Allia has today launched the first social impact bond for retail investors.

The Future for Children Bond, which is looking to raise £1m, will invest into a social impact bond in Essex County Council providing intensive support to 380 vulnerable young people and their families

The eight-year Future for Children Bond has a minimum investment of £15,000 and gives a minimum return to investors of 100 per cent of funds invested.

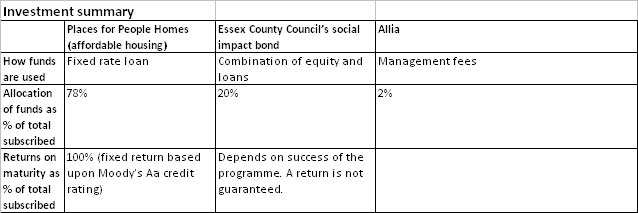

So investors get back at least their original investment, the bond combines a low-risk investment into affordable housing with a high-risk investment into the social impact bond.

Of every £1,000 invested £780 will be loaned to Places for People Homes, a Moody Aa housing provider that builds, sells and rents homes. The repayment of the loan plus compound interest will be £1,000, enabling Allia to give investors back the amount they originally invested. Some £20 will be levied in management fees.

The remaining £200 will be investment in the social impact bond for Essex County Council. The social impact bond has already raised £3.1m in commitments from a range of institutional investors, including Big Society Capital.

Some of this institutional investment has been scaled back to allow for retail investment into the social impact bond. Therefore, because the full amount has already been raised, the Essex social impact bond will go ahead regardless of whether the full target of £1m is raised in Allia’s Future for Children Bond.

Tim Jones, chief executive at Allia said: “We’re seeing growing interest amongst investors in using their investment funds to achieve a social impact as well as providing a financial return. Our capital plus bond gives the first public opportunity for retail investors to take part in this kind of innovative high-risk high-impact model.

“With the Future for Children Bond, investors can help give a better future to some of society’s most vulnerable young people, with the potential for sharing in the financial benefits while also keeping their capital at very low risk.”

The Essex social impact bond, which is managed by Social Finance, will fund a programme of multi-systemic therapy which will provide intensive support to approximately 380 children and their families. The target is to divert around 100 young people from entering care by providing support to them in their home. The success of the social impact bond will be measured by the reduction in days spent in care by these children, as well as improved school outcomes, wellbeing and reduced reoffending.

If the programme is successful in reducing the amount of time children need to spend in care, it will result in cost savings for Essex County Council, which can be used to provide a return to the investors in the social impact bond.

Data on the number of care placement days for children in the programme will be tracked on a monthly basis and investors in the Future for Children Bond will be updated annually on the payments received.

David Hutchison, CEO, Social Finance said: “We are keen to expand the investor base into the Social Impact Bond market and are delighted that Allia is offering this investment opportunity to retail investors through the Future for Children Bond.

“Allia has a strong track record in developing investment products to raise finance for social benefit. We feel this launch is a particularly innovative way of giving retail investors the opportunity to invest in a social impact bond whilst having confidence that they’ll get their capital back.”

The Future for Children Bond opens on the 4 February for investment and closes on 15 March 2013 or earlier if fully subscribed.