There has been increasing negative sentiment against climate change mitigation and broader sustainable investing in 2025, most notably from the second Trump administration in the US.

However, we believe the case remains strong for investors aiming to align with the goals of the Paris Agreement.

Political pushback against climate change has been brewing since the beginning of the year. In January, US President Trump signalled his intention to withdraw the US from the Paris Agreement on climate change for the second time.

The administration has pulled grants supporting climate-positive agriculture, clean energy and transportation through its Department of Government Efficiency (DOGE).

More recently, we saw the dismissal of hundreds of scientists working on the National Climate Assessment, a congressionally mandated report on extreme weather events.

While this is concerning, looking back at Trump’s first term may provide some comfort. Companies continued to announce greenhouse gas (GHG) emission reduction goals at pace, while several global industry decarbonisation initiatives also took root during the period.

For example, Climate Action 100+ was launched in 2017, bringing investors together to engage with the world’s largest corporate GHG emitters, to curb GHG emissions and improve governance on climate-related risks.

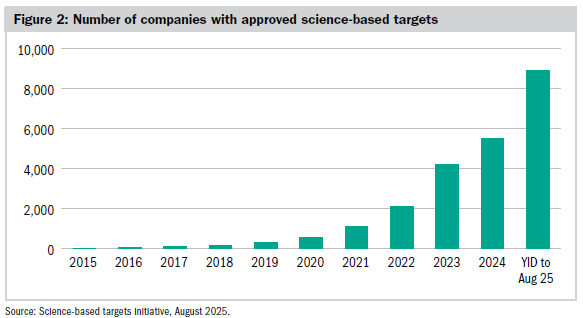

The science-based targets initiative (SBTi) also gained traction, encouraging companies to set ambitious, externally verified emission reduction targets in line with climate science.

Decarbonisation is an integral part of risk management

M&G’s Sustain Paris Aligned strategies aim to invest in quality companies. Specifically, we seek companies which are capable of delivering sustainable and growing financial returns over time, and showing resilience through different market conditions, with a strong focus on managing risks.

Against a backdrop of rising physical climate effects and increasingly stringent regulations, we believe that climate change and decarbonisation can present a significant risk for all companies. We therefore dedicate significant resources to the analysis of companies’ decarbonisation approaches.

We consider whether companies have set science-based targets, aiming to deliver decarbonisation at the rate needed to limit the worst effects of climate change.

We also review the company’s decarbonisation strategy (ie the steps it will actually take to cut GHG emissions), and the governance around this (for example, whether executive remuneration is linked to GHG emission reductions).

This information helps us to understand how the company is mitigating the risks surrounding decarbonisation, and forms an important part of our fundamental analysis.

Companies are in it for the long term

Turning back to the recent political environment, we should also consider that decarbonisation is a long-term effort, which will play out over the next decades.

Conversely, president Trump will only hold office for another three and a half years. Crucially, if a Democratic candidate is elected in 2028, they are likely to re-commit the US to the Paris Agreement.

It is encouraging that many companies in the US and elsewhere are sticking to their decarbonisation commitments in the face of political headwinds. Many have already set out long-term plans – and invested significant amounts of money – towards decarbonising their operations.

Furthermore, companies operating globally operate across different regions, including those that remain committed to decarbonisation. They will therefore need to continue their efforts, in line with the regulatory requirements and social demands.

Even within the US, companies operating in states that have set state-wide targets, such as California, must continue decarbonising without losing progress in these crucial years.

Momentum continues apace

While it may be easy to be caught up in the pessimism, it is important to note that the world’s progress towards net-zero GHG emissions continues. In our opinion, the risks and opportunities around decarbonisation aren’t going anywhere.

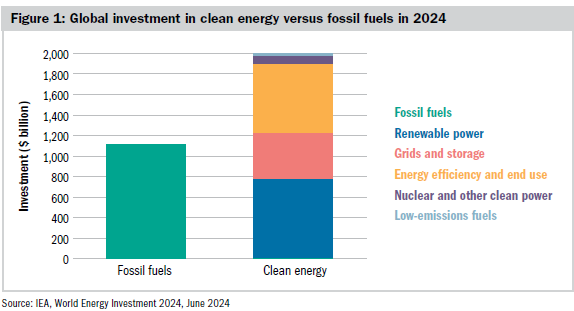

Today, according to IEA’s World Energy Investment 2024, the world invests twice as much in new energy technologies as it does in fossil fuels. In 2024, Ember Energy’s Global Electricity Review stated that the global increase in solar generation capacity reached a record 474 terawatt-hours (TWh), almost matching the entire electricity demand of Germany.

In China, more than half of all new car sales are reportedly electric. The process of upgrading our infrastructure towards decarbonisation is continuing apace.

We have also seen increasing numbers of companies take a step towards mitigating decarbonisation risks by setting science-based GHG emission reduction targets. As of early 2025, nearly 8,900 companies had their emission reduction targets approved by the SBTi, up from 5,500 in 2024.

It is also encouraging to see that nearly a third of companies with validated climate targets are now based in Asia. This signals growing participation in that region, and will aid the efforts of global companies in securing GHG emission reduction across their wider supply chains (also known as Scope 3 emissions).

What does this mean for Paris-aligned strategies?

Despite near-term political headwinds for decarbonisation, we remain confident in the long-term outlook for Paris-aligned investing.

Climate change-related risks and opportunities clearly aren’t going anywhere, and will likely become even more pronounced over the coming years. They will continue to form an integral part of company analysis.

Engagement with investee companies remains crucial. And while there may be new challenges with US-based companies in the short-term, we are committed to engaging on topics such as net-zero targets, decarbonisation strategies and ongoing monitoring of progress. Our engagement with US companies remains positive.

Our investment philosophy remains unchanged. We will continue to seek quality companies, that can show resilience and have the potential to deliver good long-term financial returns for our clients.

The analysis of decarbonisation risks remains part of our deep fundamental company analysis, as we believe this will continue to be an essential part of holistic risk management, despite the recent political headwinds.

Case study: Siemens

Siemens is a company listed in Germany, but has a global footprint. It serves over 190 countries, and more than 90% of Fortune 500 companies use its software, while 33% of machines worldwide run on Siemens AG controllers (pieces of hardware used to automate processes).

In order to meet local regulations across the many jurisdictions in which it operates, the company has set stringent decarbonisation targets. It aims to reduce GHG emissions from its own operations (Scope 1 and 2) by 90% and its value chain (Scope 3) by 15% by 2030 compared to 2019, in line with a net-zero pathway.

The company has set a clear strategy to achieve these targets, and responsibility for sustainability lies with the managing board and chief sustainability officer, supported by the Siemens Sustainability Board, with ESG metrics included in executive compensation calculations.

This focus on decarbonisation also provides economic advantages. The company falls on the right side of regulations, so is less likely to face fines, suffer reputational damage or otherwise require capital expenditure to bring it in line with future requirements.

Decarbonisation measures can also help to reduce costs – for example, by reducing energy usage and increasing efficiency – providing the company with a long-term competitive advantage.

Charity Finance wishes to thank M&G Investments for its support with this article