While a halt in activity may be necessary to save lives, the cost is a huge burden upon those who are reliant on near term cash flows and who lack the ability to draw on large pots of savings. This not only applies to many that the charitable sector seeks to help, but also to charities themselves. A report released in July 2020 by BDO suggested that even before the pandemic hit, the average charity only held sufficient reserves to cover two months of running costs. It has also been suggested that close to 25% of charities had no reserves at all.

Pressure on income sources

This reliance on near-term income will undoubtedly lead to huge pressure for many. While demand for charitable services has increased, the early signs are that donations have declined, according to CAF. The impact of falling incomes, together with closure of charity shops and the cancellation or curtailment of fundraising events around lockdown measures, has had a material impact.

This represents a huge challenge given how significant a proportion of income such sources represent for most charities. Work by NCVO looking at over 160,000 voluntary organisations suggests that around 47% of income comes from the public (including both donations and charity shop turnover).

This means that for the sector as a whole, a large part of the income charities receive will be vulnerable to declines in just those periods when demand for their services is at its highest. A survey by CAF in April 2020 suggested that 29% of charities would have had to close within twelve months if lockdown continued.

Potential offsets

Thankfully not all charity income will be quite so vulnerable. Many charities will have other sources of income that are less sensitive to the economy. NCVO puts the income derived from government and the voluntary sector (including grants) at around 39% of the total. These sources of income can be vital, but are largely outside the charity’s control.

An alternative for those charities fortunate enough to have reserves or other capital available is investment. The range of investment vehicles available means that charities have the ability to select holdings that are relevant for their specific situation. Traditionally fixed income exposures will have provided more stable income as a supplement or support in periods in which donations and other sources are less available. Alternatively, charities with more capital or longer time horizons may have made more use of the stock market to help grow capital ahead of inflation for use in the future.

Today’s challenges and opportunities: using multi asset investment portfolios to manage income

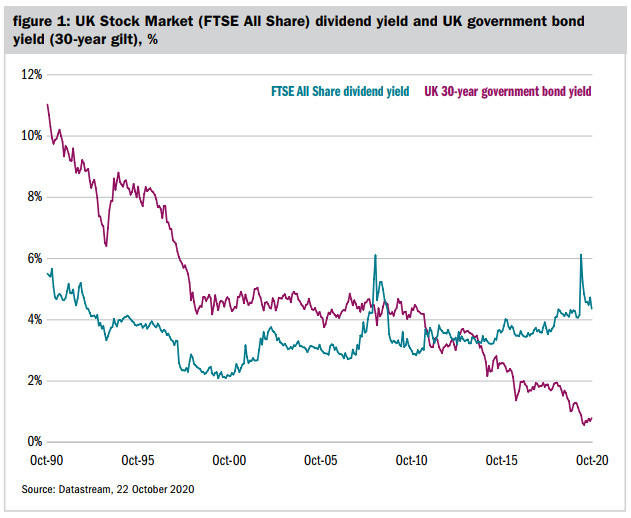

Today, around 8% of charities’ income is estimated to be derived directly from investment whether via bond coupons, share dividends, or other sources. However, the pandemic has created a real challenge for all investors looking for income. The annual return on lending to the UK government (a key source of safe income for much of the last thirty years) reached as low as 0.6% in August (for thirty year gilts), and that’s before inflation is taken into account.

For company shares (equities), long-term dividend yields look more attractive, but in the near term much of that income has been put on hold. Over 445 companies listed on the London Stock Exchange are said to have cut, cancelled or suspended dividend payments in 2020, and dividends paid out by the UK market are expected to be between 35% and 40% lower than they were in 2019.

This creates a challenge whereby the source of income less exposed to a charities funding needs (bonds) no longer offers the levels of income required. The stock market appears more compelling, but income levels are likely to be more variable and potentially correlated to the very economic trends that impact donations and funding needs.

Looking ahead therefore it seems that multi-asset strategies, which blend contributions from a range of assets such as equities, bonds, cash and property, will become increasingly important for charities. A silver lining to the journey to low gilt yields has been the strong capital gains from these bonds and others like them. This will have helped cushion losses in shares and other assets.

However, with yields so low today, managing capital and finding diverse sources of income in a multi-asset portfolio will very likely entail a more active approach than has been the case for much of the recent past. This activity will not only mean looking beyond more traditional exposures, but critically, being able to also adjust exposures between asset classes as markets move. As an example, active approaches that were able to add to equity and corporate bond exposures when panic hit markets in March will have been able to benefit from the strong recovery in prices and capture assets with far more compelling income yields. With interest rate and bond yields possibly staying lower for longer, the ability to generate total return (capital and reinvested income combined) out of volatility in this way will become increasingly important, as will the ability to look beyond the more traditional income-bearing assets.

The future

The path of the virus, the long-term impacts on the economy, and the passthrough from these effects to charitable giving are uncertain. Predicting the state of the charitable sector a year ahead from now is very challenging. However, the experience of the pandemic has emphasised the importance of diverse sources of funding, particularly the importance of income sources that are less likely to fall when needs are greatest.

Although investments in financial markets will always be sensitive to the state of the economy, the ability to create diversified portfolios to mitigate this risk, and to meet the particular needs of individual charities, mean that they can play a vital role. However, the landscape is one in which delivering these solutions will require more active management than may have been required in the past.

Stuart Canning is deputy fund manager for the M&G Charity Multi Asset Fund

Charity Finance wishes to thank M&G for its support with this article