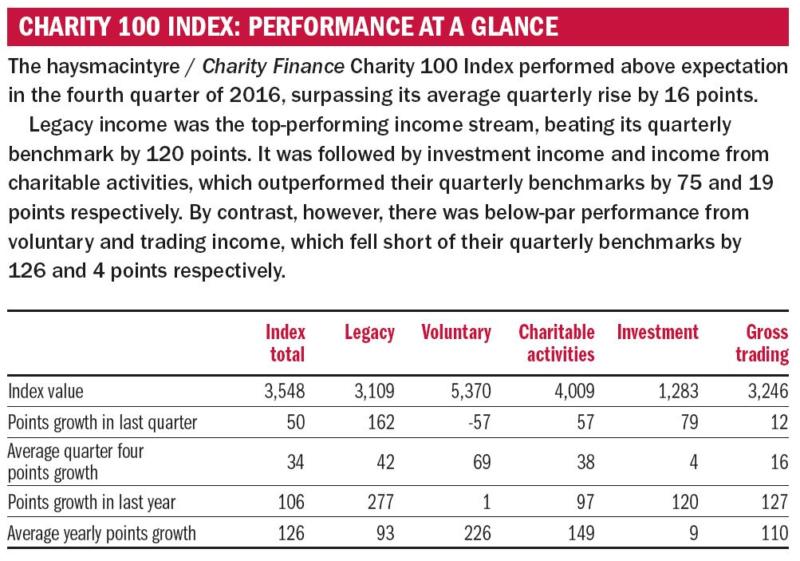

Legacy income generally accounts for a significant proportion of income at animal welfare charities, and for those in the haysmacintyre / Charity Finance 100 Index reporting in the fourth quarter, it has performed extremely well. It rose by an impressive 162 points in the three months to 31 December 2016, beating its average quarterly rise by 120 points.

At the RSPCA, legacy income grew by 25 per cent to £78.6m in the year to 31 December 2016, where it now accounts for 57 per cent of total income. Double-digit increases in legacies were also reported by PDSA and the Dogs Trust, where legacies account for 44 per cent and 31 per cent of total income respectively.

And at Guide Dogs, the animal-related disability charity, legacy income rose by a healthy 8 per cent to account for 44 per cent of total income.

Other charities reporting their results in the fourth quarter that have a strong reliance on legacy income include the RNLI and Macmillan Cancer Support, where legacies account for 66 per cent and 31 per cent of total income respectively.

Increases in any type of income are of course welcome news, though the risk associated with legacies is that they are not very predictable year on year. It is therefore welcome that all three animal welfare charities – RSPCA, PDSA and Dogs Trust – report strong increases in other income streams, particularly trading. Here all three report rises of 25 per cent or more.

The investment income sub-index also excelled in the three months to 31 December 2016, spurred by the results of the two highest performing charities. The Children’s Investment Fund Foundation (UK) reported a 22 per cent increase in investment income, which contributed to a 19 per cent increase in total income, while the Leverhulme Trust, which relies exclusively on investment income, reported a 17 per cent rise.

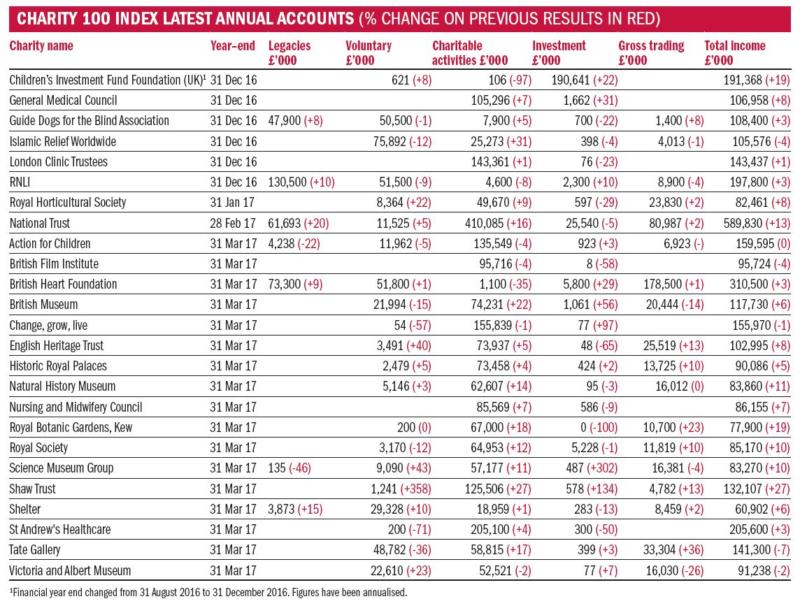

Looking ahead, around a third of charities with financial year-ends falling in the first quarter of 2017 have filed their accounts, and these are included in the table below. Almost 60 per cent of charities in the Charity 100 Index have financial year-ends falling in the first quarter.

Heritage, culture, arts

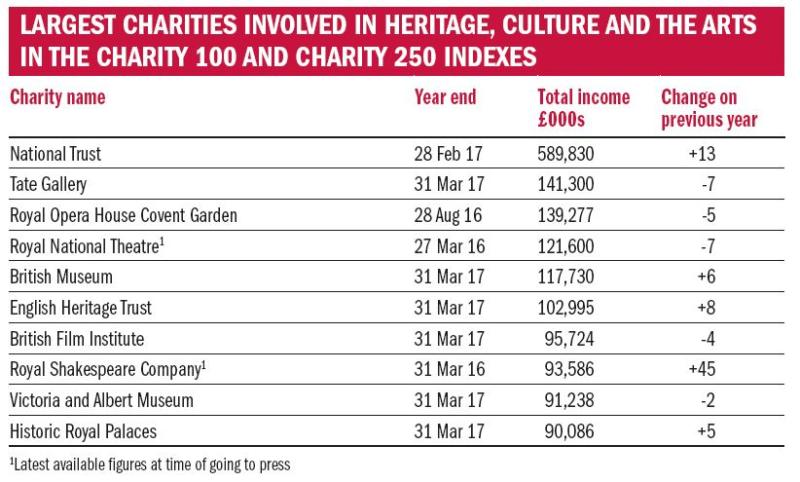

Among these early filers there is a strong prevalence of charities active in heritage, culture and the arts. Across the Charity 100 and Charity 250 Indexes, there are over 30 charities involved in this broad sector. They span the National Trust, the UK’s largest membership organisation with annual income of £589.8m, to the Wales Millennium Centre with annual income of £18.1m.

In between are a diverse range of sub-sectors including the performing arts (mainly theatre, opera and ballet), museums and art galleries, and heritage properties and sites of interest such as the Historic Royal Palaces.

Museums and art galleries comprise the most important sub-sector, accounting for around 45 per cent of charities in the broader heritage, culture and arts sector. They are generally national collections in England, Wales and Scotland, such as the Tate, the National Museum of Wales and National Galleries of Scotland. The only regional collections are National Museums and Galleries on Merseyside and the Lowry Centre Trust, which is focused on the North West of England.

Performing arts charities are also a significant sub-sector, accounting for just under 40 per cent of charities in the broader heritage, culture and arts sector. Similarly, they tend to be large national groups such as the National Theatre, Royal Opera House and Royal Shakespeare Company, with the Birmingham Hippodrome Theatre Trust the only regional player.

Heritage properties and sites of historic interest account for the balance, though this smaller sub-sector includes larger charities such as the National Trust, the English Heritage Trust and Historic Royal Palaces.

The English Heritage Trust is a relative newcomer, having joined the Charity 100 Index in April. It came into being as a result of the restructuring of English Heritage, a non-departmental public body (NDPB). This was divided into two organisations in April 2015: Historic England, a NDPB which owns and has statutory responsibility for protecting the 400-plus historic properties, and the English Heritage Trust, a charity responsible for managing their day-to-day operations. Under the terms of their agreement, English Heritage Trust has an eight year license to operate the National Heritage Collection, owned by Historic England, and the freedom to pursue an independent strategy aimed at achieving financial independence by 2023.

In its second year of trading, English Heritage Trust reported total income of £103m, some £4m ahead of its 2016/17 target of £99m. This was due mainly to a 9 per cent increase in income from membership and admissions and a 13 per cent increase in trading income.

Diversifying income

Taking all charities active in heritage, culture and the arts in the Charity 100 and Charity 250 Indexes as a composite, income from charitable activities accounts for 71 per cent of income, followed by trading income at 15 per cent, voluntary income at 9 per cent and the remaining 5 per cent split between legacy and investment income. Income from charitable activities includes fees for services, though it also includes a significant amount of state funding in the form of grant in aid and Heritage Lottery funding in the museums and art galleries sub-sector, and Arts Council funding in the performing arts sub-sector.

Legacies are significant at only two charities active in the heritage, culture and arts sector. They are the National Trust and the National Trust for Scotland, where legacy income accounts for 10 per cent and 15 per cent of total income respectively.

Similarly, investment income only makes a significant contribution to income at the National Trust for Scotland, where it accounts for 16 per cent of total income.

If they have not done so already, charities looking to further diversify their income should consider the range of creative sector tax reliefs that the government has introduced in recent years. More details are provided in this article by Louise Verago.