How can charities get better advice to optimise their spending needs? SEI conducted a study into the charities sector in 2018 and found that over a five-year period, 62 per cent of all charities experienced a growth in the value of their listed assets that was not proportionally matched by a subsequent growth in spending. Additionally, 38 per cent of study participants overspent against their asset growth. These study findings suggest that charities could benefit from dedicated investment management and advice on aligning their growth targets with their spending requirements.

What is an OCIO?

OCIO, which stands for outsourced chief investment officer, is a relatively new concept in the UK. It is a delegated investment model providing trustees with enhanced resources in advice and investment management, whilst offering potential cost savings, improved governance, access to technology and proactive ideas that aim to improve focus and overall results.

An OCIO goes beyond giving advice and investment management and provides insight into the holistic financial statements of a charity. An OCIO provider with sufficient scale reduces the fees paid for investment managers, but also increases spending power. This allows any charity to act like a multi-billion pound scheme, with the benefit of having skilled people, brand recognition, lower fees, and in-house resources at their fingertips.

What benefit does this have in practice?

Case Study – Coverage Ratio Analysis

Charities want to exist into perpetuity and act like long-term investors. The challenge is accommodating charities’ spending needs for the short and medium term, as well as creating bespoke investment targets for each charity. Charities that act like long-term investors tend to have the same investment goal: inflation + 3-4 per cent. But with varying business models and financial statements, should the investment targets be the same?

In order to answer that question, a coverage ratio can be very useful. A coverage ratio takes into account a charity’s current portfolio value and considers how a charity can ensure that sufficient resources exist over time to meet the required planned levels of spending.

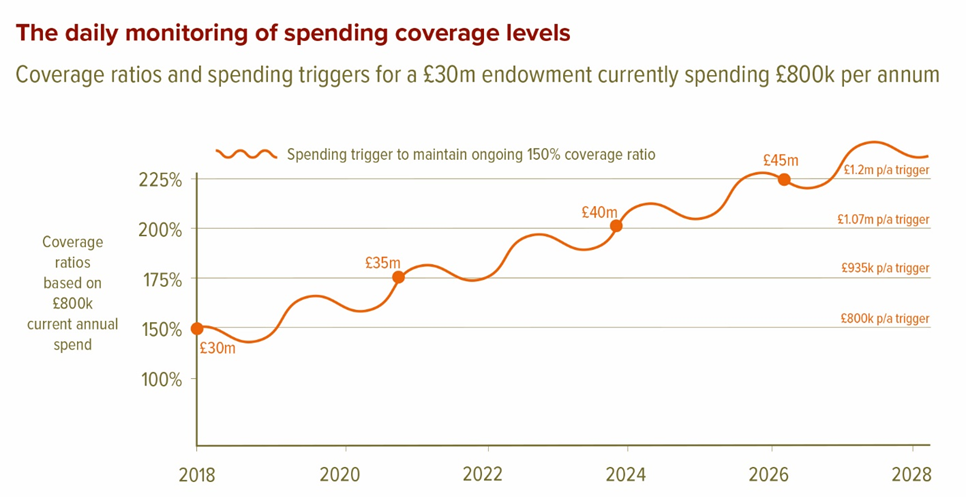

As an example, let’s take a charity with £30m of investable assets, an investment objective of inflation + 4 per cent and current yearly spending of £800,000.

The capital required to support £800,000 per year into perpetuity is £20m (£800,000/4 per cent), meaning that the coverage ratio of the portfolio is 150% (£30m/£20m).

Let’s say that the value of the portfolio rises to £40m. The endowment now has a coverage ratio of 200 per cent (£40m/£20m) if it wished to continue to maintain annual payments of £800,000 per annum in perpetuity.

At this stage, the endowment can now choose to release an extra £270,000 to support its charitable activities or work on a special project and still maintain its original coverage ratio of 150 per cent. This process can be repeated across various scenarios of required spending and target returns, enabling charities to quantify the link between endowment values and required spending. It takes into account the changes in risk via an increase or decrease in spending for a given portfolio return, meaning the OCIO model can beyond a static inflation + 4 per cent target, delivering the dynamism that could help charities further their mission.

Conclusion

By partnering with an OCIO with significant scale, focus and the open architecture of a manager-of-managers platform, charities can access a holistic solution that not only accesses fee leverage, but can unlock access to a vast array of specialist managers. This helps charities to:

- Align endowment assets with organisational spending and liquidity needs

- Improve stability and predictability through active diversification and portfolio modelling

- Refine focus to the issues that impact their long-term mission

Pradeep Kachhala is a business development director at SEI Investments, a global fiduciary manager.

This content has been supplied by a commercial partner

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. Past performance is not a reliable indicator of future results. The value of an investment and any income from it can go down as well as up. Investors may get back less than the original amount invested. Additionally, this investment may not be suitable for everyone. If you should have any doubt whether it is suitable for you, you should obtain expert advice. The opinions and views in this document are of SEI only and are subject to change - they should not be construed as investment advice. This information is approved and issued by SEI Investments (Europe) Ltd (SIEL), 1st Floor, Alphabeta, 14-18 Finsbury Square, London, EC2A 1BR. SIEL is authorised and regulated by the Financial Conduct Authority (FRN 191713). This document and its contents are directed only at persons who have been categorised by SIEL as a Professional Client for the purpose of the FCA Conduct of Business Sourcebook.

Related articles