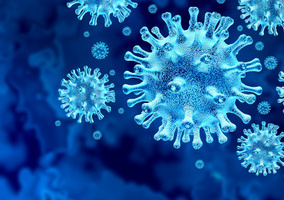

We regularly start client meetings with a breakdown of the valuation opportunity that we believe UK equities (company shares) represent at current levels. As illustrated in figure 1, when looking at a number of widely used valuation metrics we see that the UK stock market has hit historically low valuation levels relative to global indices. Much of the relative loss in value has come since the Brexit vote in 2016.

In figure 1, price/earnings (P/E) refers to the price of a security divided by the earnings per share. This measure provides an indication of how cheap or expensive a company’s shares are in comparison to one another with a high P/E level being considered expensive. Average measures can be used to look at different markets and indices.

Dividend yield, expressed as a percentage, is the dividend per share divided by the company share price. In normal market conditions, a high yield for a company or index would suggest a share or overall market was cheap. Dividends are a share in the profits of a company, which are paid out to its shareholders at set times of the year.

Price/book value, also known as price-to-book, is the ratio of the share price of a security divided by the book value per share. It compares the share price to the book equity value where equity is defined as assets less liabilities. Average measures can be used to look at different markets and indices.

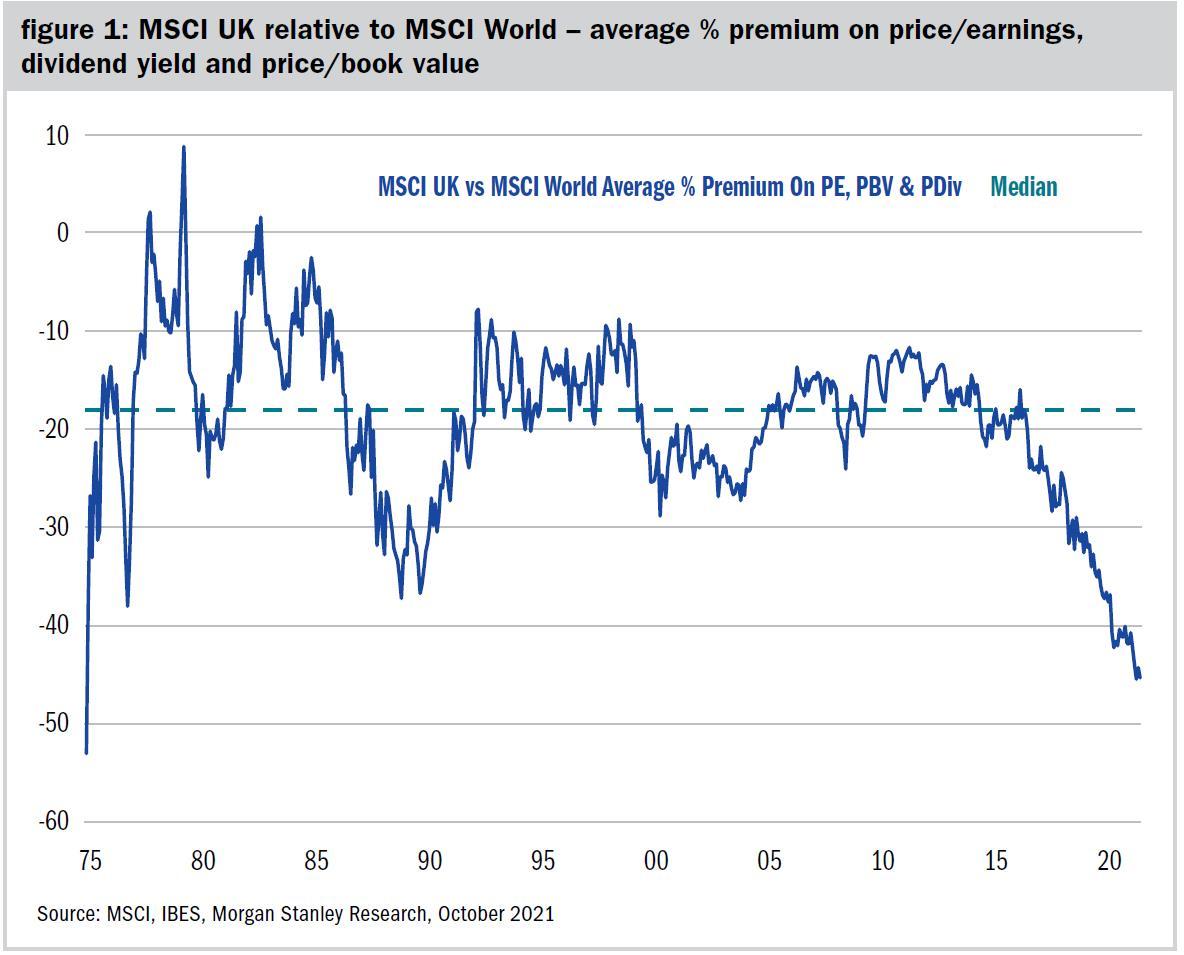

One of the consequences of this valuation dislocation is that holders of UK equities over the past five years have underperformed the wider world index. As is often the case, extended periods of underperformance can lead to investors questioning their decisions and wondering whether to allocate more capital away from the markets that are underperforming and towards those markets that are doing better.

In the case of UK investors, many have chosen to allocate more capital to international funds and global benchmarks over the past few years. Given their performance over that period the decision will have worked well, however, it is worth reflecting on the drivers of some of the international strength.

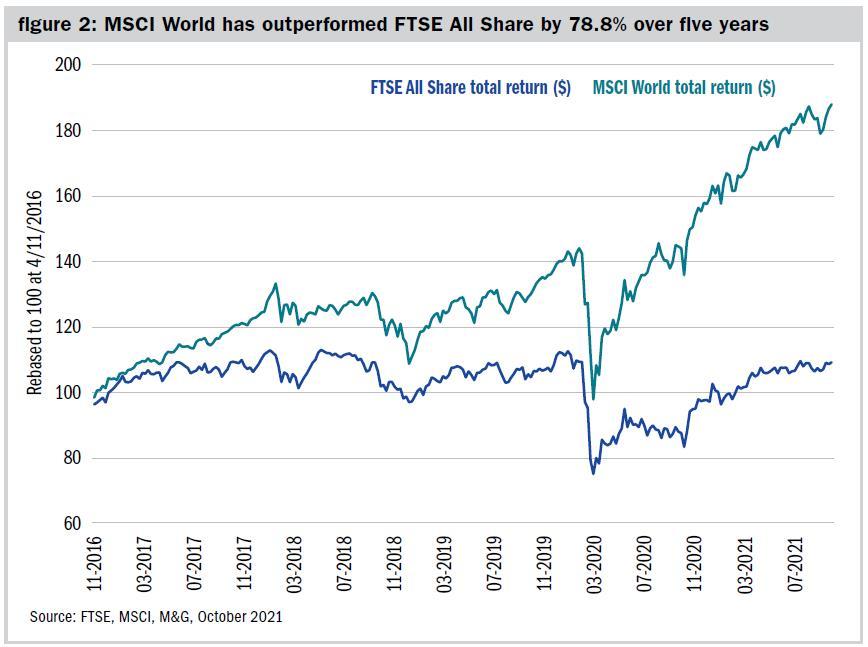

In particular, a small group of stocks by number, but of significant size, has been driving some of that international performance.

The five prominent American technology companies that constitute the so called FAANGs (Facebook (now Meta) Apple, Amazon, Netflix and Google (now Alphabet)) make up 11.1% of the MSCI World index, 17.2% of the S&P500 Index in the US and together are 1.9x larger than the combined market capitalisation of the UK’s FTSE All-Share Index (as at 27 October 2021). If we include Microsoft and Tesla too, then these seven companies represent 17% of the MSCI World and 26% of the S&P500.

This limited list of stocks exert significant (and, because of their size, increasing) influence on the performance of global stock markets. If we look at the performance of this cohort of stocks over one year for instance, we can see that they have, on their own, delivered 8% performance for the MSCI World and 12% for the S&P500, which represents nearly a quarter of the returns for each index. This accounts for all of the outperformance that the MSCI World has delivered above the FTSE All Share over the last 12 months.

When we look at the performance of the MSCI World index over the last five years and split performance of the top 20 by size, we can see how heavily these seven and other (mainly US) mega-sized companies, contribute to the index.

The strong performance of the international index, therefore, has been driven by a fairly narrow group of companies.

So what could change all of this? Interest rates

If interest rates do start to climb this could, in our opinion, provide a backdrop for better performance from the UK and also a more difficult backdrop for the FAANGs. The ultra-low interest rates that we have seen for the past decade (or more) have been one of the supportive elements for the performance of the share prices of the FAANGs. In an environment where interest rates are near zero, high valuations are more easily justified, because investors feel more emboldened to put their money in stocks rather than keep it in the bank. Conversely, rising interest rates are seen to help value stocks, which are traditionally represented in more cyclical, or economically sensitive, sectors of the market. The UK is one of the most value based developed markets. So, in a world where rising interest rates are now acknowledged as a possibility, there is a greater chance in our opinion of the UK performing strongly, and the FAANGs performing less well.

When investors look at the decision to allocate away from the UK and to international markets they therefore need to be aware of three things. The UK has suffered a period of poor relative performance that leaves it trading near 50-year lows; international markets have performed well as a consequence of the performance of a narrow group of companies that may or may not continue to shine; one never buys past performance, only performance to come – and UK markets, in our view, may have better relative days ahead.

The temptation when trying to determine asset allocation is to chase strong performance – after all the experience of the past decade is that assets that have performed well often continue to deliver good relative returns. However, there are times in markets when the investment environment changes and those things that have worked well don’t any longer. We do not know when the UK market will start to deliver better performance, it may well be that big tech companies continue to grow and contribute to strong performance from global indices. However, given the relative fortunes of the two markets over the past five years, there is a good argument to be made for diversification in asset allocation. If this performance normalises – ie big tech stocks return to more normal levels of performance – the benefits of remaining exposed to the undervalued UK market will, we think, become clear.

Michael Stiasny is head of UK equities at M&G

Charity Finance wishes to thank M&G for its support with this article

Related articles