Few would have predicted that a global pandemic and the virtual suspension of the global economy would have provided the backdrop for an upward crash’ in asset prices. With the many nations now tentatively walking down the vaccine path towards re-opening and normality it is evident, however, that ebullient asset prices are juxtaposed with significant social and economic costs and challenges that must be addressed by the central authorities. And many foundations now sit at the crossroads of these tensions.

On the one hand, the swift action of central banks through further quantitative easing and the purchasing of bonds coupled with aggressive government debt expansion have averted a financial market, economic and social calamity. Unintended or otherwise, the outcome of this cocktail of intervention has been a further and significant rise in the value of financial assets to include bonds and equities that comprise the mainstay assets for foundation endowments.

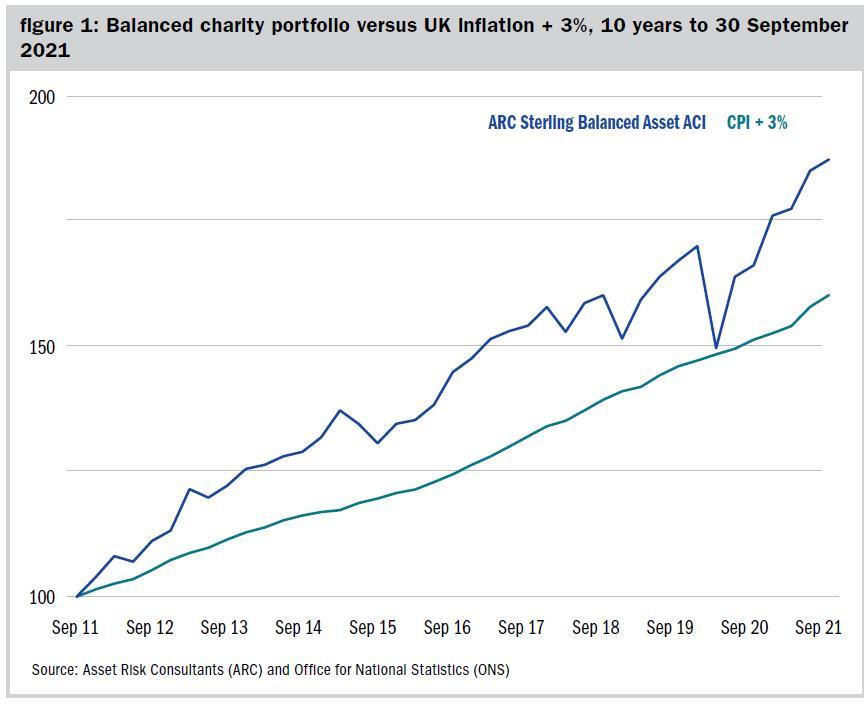

The majority of endowments target investment returns of 3-4% over the inflation rate. It will now be evident to most finance directors that the cumulative returns built up in endowments over the past decade are now significantly ahead of such long-term return targets. Broadly speaking, after accounting for regular charitable grant making and inflation, the real value of the endowment is now likely be registering a return premium over long-term targets. All to the good.

On the other hand, the real economy and broader society are now confronted by government indebtedness at post-war highs and social fragilities that are likely to influence government policy for generations. Government spending is likely to be a sustained feature of the post-pandemic world. The need to sustain the economic recovery and address the social inequalities spotlighted and heightened during the pandemic will be paramount. This economic and political backdrop will inevitably have implications for monetary stability and the current inflationary blip could readily become more entrenched and significant than currently anticipated. Certainly, volatility in the inflation rate is likely to heightened relative to the subdued and steady experience of past decades.

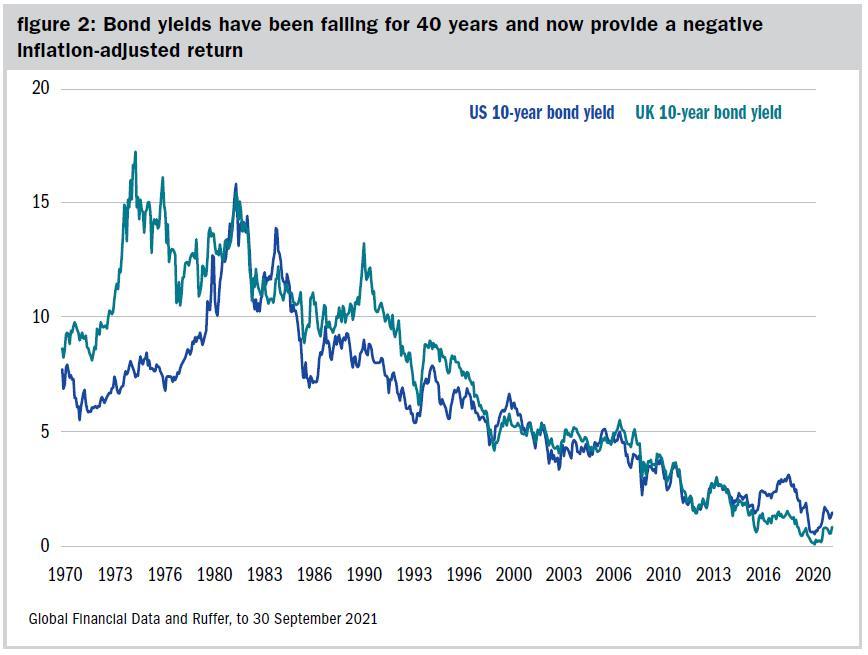

This leaves the stewards of charity assets with something of a dilemma. At current elevated levels, asset prices arguably offer little margin of error should consensual inflation expectations and bond yield forecasts prove unduly optimistic. The pattern of market returns over recent months have clearly demonstrated that even a modest increase rise in bond yields (provoked by higher inflation expectations) quickly pulls the rug from under significant sectors of the stock market. September 2021 was a case in point; higher than expected inflation prints jolted bond yields higher, causing equity markets to have their worst month since March 2020, the month the world went into global lockdown.

With many endowments maintaining asset allocations closely correlated to a 60:40 equity bond allocation, the question arises as to what might provide protection should both areas of this traditional portfolio allocation come under pressure.

In even a modestly inflationary environment, the current pricing within financial markets leaves historically safe and protective assets such as government bonds vulnerable. Consider for example, the UK bellwether asset, the 10-year gilt currently yielding around 1%. With inflation annualising at 4%, charity investors really do need to buy into the notion that recent inflationary readings are no more than a transitory blip in the journey out of Covid. That would imply a real yield of -3%; investors need to swallow the assumption that inflation will dwindle to below 1% just to get a real return.

Why should this be alarm bell for asset allocators? Most accept that we are no longer in the benign environment of steady growth coupled with modest inflation. In a new epoch of record government debt levels, more erratic growth patterns and more volatility in the rate of inflation, the risks to the traditional balanced charity portfolio structure are enhanced. As highlighted by the ten-year gilt example above, the current pricing structure of markets and the recent returns accrued by many endowments are based more on the old regime than the new.

Protect the gains

Within the institutional pension market, it is common practice for schemes to reduce portfolio risk levels and diversify exposure when returns have been sustained at levels ahead of target. In the United States, endowments have also been on the front foot in terms of deploying a range of asset classes and managers that seek returns that are lowly correlated with the traditional 60:40 equity-bond mix.

The returns from the traditional model have been phenomenal and present many UK charities with an opportunity to secure those gains, which represent a premium to their long-term return targets. Embracing absolute return investment strategies may be part of the solution for endowments. Many foundations are now deploying absolute return managers to diversify their overall investment strategy. A focus on protecting capital and an investment toolkit that can steer through increasing levels of volatility could add genuine investment diversification and improve risk-adjusted returns.

Christopher Querée is investment director and head of charities at Ruffer

Charity Finance wishes to thank Ruffer for its support with this article

Related articles