Charities involved in the Growth Plan pensions scheme should brace themselves for further increases in payments, says David Davison.

Participants in the Pensions Trust Growth Plan should shortly be receiving details of their new deficit contributions payable from April 2016. Frighteningly these are related to the September 2014 actuarial valuation, the results of which should only be made available this month.

This means that changes are being made available 16 months after the fact, leaving participants with less than three months to prepare for the changes, let alone consider questioning them or taking action to deal with them. In an age of high tech computer technology this does seem an inordinately long time to take to produce the scheme results.

The other problem with this is that it means that the contributions are being set based upon information and market conditions which could be very dramatically different from the up to date position.

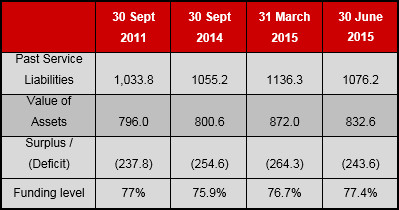

For example in the quarterly update as at 30 June 2015 issued by the Trust at the end of October 2015, for the first time in a very long time we saw an improvement in the deficit position of about 4.3 per cent over the position at September 2014. This is welcome news given the 17 per cent fall between September 2013 and 2014.

The improvement would have been even greater, just short of 20 per cent, had this been on like for like assumptions. However market conditions had deteriorated to June and so the lower improvement reflects this. The solvency valuation figures in the update and from 2011 are shown below.

The improvement in the funding position from September 2014 to June 2015 was primarily down to:-

- Recovery plan contributions paid over the period

- Changes in gilt yields resulting in a reduction on the value placed on liabilities

- The above have been to some extent offset by higher expectations of long term inflation which has increased the value of past service liabilities

The good news for Growth Plan participants is that I would expect that if interest rates / gilt yields begin to rise, then given the Growth Plan has a disproportionately small amount of inflation linked liabilities, continued reduction in liabilities and therefore deficits could continue, subject of course to what happens on the asset side. However, again given that pretty much all of GP3 liabilities are matched out by deposit type assets the return on these should also improve if interest rates rise, providing a welcome boost to asset returns.

The bad news however is that while the funding deficit between 2011 and 2014 has only marginally deteriorated over the period the number of employers in the Plan has also fallen significantly so this deficit must now be shared out across a smaller number of participants resulting in higher contributions, the same contributions over a longer period or a combination of both. Based upon the Trusts figures the Plan seems to be losing employers at rate of around 100 a year so numbers will have fallen from below 1,500 at the last valuation, to something below 1,200 now.

Clearly the impact on the contributions will depend upon the relative size of the employers who have left in comparison to those who remain and also the terms on which they exited, namely were they able to settle their exit debt in full or did they add to orphan liabilities by being unable to settle the debt in part or in full? We’re unlikely to know the detailed impact of this until the full valuation report is available.

The Trust suggest that only a very small number of employers, around 50, have been unable to settle their debt in full since the regulations were changed in 2005, and some of those were able to make a partial payment suggesting that the majority of the orphan debt issues are legacy ones.

So employers need to brace themselves for further contribution increases payable from April 2016. It is also important that employers are aware that these contributions are set to target full funding on an ‘ongoing’ basis – they are not set to target exit or wind up. This means that on a like-for-like basis a further liability might well be due at the end of the funding period to allow employers to exit the Plan at this point.

With this knowledge, employers need to be considering what options might be open to them in the short to medium term to allow them to better and more cost effectively manage their pension scheme liabilities.