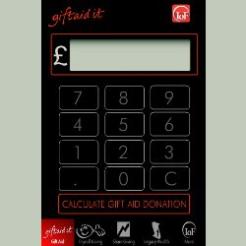

The Institute of Fundraising has launched an iphone application making it easier for donors to see the benefits of tax-effective giving.

The Giving Calcs application calculates the tax benefits and costs of donating using gift aid, or through payroll giving, legacy giving or share giving. Users will be able to use Giving Calcs to breakdown the value of a donation and the relief available.

The application uses four calculators which relate to each of the aforementioned donation types. The share giving calculator allows the user to calculate the value of a share donation by selecting the appropriate tax rate, and the legacy calculator allows you to make a calculation based on the value of a donor's assets including their house, cash savings, shares, bonds and life policies.

While the calculators are already available on the IoF website, Lee Grant, IoF’s tax-effective giving project manager hopes the iPhone app will make the service even more accessible: “I am delighted to announce this great resource for those involved in charitable giving, providing a wealth of information about tax-effective giving at your fingertips,” he said. “We hope the app will become the ‘must have tool’ for face to face and major donor fundraisers”.