For charity trustees, navigating markets may have felt like travelling through unknown territory in the past few years. But we’re starting to see some landmarks which give us encouragement that we’re on the road to lasting recovery. The path ahead isn’t completely clear, but we’ve seen enough to turn more positive about what’s around the corner.

The first landmark we saw was the top of the mountain of US interest rate hikes, which came into view in July last year. Now we believe we’ve seen a second – a trough in leading indicators of the global economy.

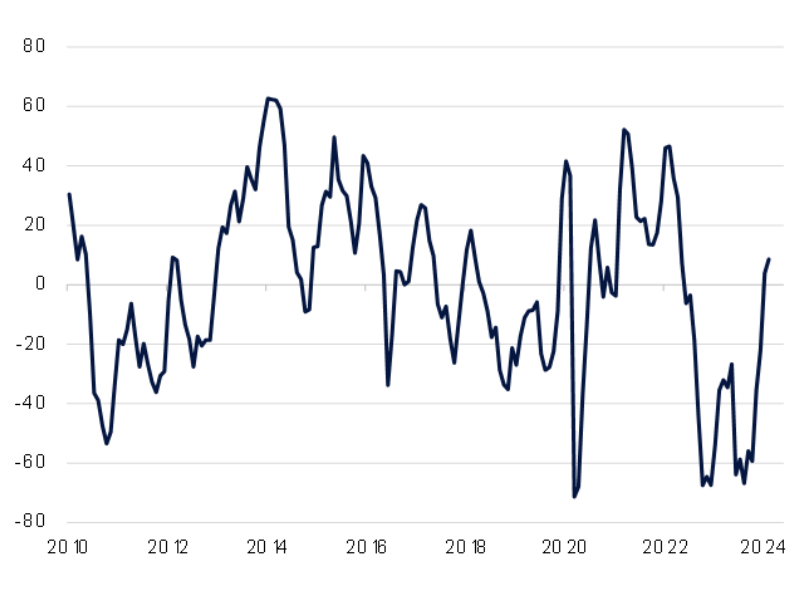

Rathbones tracks a broad range of data in order to give a timely indication of the direction of the global economy. And since late last year, there’s been a broad improvement in these statistics following a long period of deterioration. Things like trade figures from countries high up global supply chains, consumer confidence readings, and businesses’ reports of their new order books have improved around the world. Forward-looking surveys of the housing market have bounced in both the US and the UK too (figure 1).

And across advanced economies, we’ve seen more evidence that we’re past the worst when it comes to banks tightening their lending standards.

In many cases, these better measures still aren’t particularly strong. But there’s been a clear improvement in the rate of change, and this is very often what matters most to markets.

Taken together, this evidence suggests that the global economy may now be finding its feet again, having slowed significantly since 2021.

A few factors have probably contributed to the improvement we’ve seen in the past few months. Most significantly, the enormous shocks to food and energy supply, caused by the invasion of Ukraine, have reversed remarkably quickly. That has helped bring inflation down from double digits to low single digits, both easing the cost-of-living squeeze on consumers and allowing central banks to stop raising interest rates. In the meantime, some of the economic scars caused by the pandemic have continued to fade.

Risks remain

It is important to emphasise that there are still risks on the road ahead that charity investors need to be on the lookout for.

In the unusual economic cycle that has followed the pandemic, many of the leading indicators mentioned have been a less reliable guide to growth than in the past. So we should be careful not to overinterpret their recovery.

A few risks are still lurking, so we believe investors should temper optimism and retain an element of defensiveness even as we move away from our previous very cautious stance. Three are worth highlighting.

First, there’s evidence that all bar the wealthiest US consumers have now exhausted the so-called excess savings which they accumulated during the pandemic.

Second, there are signs that the US labour market is cooling, with job vacancies and firms' hiring intentions falling, according to surveys. So far, this hasn’t been accompanied by a marked increase in unemployment. But this is a risk we’re monitoring, since these signals have usually preceded rising unemployment in the past.

Lastly, there’s the possibility of hidden losses in the financial system after the sharp increases in interest rates since 2021, particularly connected to commercial real estate. It’s encouraging that the largest financial institutions generally have limited exposure to commercial property, but there may be some more pain to come for small and mid-sized commercial banks.

A better backdrop

Overall, though, we think that the economic backdrop has improved, laying stronger foundations for a broad, sustainable recovery in stock markets. That’s why we’ve turned more positive on equities. In doing so, we’ve deliberately taken a selective approach. Stocks have generally rallied strongly already since late last year, with major indices like the S&P 500 at all-time highs.

That makes us wary of simply adding to areas that have already factored in the improvement in the global economy we’ve seen, those where prices already incorporate a strong fundamental backdrop.

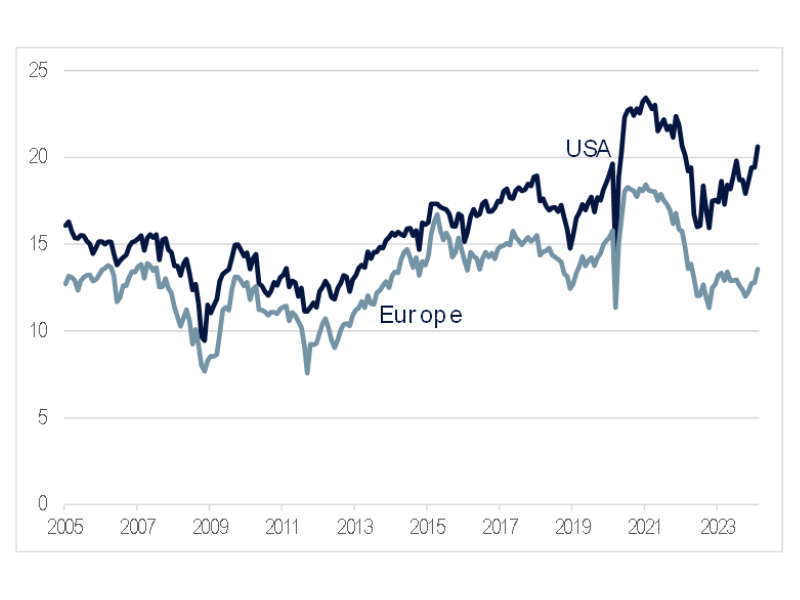

Analysts already anticipate profits of the 500 largest listed companies in the US growing by 10% or more this year and next, even though they fell last year (outside of the ‘Magnificent Seven’). The scope for positive surprises therefore seems limited compared to other markets, where expectations for profits are more moderate. It’s true that the US normally trades at a premium to the rest of the world, but that premium is currently far larger than usual (figure 2).

Instead, looking further afield, smaller stocks and those listed in Europe seem more attractively valued. As far as Europe is concerned, we’ve recently seen tentative improvement in the economic outlook alongside the brightening global picture. The region initially suffered much more than the US after Russia invaded Ukraine, causing its economy to stagnate for more than a year.

The region more broadly now seems to be recovering, and crucially less good news is already factored into asset prices there – so it’s an area to consider for broadening out your investment opportunities. Expectations for profit growth and valuations are significantly lower than among US large cap stocks. So, the bar for success has been set much lower.

While it is not completely clear what lies ahead, the economic backdrop has certainly improved.

Figure 1: UK RICS survey house price expectations balance

Figure 2: 12m forward price/earnings ratios (prices relative to earnings forecasts for the next 12 months)

Related Articles