The UN’s climate panel recently published its most comprehensive assessment yet included a clear warning: unprecedented and irreversible climate change is here – and it is only going to get worse. To minimise the impact, emissions must reach net zero around mid-century.

We believe policymakers and companies cannot wait for changes in the climate to become so severe that they are forced to act. According to LGIM research, if global emissions do not start falling until 2030, the cost of the transition will increase by five times.

Three pathways

At LGIM, we use three central climate scenarios in our analysis:

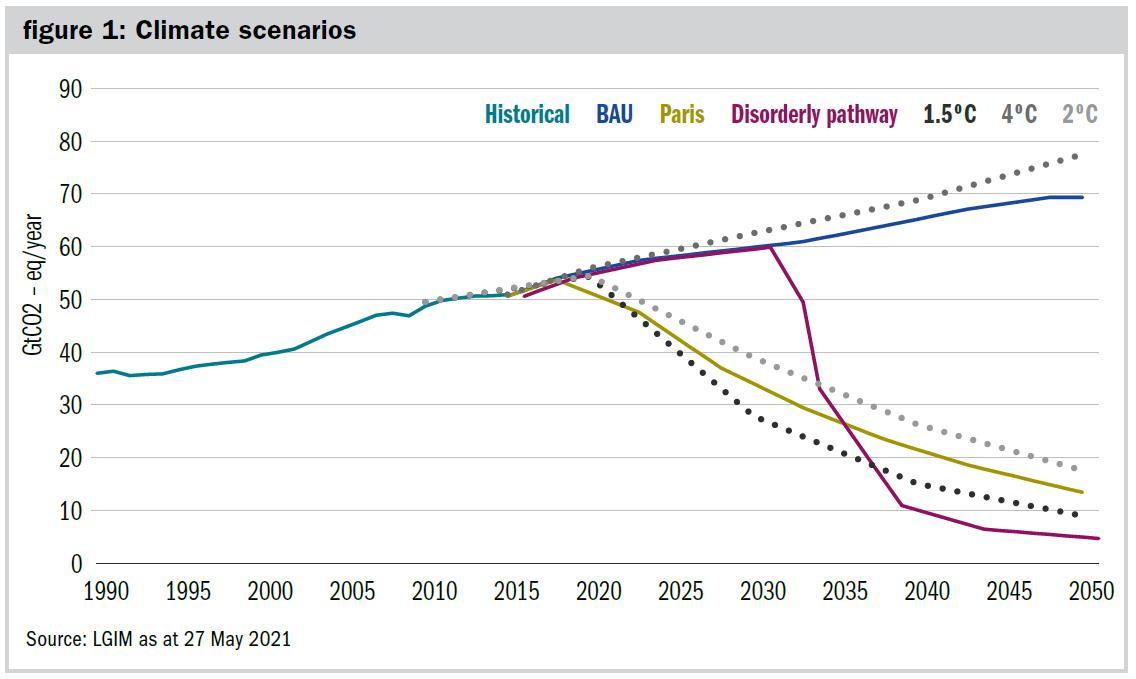

- The world takes no policy action, in a business-as-usual pathway, consistent with global warming of around 3.5 degrees by 2100. This scenario would be associated with significant physical risks in the second half of the century, potentially resulting in widespread macroeconomic disruption and geopolitical stress.

- The world takes organised, logical policy steps to reduce global emissions at a rate fast enough for an outcome consistent with the Paris accord and well below two degrees (although not to net zero emissions). This scenario has far smaller physical-risk consequences, but is associated with moderately significant transitional risks as carbon costs rise from near zero today to around $400 a tonne by 2050.

- The world does little to address climate change until the end of the decade, thereafter attempting to reduce cumulative emissions by the amount necessary under the second scenario. This disorderly scenario results in material macroeconomic disruption, creates a material risk of stranded assets, and pushes carbon prices to $1,000 a tonne.

In addition to the consequences outlined above, each scenario would clearly hurt risk assets, with the first and third causing the most damage to markets such as equities. The physical risks from climate change – and potential policy risks from mitigation actions – will also have other profound repercussions for a broad array of assets that are unlikely to be priced in today.

Concrete steps

This is why we believe investors and their advisers must start taking concrete steps to ensure they are integrating climate analysis into their strategic frameworks. As fund managers, we can conduct this analysis and design products that channel financial resources towards mitigation and adaptation.

But the challenge goes beyond changes we can make at the fund level. Climate change poses such a significant threat that we believe it needs to be considered as an issue of strategic importance by asset allocators worldwide.

In our view, active engagement could also help ensure the worst outcomes are not realised. Hence our work with companies under LGIM’s Climate Impact Pledge, to encourage them to increase the quality of disclosure, set credible targets and adapt business models, with the threat of sanctions should they fall short of our expectations.

The science underpinning the UN report could not be clearer: governments, companies and investors must take action. We cannot wait until more and more extreme climate events force our hand.

Nick Stansbury is head of climate solutions at LGIM

Charity Finance wishes to thank LGIM for its support with this article