While governments and central banks around the world have acted quickly to mitigate some of the consequences of the Covid-19 crisis, we are all too well aware that charities are feeling the effects, both in their own charitable work and in their finances. Fundraising events have been cancelled, donations have fallen and charity shops have closed. A recent survey by CFG, NCVO and the Institute of Fundraising indicated that UK charities are expecting the pandemic to cause a 48% decline in fundraised income at the same time as a 43% rise in demand for their services. Evidently, many things have changed, but their need for income has only become greater.

For those charities who are fortunate enough to have invested assets, the income flow from those assets often provides the financial backbone of the charity, supplying working capital as well as supporting beneficiaries and funding grants. While there are a number of different investment strategies a charity might adopt to meet its objectives, traditionally, those charities with an income approach to investment, would only withdraw the income (equity dividends, fixed interest coupons, income received from unit trusts and cash interest) that is physically produced by the portfolio. This has many advantages including ease of identification, reliability of income and long-term protection from inflation.

A charity adopting this approach will likely have had a large proportion of their assets invested in UK equities over the last 20 years, a theme that remained as prevalent as ever in 2020. The UK has been an increasingly attractive place to invest for income investors, from a yield perspective, as yields elsewhere have compressed.

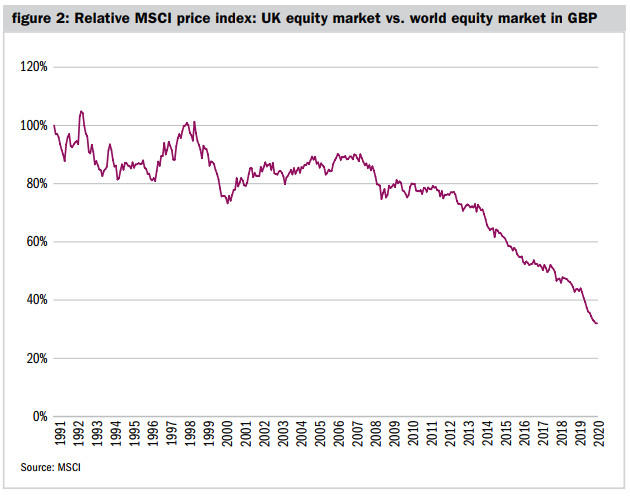

However, the UK has been a particularly challenging place to invest, especially when compared to other overseas developed markets. In the year to 30 September 2020, the UK equity market fell 17.5% compared to global equities, which have returned 0.5% in sterling terms. This underperformance is not a new phenomenon, though, and has been a recurring theme on and off, apart from short spells of outperformance, for the last 20 years. This is also somewhat true over the longer term. Figure 2 shows the MSCI United Kingdom Index relative to the MSCI World Index (in GBP) since 1990. The relative underperformance, since 1999 anyway, is quite staggering.

Much of this can be explained by the sector composition of the UK market; a heavy reliance on financials, telecoms, big pharma and old energy, none of which have performed well in the low interest rate, low growth environment we have been living in for much of the last two decades. Unfortunately, for income investors, they also happen to be the companies that have historically been some of the biggest payers of dividends.

However, the reaction to the pandemic has seen the revenues of many businesses dry up and with no earnings and profits, dividends have had to be cut. This has been prevalent in areas of the world with an engrained dividend culture and the UK is at the forefront of this. When revenues recover, one would hope that these dividends will be reinstated, but there are plenty of companies that have been over distributing over the years and the events of this year may well shape their capital allocation decisions going forward, with payout ratios falling significantly.

This raises a number of questions. How are these investors going to make up this potential income shortfall? Will they have to just accept a lower income? Adjust their budgets permanently? Should they forgo income and invest more overseas? Or should one consider a change in investment strategy, by adopting a total return approach?

Under this approach, the form in which investment return is received does not matter as both income and capital can be used to meet spending requirements. The yield of a portfolio becomes the function of the asset allocation and the investments selected rather than vice versa. There are many advantages for charities adopting this approach. Investments can be selected on a best of breed basis, which ensures there is no bias within the portfolio. When yields are low, total return investors can still remain well diversified across a broad range of asset classes and sectors, not just invested in those assets paying the required income.

Perhaps most importantly though, investment choices are maximised and this enables charities to focus on investments that are expected to give the best performance overall. We now live in a complex, faster moving economy where globalisation, technological change, increasing regulation and shifts in consumer demand are all exacerbated by the speed at which information is disseminated. Many of these trends have been accelerated by the recent pandemic. One only has to look at the change in the composition of the top ten companies in the MSCI World Index over the past 20 years; in today’s top ten, Microsoft is the only survivor from 1999 (which included BP).

The top ten is now dominated by new economy companies, only a handful of which pay out any dividend income. Companies that prioritise dividends look destined to stagnate. Global stock markets have been wise to this too: high dividend payers rank as some of the worst performers year-to-date. Furthermore, the UK makes up around 5% of the index, so it seems prudent to widen your investment universe, even if it is at the expense of a bit of income.

Over the last decade we have adopted a more global approach with a focus on those companies that we feel can grow steadily over time, have strong economic moats and robust cash flows to pay dividends. This allows us to capture more investment opportunities from all over the world, including in sectors less well represented by UK-listed stocks, such as technology and healthcare. We have therefore been allocating capital away from the UK.

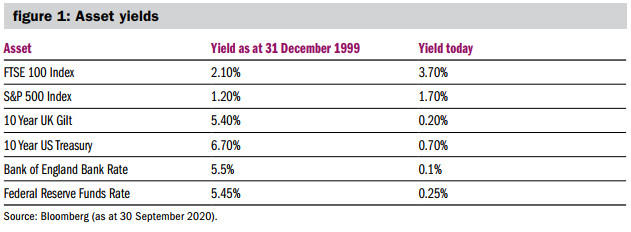

Furthermore, a total return approach also allows investors further flexibility to invest in other asset classes, outside of equities, that potentially offer less by way of an income return but with the potential to achieve higher total returns. In the current environment, with bond yields anchored near record lows, this is an attractive proposition for investors.

There are disadvantages of course. The capital gain element is not as easy to separate out the way that income is, and you may well be forced to sell investments to fund a withdrawal when markets are low. This would have a negative effect if the sale occurs when markets are low although it can have a positive effect if they are high. This risk can be smoothed out if withdrawals are made monthly for instance, rather than annually. Income will continue to form part of the return, while we usually have some cash on deposit that again can reduce the risk of bad market timing.

Looking at the empirical evidence, though, it is conclusive that investing using a total return approach over the last decade will have produced a better overall return. A charity with a 3% income requirement, that had adopted a total return approach and simply withdrawn 3% every year from a mixture of capital and income, but had the freedom to invest in the best opportunities available to them, would likely have had a larger allocation to the MSCI World Index (for this illustration we are assuming a 100% allocation). This charity would have generated a total return of +11.6% per annum over the last 10 years through a mixture of both capital appreciation and income generation. At the same time, a charity that had adopted an income only approach, in order to meet this 3% income target, would have been “forced” to invest the bulk of their assets in the MSCI UK Index in order to meet this requirement (again for this illustration we are assuming a 100% allocation). This charity would have returned +4.1% over the same period with the majority of that return being made up of income and with little growth in the capital base.

The difference in returns are easily visible. In both cases they would receive the 3% income they required but the charity adopting the total return approach would have been able to grow its capital base by c.7% per annum more than the charity that had simply adopted the more traditional income only strategy. Evidently, this is a very simplistic way of highlighting the different return profiles of each strategy over the last 10 years, and of course, there are other asset classes available, but it does demonstrate the difference to some extent.

For investors that are currently invested for income and therefore might have a high allocation to UK equities, they may well question whether now is the right time to start shifting exposure overseas. On some valuation metrics, shares in Britain’s leading companies are currently the cheapest they have been since records began. Much seems to depend though on a strong global recovery, driven by the discovery of a Covid-19 vaccine and a workable trade deal with the EU but one could argue though that it is more of an asset allocation call rather than an investment strategy decision.

A total return approach has many of the positive attributes an income only approach can offer, as well as greater flexibility. Although the income stream might be a bit more volatile on an annual basis (more volatile the higher the withdrawal rate), the opportunity set of what one can invest in increases significantly, hopefully enhancing returns, while reducing volatility as portfolios become more diverse, rather than just income producing. They both have their distinct advantages and disadvantages, and we do not favour one approach over another but believe the merits of each approach should be considered by trustees.

Sam Barty-King is investment director at JM Finn

Charity Finance wishes to thank JM Finn for its support with this article