The noise around the progress of Brexit – or lack of – continues to be relentless. As far as financial markets are concerned, the fault line as to sentiment over Brexit has very much been focused on sterling.

Despite a significant wobble following the referendum, UK equity valuations are now broadly higher than back in June 2016. This is largely attributable to the fact that many international companies listed in the UK benefit from weak sterling as their foreign currency profits are translated at a more favourable rate.

However, even domestically focused companies that may be considered proxies for the UK economy (eg UK banks or property developers) are getting close to their pre-Brexit-vote valuations.

No deal?

This month Mark Carney of the Bank of England entered the political sphere once again in his address to Cabinet about the consequences of a no-deal Brexit. He explained that in that event, the UK would see a rise in unemployment and inflation, and net emigration for the first time since 1994.

He determined that this could culminate in a crash in property prices (an estimated 35 per cent fall), and damage to the economy that could not be remedied by cutting interest rates as the central bank did in the wake of the 2008 financial crisis.

In considering the future direction of sterling and the UK economy, it seems sensible not to rule out a no deal Brexit but to also consider that a considerable amount of bad news and uncertainty is already in the price.

It is also worth bearing in mind that the decision on any deal with the EU, including the trading relationship, will be decided in the two-year transition period. It will be the shape of this trade relationship as well as others subsequently established around the world that will inform the long-run equilibrium value of sterling versus its counterparts.

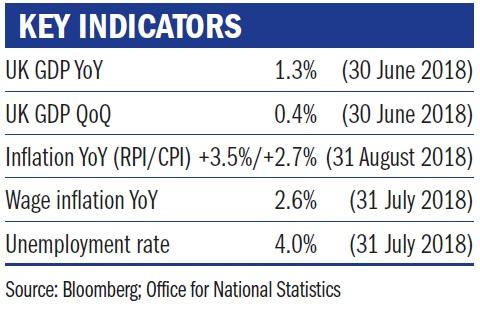

In the shorter term, while commentary around Brexit will continue to move our exchange rate, we must not lose sight of the domestic economic data and the path of Bank of England policy. On that front, the news flow has been rather more positive recently (services data, retail sales, tax revenue), and in the near term at least, this appears to offer something of a floor for the pound.

Jenny Renton is an investment manager at Ruffer