Scrutiny of the Church of England’s investment portfolio, which grew in value last year by 9.7 per cent, has intensified, with Conservative MP Claire Perry urging the Church to disinvest from Google in protest at its failure to tackle online child pornography.

It follows last week's revelations that the Church Commissioners, which manage investments on behalf of the Church of England, indirectly invests in Wonga, which the Archbishop had said he wanted to “compete out of business”.

Speaking to the Daily Telegraph, Perry, an adviser to Prime Minister David Cameron on preventing the sexualisation and commercialisation of childhood, said: “It is quite clear that many companies, in particular British internet service providers, are finally now taking a really responsible approach to this. They are seeing that we want a level of social responsibility.

“There are others out there who have not got that attitude. The Prime Minister was saying Google have a responsibility, they are effectively helping people for which there can be no case made.

"They [the Church of England and other investors] have a role to play, they have questions to ask themselves. They are moral leaders. If they are going to opine on things then putting your money where your mouth is an incredibly powerful tool."

The Church, through its ethical investment advisory group, has already pledged to challenge internet providers which promote pornography.

It said in a statement today: “We share the government’s concern about access to child pornography and are glad they are engaging with Google on this issue. We engage ourselves with internet companies relating to pornography and take this issue very seriously. The issue with Google is a structural one relating to search providers and we support the government’s work in this area. ”

Last year, the Church sold its £1.9m share in News Corp after deciding it was not happy with its governance.

Church's investment portfolio performing well

The Church Commissioners' accounts for the year ending December 2012 show that its investment portfolio, worth around £5.5bn, has experienced an average 9.9 per cent growth every year since 1992. Over the past decade its portfolio has returned 139 per cent; over the past 20 years, it has returned 558 per cent.

Some of the Church’s largest investments are in Shell (£37.8m), HSBC (£32.9m), GlaxoSmithKline (£18.2m) and mining firm Rio Tinto (£12.1m).

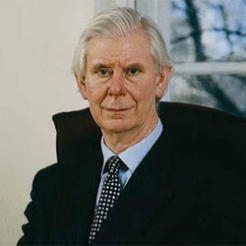

Looking in detail at its investments in 2012, Andreas Whittam Smith, the First Church Estates Commissioner, said it was well served by equities, which exceeded performance. He adds that investments made into smaller companies outperformed their larger counterparts. Residential and rural property also outperformed. And it had good performance from the asset class timber, which has recently been added to its portfolio.

Andreas also said keeping away from investing in longer-dated government bonds, index-linked bonds and quality corporate bonds turned out to be a “wise decision”.