report admits, however, that “in general terms, the tax policymakers show little sign of discontent with the status quo on the grounds that charities do not operate to earn profits for their shareholders”.

Public sector providers have also drawn attention to the relative advantages enjoyed by hospitals with charitable status. Last year more than 100 NHS trusts wrote to their local authorities claiming that they too should be eligible for the 80 per cent discount on business rates enjoyed by charities. Although their requests were rejected, the trusts, represented by property consultancy Bilfinger GVA, are understood to be considering mounting a legal challenge.

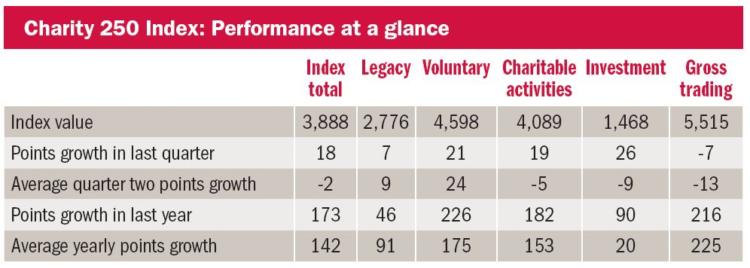

Charity 250 Index: Performance review

The haysmacintyre / Charity Finance Charity 250 Index performed well in the second quarter of 2016, outperforming its average quarterly rise by 20 points.

The top-performing income streams were investment, charitable activities and trading income, which outperformed their quarterly benchmarks by 35, 24 and 6 points respectively. Together they offset below par performance from voluntary and legacy income, which fell short of their quarterly benchmarks by 45 and 31 points respectively.