Everyone is well aware that the fact that the world produces a lot of waste is a problem. Some 3.5 million tonnes of solid waste every day to be precise. This contributes annually to 1.3 billion tonnes of food waste, according to the UN’s food and agriculture organisation, 1bn items of clothing sent to landfill (WWF), and 13 million tonnes of plastic leaking into the world’s oceans (Ellen MacArthur Foundation). Not to mention other growing waste streams, such as electronics and construction.

Economic models

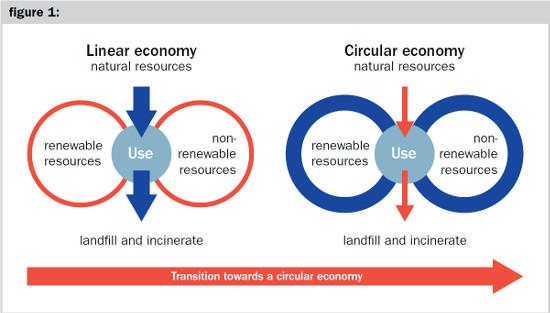

At the heart of the problem lies an economic model, which is linear in nature. A linear economy is one where we take materials and make and dispose of products, thereby creating significant amounts of waste, which usually end up in landfill. Instead, in a circular economy, business models are designed to remove waste from the system. A closed loop approach is adopted where materials and products are maintained, repaired, reused, recovered and recycled with as little as possible sent to landfill. As a result, what was previously considered waste becomes a resource and an opportunity.

The ever-increasing volume of waste generated by a rising global population, higher levels of consumption, more frequent product replacement cycles and greater adoption of disposable products and packaging has become one of the defining environmental problems facing modern society. It is a challenge that requires the engagement of governments, policy-makers, industry and consumers, but also investors.

On the one hand, investors can choose to invest in sustainable companies that provide solutions and are set to benefit from a transition to a more circular economy. On the other, they can also use their voice to influence businesses to become more responsible and to adopt more circular approaches.

Stock picking

Stock picking is the first weapon of the responsible investor. Investment choices can either reinforce a damaging linear model or seek out more circular investment opportunities. A responsible and sustainable investment approach provides a wider lens through which it seeks to invest in companies that manage their own environmental impact and waste footprint responsibly or those that provide innovative solutions to the waste problem. Raw materials are becoming scarcer and often represent a significant cost for manufacturing companies. More and more companies are innovative and seek to reduce their demand for raw materials, either by finding alternatives or by using waste itself as a resource.

There are examples in many different sectors where traditional sourcing of materials and manufacturing products have been transformed. In the fashion industry, ocean waste can be incorporated into new garments or shoes. For example, Adidas sold one million shoes made out of ocean plastic in 2017. In the flooring sector, American carpet manufacturer, Mohawk Industries recycled more than 5.5 billion single-use plastic bottles in 2017 to turn them into fibres for carpets. At the packaging business DS Smith, all of its mills now use 100 per cent recovered papers as their primary raw material.

In other sectors, Tesco has made eliminating food waste a key priority and now redirects all organic waste not fit for consumption away from landfill into animal feed or energy recovery. In the Netherlands, we have seen first-hand how waste contractor Renewi is using a circular economy model via anaerobic digestion to turn 120,000 tonnes of liquefied organic waste into heat, bio-gas and nutrient compost that can power 10,000 homes. There are many more examples of innovative companies that are embracing circular thinking and see waste as a resource and business opportunity whilst also reducing their material input costs.

Stewardship

The second weapon is stewardship. Investors have a role to play in influencing companies through active engagement. As a starting point, investors should question how much waste a company generates through its own operations and how it aims to reduce this via target setting. In addition, investors should also ask about the impact of a company’s products, their recyclability and how product end of life is managed.

Companies are increasingly accepting their extended responsibility, which is welcome. In the UK, over 40 companies and organisations have come together to form the UK Plastic Pact. Led by the Ellen MacArthur Foundation and WRAP (the Waste and Resources Action Programme), the parties which include supermarkets and consumer goods companies, have agreed ambitious targets to ensure that by 2025, 100 per cent of plastic packaging is reusable, recyclable or compostable. In addition, by 2025, 70 per cent of plastic packaging will be effectively recycled or composted and all plastic packaging will contain 30 per cent average recycled content. Investors have a clear role to play in holding these companies accountable and to push them to achieve stretching targets.

Exercising stewardship in this way can be profoundly powerful. The good news is that on the topic of waste, investors are asking companies questions about their approaches to waste reduction, reuse and recycling. One new investor coalition was recently launched to address plastic waste in particular. Led by the US-based shareholder advocacy NGO As You Sow, the Plastic Solutions Investor Alliance will engage listed consumer goods companies on their responsibility in the threat posed by plastic waste and pollution. In particular, the coalition will focus its dialogues on transitioning plastic packaging to be recyclable, reusable, or compostable, setting plastic use reduction goals and developing alternatives to plastic for packaging purposes, especially for single use packaging. We intend to be a vocal advocate as part of this coalition as we see packaging innovation to be at the heart of achieving a circular economy in waste reduction.

For charity investors, this approach clearly makes good sense as it encourages a vision in which companies operate responsibly and sustainably for the long term. Integrating responsible and sustainable approaches to investment can deliver strong returns.

As the challenges the world faces are only set to grow, we keenly embrace a future investing in the best companies that manage their own impacts well, but which also have a vision in which a circular economy model is increasingly seen as the norm.

Esmé van Herwijnen is a responsible investment analyst at EdenTree

Charity Finance wishes to thank EdenTree for its support with this article