Thomas Mobee provides a guide on how to get the maximum VAT relief on fundraising events.

One of the most valuable and widely used VAT reliefs from which charities benefit is their ability to exempt from VAT, the income generated when they hold events for the purposes of fundraising. This is generally referred to as a “one-off fundraising event”. Although widely used, our experience is that a number of charities continue to be caught out when they try to take advantage of this relief. We’ve put together for you, the top issues to be aware of when putting on a fundraising event.

What is a one-off fundraising event?

From a tax or VAT perspective, a one-off fundraising event is “any event organised and promoted primarily to raise funds (monetary or otherwise) for a charity”.

Therefore, it is important that attendees, participants, as well as members of the public are made aware that the motive for holding the event is fundraising.

Figure 1: Examples of qualifying fundraising events

- A ball, dinner dance, disco or barn dance

- A performance, such as a concert, stage production, film presentation,

- A fete, fair or festival

- An exhibition – such as art, history or science

- A bazaar, jumble sale, car boot sale

- Sporting participation, e.g. sponsored walk or swim

- A digitised event, for instance, on the charity’s own website, or that of a third party

HMRC agrees that where an event is designed in such a way as to span more than one day, it would be considered to be a single event (e.g. a golf tournament). However, where an event clearly starts and finishes in one day, but happens to be repeated on successive days, each one of those days would be considered to be a single one-off fundraising event (e.g. a jazz concert).

How does the VAT relief work?

This relief enables all income generated from the supply of goods and services at, or in connection with, a fundraising event, with the exception of income streams that would ordinarily benefit from being treated as zero rated, or non-business, to be treated as exempt from VAT. In other words, fundraising event income such as ticket sales, admission charges, advertising space in programmes would all potentially benefit from VAT exemption under this relief.

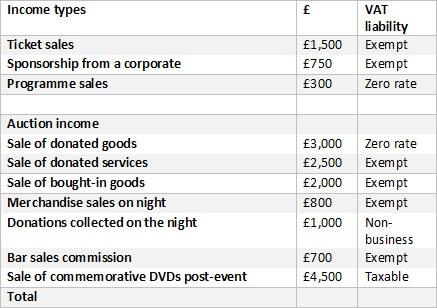

The following table shows the common income types that can be generated at a typical fundraising event, as well their applicable VAT treatment:

Figure 2: Common income types generated at one-off fundraising events

Where an event qualifies for the relief, the one-off fundraising exemption would be mandatorily applied and VAT would not be recoverable on costs. This could therefore have an adverse effect and the charity may choose not to fall within the fundraising exemption. In this example however, the costs incurred in respect of the fundraising event would be partly recoverable, because a proportion of the income generated (approximately 45 per cent) is taxable.

Who is entitled to benefit from the relief?

This exemption is unusual in that it is one of the few VAT reliefs that is not restricted just to the charity. Where it is clear that the event is for the benefit of the charity, a trading subsidiary could equally also benefit from this relief (for VAT purposes only*), provided:

a) It is wholly owned by a charity; and

b) it donates all profits made, from whatever source, to a charity.

It should be noted that even though an event may be organised for the benefit of a charity, the event would still not qualify for VAT exemption unless it is organised by a charity, or other qualifying body.

*For direct tax, profits generated in a trading subsidiary, are subject to corporation tax, regardless of the VAT exemption. However these can be reduced to nil by gifting profits to the charity.

VAT recovery on event-related costs

This VAT relief would only apply to income generated from the fundraising event. It, for instance, would not apply to any goods or services purchased in relation to the event. Where a charity appoints an agent, or promoter to organise the event on its behalf and the agent retains a proportion of the gross receipts from the event, this would be an agency fee and should be treated as subject to VAT at the standard rate.

That being so, charities should expect that VAT would be incurred on most, if not all of their event related costs, as the normal VAT treatment would be applied to these by their suppliers.

Summary

As a final comment, you might want to consider whether over the last four years, your charity has properly benefitted from this relief. For instance, there might be an opportunity to make a retrospective claim where supplies of zero rated items at fundraising events had not previously been separately identified in collating the income generated from the event. In such a situation, it is more than likely that the charity would benefit from making a windfall claim for additional VAT recovery on historic fundraising event costs.

Thomas Mobee is charity VAT senior manager at Buzzacott.

Civil Society Media would like to thank Buzzacott for its support with this article.

Thomas Mobee is available to contact on (0)20 7556 1320 or [email protected].