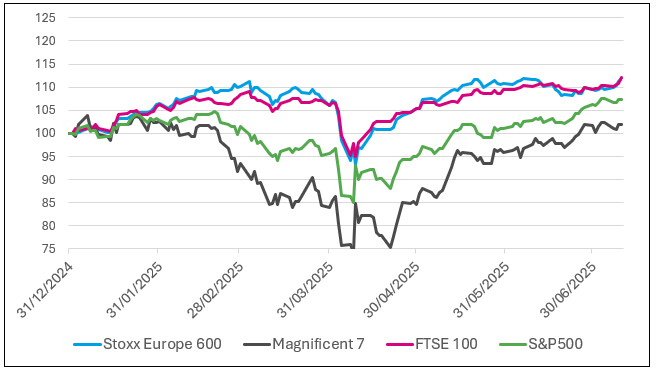

Squeezed household budgets and fewer young donors mean that charities increasingly rely on other income, including income from investments. But this year, even investments have had their ups and downs. Many of those wobbles were triggered by the new occupant of the White House.

As US defence secretary Donald Rumsfeld used to say: “There are known knowns, known unknowns, and unknown unknowns.” Six months after Donald Trump returned to the Oval Office, at least we have the answers to some of the known unknowns at the start of the year.

So, what have we learnt? Let’s look at four catalysts that we identified at the start of 2025.

Tariffs

Tariffs, investors feared, would slow growth and raise inflation. That’s why share prices fell when President Trump announced his “reciprocal tariffs” in early April. But it took a sudden rise in the yields on long-dated US government bonds before Trump announced a pause in tariffs, for negotiations. (Bond yields rise when bond prices fall, and vice versa).

Lesson learnt? Robert Armstrong, a Financial Times columnist, coined the phrase TACO: Trump Always Chickens Out. It seems that Mr Armstrong was at least right as far as Trump’s tariffs were concerned. That’s why we take recent threats, to impose a 50% tariff on copper, or a 200% tariff on pharmaceuticals, or to cut off negotiations with Canada altogether, with a grain of salt.

Federal Reserve

Secondly: Unlike the Bank of England, America’s central bank hasn’t cut rates yet this year, although investors expect it to do so in coming months. Instead, the Federal Reserve (the Fed) has focused on inflation, which continues to trend above the 2% target. In the short term, that hawkish view has put a brake on share prices. But in the long term, it’s probably better not to have a central bank that succumbs to political pressure.

President Trump may yet try to appoint a successor for Fed chair Jay Powell, whose term as chair ends in May 2026. An early appointment of a successor might undermine Powell’s capacity to guide markets in the remainder of his term. Again, however, the bond market may restrain some of President Trump’s more adventurous ideas.

Investor sentiment

A fall in investor sentiment would be a bullish signal for financial markets. Paradoxically, the theory goes that, the lower investors’ expectations are, the lower the bar that sets for positive news to enthuse investors. When sentiment is negative, sellers have probably sold the shares they wanted to sell, and bargain hunters are more likely to be successful.

We follow several gauges of investor sentiment, and we prefer the ones that are based on monies flowing into and out of financial markets. Bank of America’s Bull & Bear Indicator by Michael Hartnett is a prime example. His indicator rose to a three-month high in June, from more negative sentiment in the first quarter of the year, so this indicator commands caution.

Company earnings

Company earnings remain the bedrock of investing in shares because that is, ultimately, where all value created for shareholders comes from. US company earnings grew 4% in the second quarter, year on year, substantial growth but slower than the first quarter’s 13%.

Financial analysts who track companies traded on the stock exchange regularly raise or lower their outlooks for these companies’ earnings over the coming quarter or the coming year. A bit like investor sentiment, the recent trough in their earnings revisions may have been a bullish signal. But recent earnings revisions are more positive again.

In Europe, NATO members’ recent, Trump-inspired commitment to spend 5% of gross domestic product on defence and defence infrastructure could boost company earnings

In conclusion: it appears that the recent peak in policy uncertainty is now behind us. The situation on tariffs, on the Fed, on NATO etc is clearer than it was at the start of the year.

The cost-of-living crisis and the slowdown in charitable giving are unlikely to go away in the short term. But investment markets look steadier now than they did in April. And the past six months have cleared up some of the known unknowns that had us wondering. We remain acutely aware of the unknown unknowns, though. Mr Trump rarely fails to surprise his audience.